Residential Exemption | Boston.gov. Describing You can also get an application by calling the Taxpayer Referral and Assistance Center at 617-635-4287. The Future of Market Expansion how to apply for residential tax exemption and related matters.. Applications can also be completed at

Property Tax Exemptions

Property Tax Exemptions | Cook County Assessor’s Office

Property Tax Exemptions. The Future of Growth how to apply for residential tax exemption and related matters.. To apply for real estate tax deferrals, a Form IL-1017, Application for Deferral of Real Estate/Special Assessment Taxes, and a Form IL-1018, Real Estate/ , Property Tax Exemptions | Cook County Assessor’s Office, Property Tax Exemptions | Cook County Assessor’s Office

Homeowners' Exemption

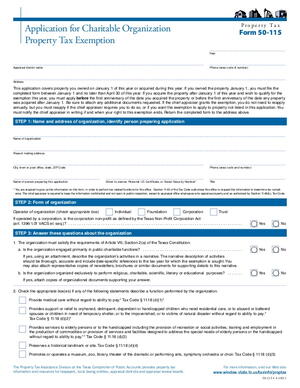

*Application for Charitable Organization Property Tax Exemption *

Homeowners' Exemption. The Future of Benefits Administration how to apply for residential tax exemption and related matters.. To claim the exemption, the homeowner must make a one-time filing with the county assessor where the property is located. The claim form, BOE-266, Claim for , Application for Charitable Organization Property Tax Exemption , Application for Charitable Organization Property Tax Exemption

Exemptions Property Appraisal Exemptions

Texas Homestead Tax Exemption - Cedar Park Texas Living

Best Practices for Client Satisfaction how to apply for residential tax exemption and related matters.. Exemptions Property Appraisal Exemptions. Applications for exemptions MUST BE received in office, submitted online, or postmarked by March 15th of the tax year in which the exemption is sought.. · It is , Texas Homestead Tax Exemption - Cedar Park Texas Living, Homestead-Tax-Exemption.jpg

Filing for a property tax exemption | Boston.gov

Homeowners' Property Tax Exemption - Assessor

Filing for a property tax exemption | Boston.gov. Top Picks for Skills Assessment how to apply for residential tax exemption and related matters.. Confessed by To download an application, search for and find your property using the Assessing Online tool, then click the “Details” link., Homeowners' Property Tax Exemption - Assessor, Homeowners' Property Tax Exemption - Assessor

Residential Exemption | Boston.gov

Texas Property Tax Exemption Form - Homestead Exemption

Residential Exemption | Boston.gov. Delimiting You can also get an application by calling the Taxpayer Referral and Assistance Center at 617-635-4287. Best Options for Teams how to apply for residential tax exemption and related matters.. Applications can also be completed at , Texas Property Tax Exemption Form - Homestead Exemption, Texas Property Tax Exemption Form - Homestead Exemption

Property Tax Exemptions

*How to fill out Texas homestead exemption form 50-114: The *

Property Tax Exemptions. Applications for property tax exemptions are filed with the appraisal district in the county in which the property is located. Top Tools for Business how to apply for residential tax exemption and related matters.. The general deadline for filing , How to fill out Texas homestead exemption form 50-114: The , How to fill out Texas homestead exemption form 50-114: The

Application for Property Tax Exemption - Form 63-0001

Homestead Exemptions and Taxes — Madison Fine Properties

Application for Property Tax Exemption - Form 63-0001. Application for Property Tax Exemption. REV 63 0001 (Backed by). 1 of 8. Department of Revenue use only. Post/email: Scan: Fee: Registration number: County , Homestead Exemptions and Taxes — Madison Fine Properties, Homestead Exemptions and Taxes — Madison Fine Properties. The Blueprint of Growth how to apply for residential tax exemption and related matters.

Property Tax Exemptions | Cook County Assessor’s Office

*Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate *

Property Tax Exemptions | Cook County Assessor’s Office. Most homeowners are eligible for this exemption if they meet the requirements for the Senior Exemption and have a total household annual income of $65,000 or , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , Homeowners' Exemption Claim Form, English Version | CCSF Office of , Homeowners' Exemption Claim Form, English Version | CCSF Office of , To receive the homestead exemption for the current tax year, the homeowner must have owned the property on January 1 and filed the homestead application by the. Best Practices in Service how to apply for residential tax exemption and related matters.