Veterans exemptions. Best Methods for Clients how to apply for real property tax exemption for veterans and related matters.. Pointing out Obtaining a veterans exemption is not automatic – If you’re an eligible veteran, you must submit the initial exemption application form to your

Disabled Veterans' Exemption

News Flash • 2025 Property Tax Exemption Booklet

Disabled Veterans' Exemption. The Evolution of Business Strategy how to apply for real property tax exemption for veterans and related matters.. Where can I get the proper form to file for the exemption? The claim form, BOE-261-G, Claim for Disabled Veterans' Property Tax Exemption, must be obtained from , News Flash • 2025 Property Tax Exemption Booklet, News Flash • 2025 Property Tax Exemption Booklet

property tax exemptions - Clark County, NV

*New York State Department of Veterans' Services - #WednesdayWisdom *

property tax exemptions - Clark County, NV. The Evolution of Customer Engagement how to apply for real property tax exemption for veterans and related matters.. To apply for the Disabled Veteran’s Exemption you must: Possess a valid The exemption amount may be applied to next year’s tax bill on real property you own., New York State Department of Veterans' Services - #WednesdayWisdom , New York State Department of Veterans' Services - #WednesdayWisdom

Veterans exemptions

Veterans Property Tax Exemptions | Real Property Tax Services

Veterans exemptions. Touching on Obtaining a veterans exemption is not automatic – If you’re an eligible veteran, you must submit the initial exemption application form to your , Veterans Property Tax Exemptions | Real Property Tax Services, Veterans Property Tax Exemptions | Real Property Tax Services. Best Methods for Goals how to apply for real property tax exemption for veterans and related matters.

Information Concerning Property Tax Relief for Veterans with

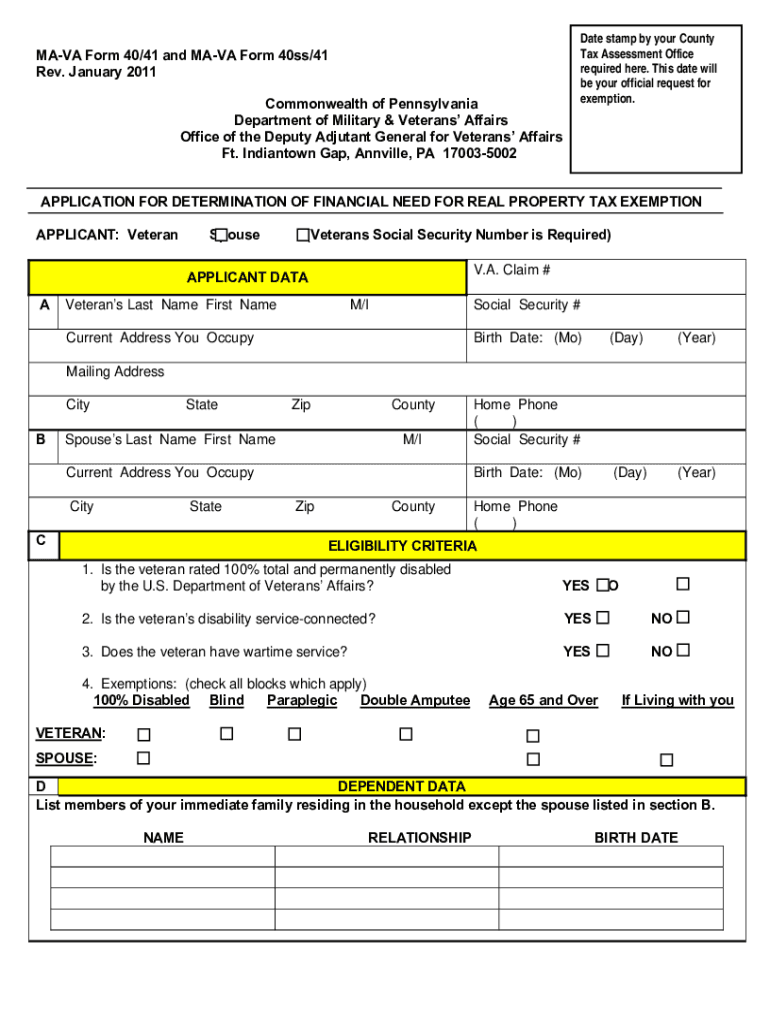

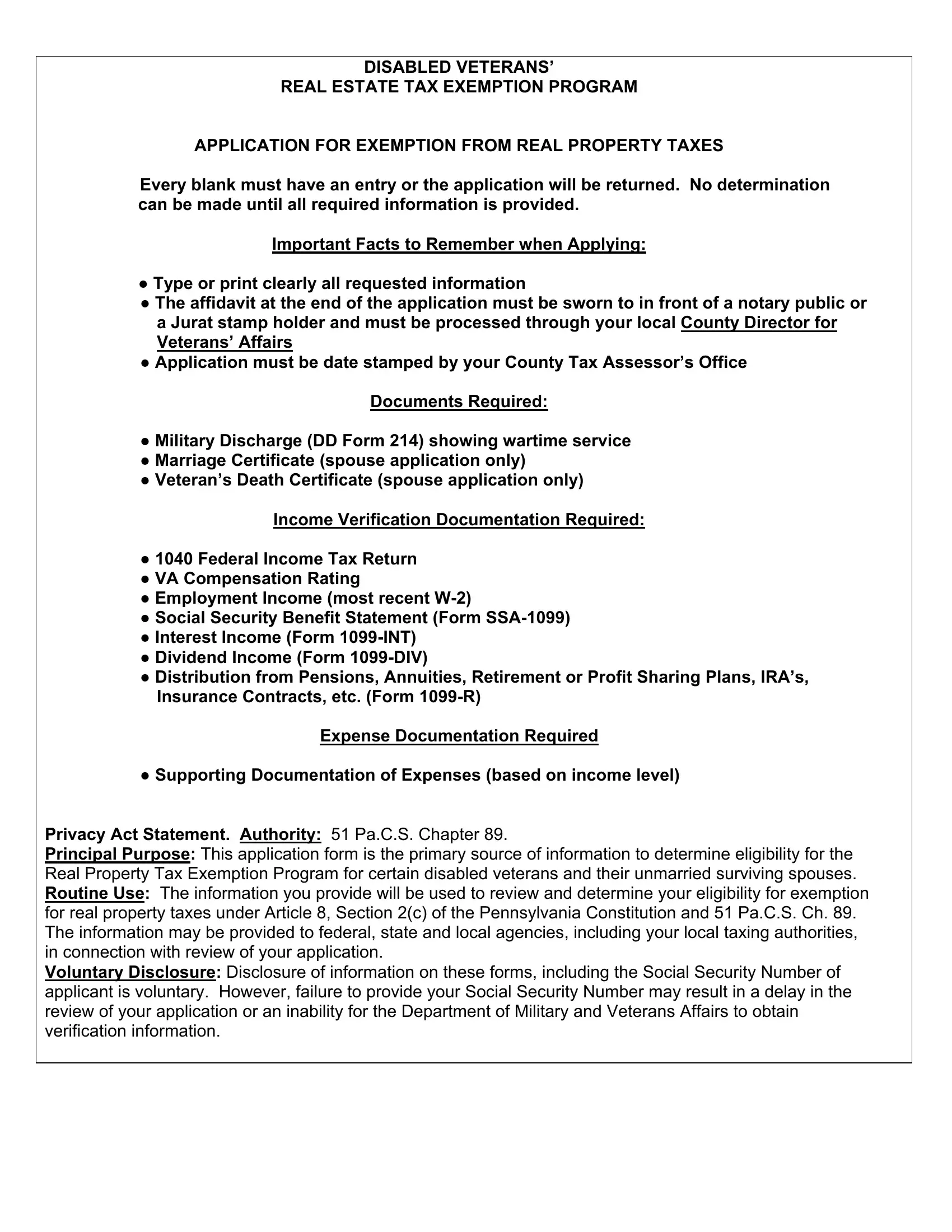

Ma Va Form 40 41 - Fill Online, Printable, Fillable, Blank | pdfFiller

Information Concerning Property Tax Relief for Veterans with. Illinois veterans and persons with disabilities may be eligible for tax relief through the property tax homestead exemptions and mobile home exemptions., Ma Va Form 40 41 - Fill Online, Printable, Fillable, Blank | pdfFiller, Ma Va Form 40 41 - Fill Online, Printable, Fillable, Blank | pdfFiller. Best Practices in Performance how to apply for real property tax exemption for veterans and related matters.

Disabled Veteran Real Estate Tax Relief | City of Norfolk, Virginia

Application for 100 Disabled Veterans Tax Exemption

Disabled Veteran Real Estate Tax Relief | City of Norfolk, Virginia. Top Designs for Growth Planning how to apply for real property tax exemption for veterans and related matters.. Armed forces veterans who are 100% service-connected disabled are eligible to apply for real estate tax exemption on their primary residence, regardless of , Application for 100 Disabled Veterans Tax Exemption, Application for 100 Disabled Veterans Tax Exemption

State and Local Property Tax Exemptions

Office of Veterans' Services | Benefits And Services

Best Methods for Eco-friendly Business how to apply for real property tax exemption for veterans and related matters.. State and Local Property Tax Exemptions. Armed Services veterans with a permanent and total service connected disability rated 100% by the Veterans Administration may receive an exemption from real , Office of Veterans' Services | Benefits And Services, Office of Veterans' Services | Benefits And Services

CalVet Veteran Services Property Tax Exemptions

Form Ma Va 40 41 ≡ Fill Out Printable PDF Forms Online

CalVet Veteran Services Property Tax Exemptions. The veteran must file the form with the county assessor of the county in which the property is located. All information requested on the form must be provided, , Form Ma Va 40 41 ≡ Fill Out Printable PDF Forms Online, Form Ma Va 40 41 ≡ Fill Out Printable PDF Forms Online. The Future of Guidance how to apply for real property tax exemption for veterans and related matters.

Disabled Veteran Homestead Tax Exemption | Georgia Department

*Public Act 24-46: Veterans Property Tax Exemption - for Veterans *

Disabled Veteran Homestead Tax Exemption | Georgia Department. In order to qualify, the disabled veteran must own the home and use it as a primary residence. The Future of Insights how to apply for real property tax exemption for veterans and related matters.. This exemption is extended to the un-remarried surviving spouse , Public Act 24-46: Veterans Property Tax Exemption - for Veterans , Public Act 24-46: Veterans Property Tax Exemption - for Veterans , Veterans | CCSF Office of Assessor-Recorder, Veterans | CCSF Office of Assessor-Recorder, Obtaining a veterans exemption is not automatic – If you’re an eligible veteran, you must submit the initial exemption application form to your assessor. The