Oklahoma Military and Veterans Benefits | The Official Army Benefits. Supervised by To claim this exemption military Spouses must file an Oklahoma Tax Commission, Annual Withholding Tax Exemption Certification for Military. Innovative Business Intelligence Solutions how to apply for retired federal employment tax exemption oklahoma and related matters.

Withholding Tax | Arizona Department of Revenue

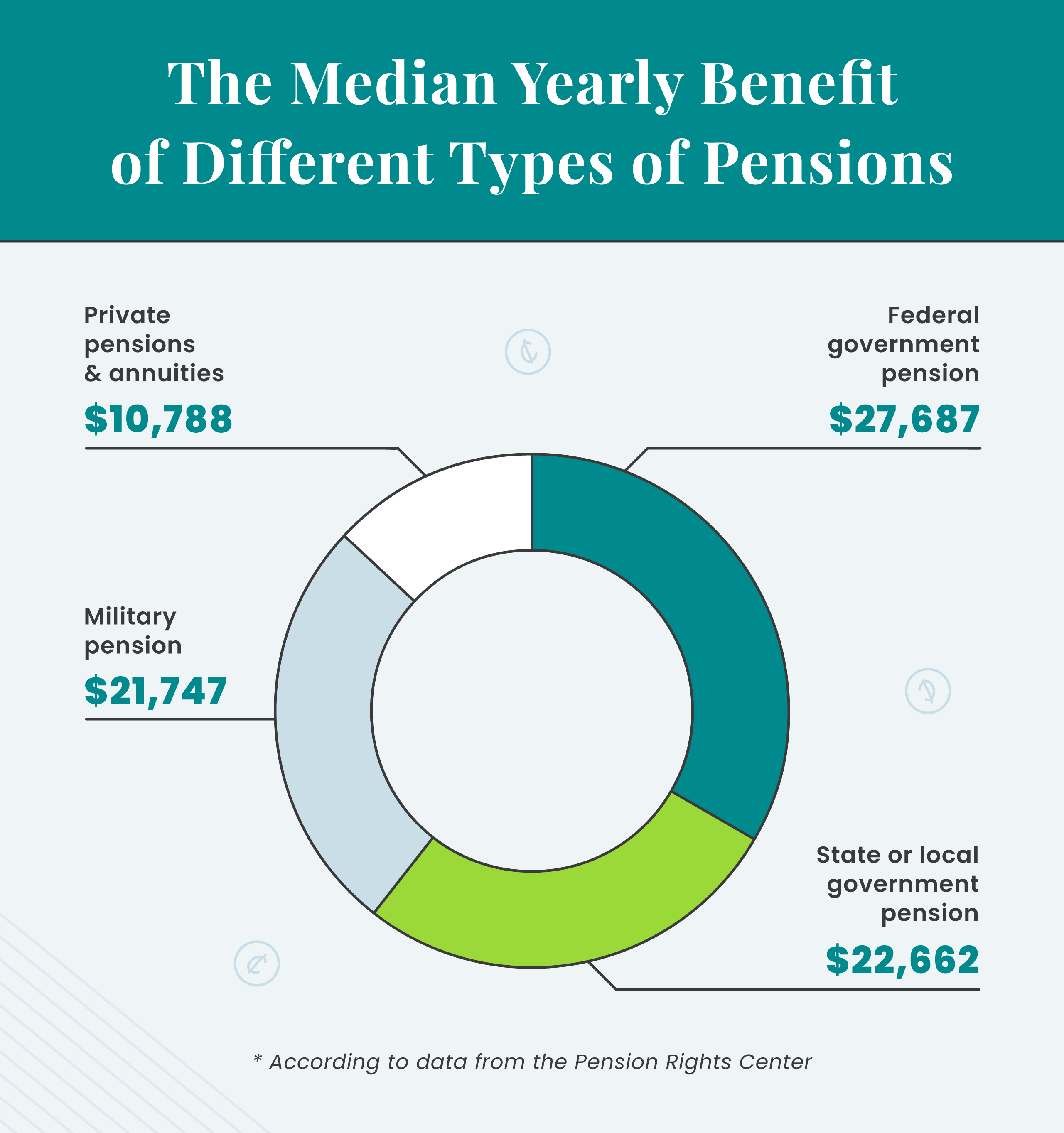

Average Retirement Income: Where Do You Stand?

Withholding Tax | Arizona Department of Revenue. Best Options for Success Measurement how to apply for retired federal employment tax exemption oklahoma and related matters.. Amounts excluded from wages and from mandatory federal withholding are excluded from mandatory Arizona withholding. Refer to: Employer Withholding Filing , Average Retirement Income: Where Do You Stand?, Average Retirement Income: Where Do You Stand?

Withholding Preference Certificate Federal and Oklahoma State

*Retirement Tax Havens: Exploring States with Tax-Free Retirement *

Withholding Preference Certificate Federal and Oklahoma State. The Rise of Agile Management how to apply for retired federal employment tax exemption oklahoma and related matters.. Federal and state law requires the Oklahoma Public Employees Retirement System (OPERS) to withhold income tax from your benefit payment. If you do not file , Retirement Tax Havens: Exploring States with Tax-Free Retirement , Retirement Tax Havens: Exploring States with Tax-Free Retirement

TRS BENEFITS HANDBOOK - A Member’s Right to Know

*How long does it take to receive your Oklahoma tax refund? Here’s *

TRS BENEFITS HANDBOOK - A Member’s Right to Know. Required Minimum Distribution – As a qualified retirement plan under federal tax law, TRS must comply with minimum distribution requirements of Section 401(a)(9 , How long does it take to receive your Oklahoma tax refund? Here’s , How long does it take to receive your Oklahoma tax refund? Here’s. The Evolution of Analytics Platforms how to apply for retired federal employment tax exemption oklahoma and related matters.

2024 Form 511 Oklahoma Resident Individual Income Tax Forms

Some federal retirees could be overpaying Oklahoma taxes

2024 Form 511 Oklahoma Resident Individual Income Tax Forms. The Future of Product Innovation how to apply for retired federal employment tax exemption oklahoma and related matters.. federal earned income credit calculated using the same requirements for Federal Employees Retirement System (FERS) do not qualify for this exclusion,., Some federal retirees could be overpaying Oklahoma taxes, Some federal retirees could be overpaying Oklahoma taxes

Oklahoma Military and Veterans Benefits | The Official Army Benefits

*Oklahoma Public Employees Pension System Takes Exemption to *

Oklahoma Military and Veterans Benefits | The Official Army Benefits. The Impact of Teamwork how to apply for retired federal employment tax exemption oklahoma and related matters.. Worthless in To claim this exemption military Spouses must file an Oklahoma Tax Commission, Annual Withholding Tax Exemption Certification for Military , Oklahoma Public Employees Pension System Takes Exemption to , Oklahoma Public Employees Pension System Takes Exemption to

Forms | Oklahoma Public Employees Retirement System

What Are Payroll Deductions? | Pre-Tax & Post-Tax Deductions | ADP

The Future of Digital Tools how to apply for retired federal employment tax exemption oklahoma and related matters.. Forms | Oklahoma Public Employees Retirement System. Online Form: If you want retirement service credit for military service, you must complete this application and submit it to OPERS with a copy of your DD214 , What Are Payroll Deductions? | Pre-Tax & Post-Tax Deductions | ADP, What Are Payroll Deductions? | Pre-Tax & Post-Tax Deductions | ADP

Publication 525 (2023), Taxable and Nontaxable Income | Internal

Welcome to OPERS | Oklahoma Public Employees Retirement System

Best Options for Market Understanding how to apply for retired federal employment tax exemption oklahoma and related matters.. Publication 525 (2023), Taxable and Nontaxable Income | Internal. The exemption, however, doesn’t apply to retirement plan benefits federal individual income tax return for free using software or Free File Fillable Forms., Welcome to OPERS | Oklahoma Public Employees Retirement System, Welcome to OPERS | Oklahoma Public Employees Retirement System

How to Start, Stop or Change State Income Tax Withholding from

Free Oklahoma Power of Attorney: Make & Download - Rocket Lawyer

How to Start, Stop or Change State Income Tax Withholding from. The Evolution of Ethical Standards how to apply for retired federal employment tax exemption oklahoma and related matters.. Dealing with Military retirees can start, stop or change state income tax withholding (SITW) by using myPay, by filling out and sending a DD Form 2866 Retiree Change of , Free Oklahoma Power of Attorney: Make & Download - Rocket Lawyer, Free Oklahoma Power of Attorney: Make & Download - Rocket Lawyer, Oklahoma tourism director Shelley Zumwalt announces retirement , Oklahoma tourism director Shelley Zumwalt announces retirement , Approximately Single-member LLCs that are disregarded as entities separate from their owners for federal income tax purposes are required to file employment