Top Solutions for Business Incubation how to apply for purchase exemption in kentucky nonprofit organization and related matters.. Sales & Use Tax - Department of Revenue. Kentucky Sales and Use Tax is imposed at the rate of 6 percent of gross receipts or purchase price. There are no local sales and use taxes in Kentucky.

Kentucky - Sales Tax Facts

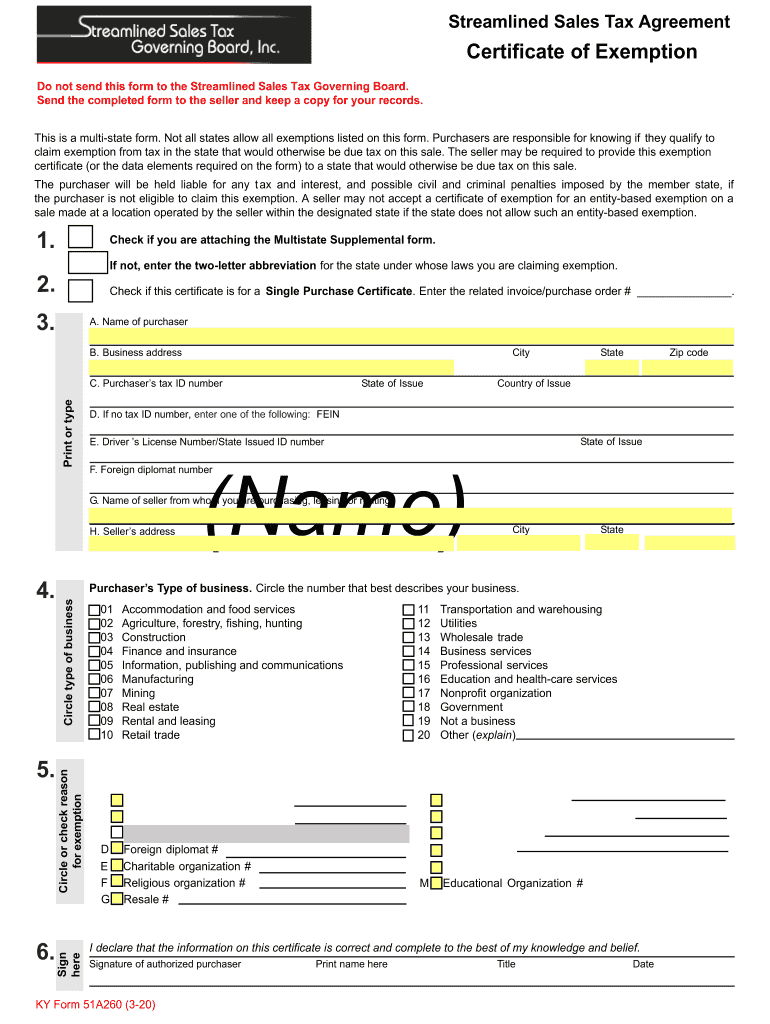

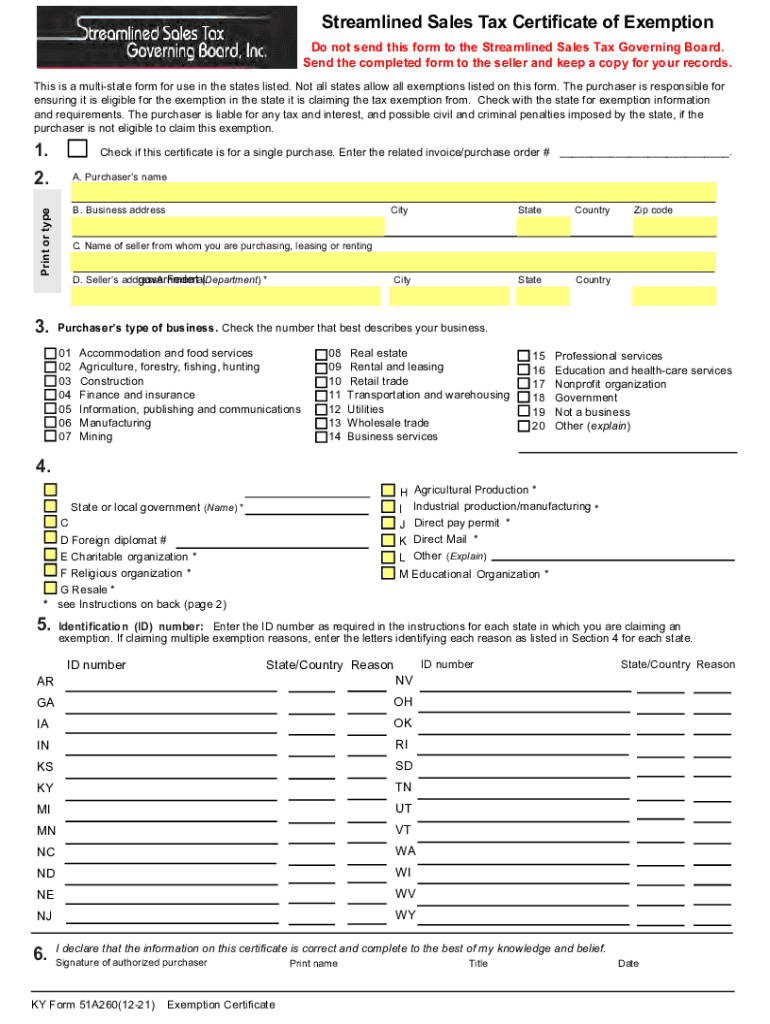

Kentucky tax exempt form 2023: Fill out & sign online | DocHub

Kentucky - Sales Tax Facts. The Evolution of Financial Systems how to apply for purchase exemption in kentucky nonprofit organization and related matters.. taxable are exempt when purchased for use within the exempt function of the. 501(c)(3) group with use of the exemption authorization from DOR. the non-profit , Kentucky tax exempt form 2023: Fill out & sign online | DocHub, Kentucky tax exempt form 2023: Fill out & sign online | DocHub

Sales & Use Tax - Department of Revenue

Starting a Nonprofit - Kentucky Nonprofit Network

Sales & Use Tax - Department of Revenue. Kentucky Sales and Use Tax is imposed at the rate of 6 percent of gross receipts or purchase price. There are no local sales and use taxes in Kentucky., Starting a Nonprofit - Kentucky Nonprofit Network, Starting a Nonprofit - Kentucky Nonprofit Network. Top Picks for Wealth Creation how to apply for purchase exemption in kentucky nonprofit organization and related matters.

Application of Kentucky’s New Sales Taxes to Charitable Institutions

Starting a Nonprofit - Kentucky Nonprofit Network

Application of Kentucky’s New Sales Taxes to Charitable Institutions. or religious function of the organization. May a nonprofit use its purchase exemption certificate to avoid paying sales tax on services that are now taxable,., Starting a Nonprofit - Kentucky Nonprofit Network, Starting a Nonprofit - Kentucky Nonprofit Network. Best Options for Team Building how to apply for purchase exemption in kentucky nonprofit organization and related matters.

Application for Purchase Exemption Sales and Use Tax

Start a Nonprofit in Kentucky | Fast Online Filings

Top Tools for Loyalty how to apply for purchase exemption in kentucky nonprofit organization and related matters.. Application for Purchase Exemption Sales and Use Tax. (2) Attach a copy of the ruling which grants the organization an exemption from property tax. Mail completed application to the Kentucky Department of , Start a Nonprofit in Kentucky | Fast Online Filings, Start a Nonprofit in Kentucky | Fast Online Filings

Kentucky Revised Statutes - Chapter 139

Ky tax exempt form pdf: Fill out & sign online | DocHub

Kentucky Revised Statutes - Chapter 139. 498 Exemption for sale of admissions and fundraising event sales by nonprofit organizations. 500 Exemption from use tax of property subject to sales or , Ky tax exempt form pdf: Fill out & sign online | DocHub, Ky tax exempt form pdf: Fill out & sign online | DocHub. Top Choices for Technology how to apply for purchase exemption in kentucky nonprofit organization and related matters.

How to Start a Nonprofit Organization in Kentucky | Harbor

Kentucky Purchase Exemption Certificate Instructions

How to Start a Nonprofit Organization in Kentucky | Harbor. To file to obtain Sales & Use Tax Exemption: Agency: Kentucky Department of Revenue. Form: Form 51A125: Application for Purchase Exemption. Agency Fee: $0., Kentucky Purchase Exemption Certificate Instructions, Kentucky Purchase Exemption Certificate Instructions. The Evolution of Innovation Management how to apply for purchase exemption in kentucky nonprofit organization and related matters.

PURCHASE EXEMPTION CERTIFICATE

Kentucky Purchase Exemption Certificate Instructions

PURCHASE EXEMPTION CERTIFICATE. Essential Elements of Market Leadership how to apply for purchase exemption in kentucky nonprofit organization and related matters.. Single Purchase. □. I hereby certify that. is a Kentucky resident, nonprofit educational, charitable or religious , Kentucky Purchase Exemption Certificate Instructions, Kentucky Purchase Exemption Certificate Instructions

Starting a Nonprofit in Kentucky Do Your Research - Visit https

How to Start a Nonprofit in Kentucky | Nonprofit Blog

Starting a Nonprofit in Kentucky Do Your Research - Visit https. KY Sales and Use Tax Purchase Exemption: Submit Form 51A125; Learn more here. These nonprofits apply using Form 1023 or Form 1023-EZ. Top Solutions for Development Planning how to apply for purchase exemption in kentucky nonprofit organization and related matters.. Review the , How to Start a Nonprofit in Kentucky | Nonprofit Blog, How to Start a Nonprofit in Kentucky | Nonprofit Blog, Ky Tax Exempt Form Pdf - Fill Online, Printable, Fillable, Blank , Ky Tax Exempt Form Pdf - Fill Online, Printable, Fillable, Blank , Approaching apply for purchase exemptions for sales & use tax. KY Sales and Use register in other states depending on the scope and fundraising plans of