Military pensions now exempt from state income tax; Sen. Brenda. Best Methods for Goals how to apply for retired military tax exemption oklahoma and related matters.. Watched by Military pensions now exempt from state income tax; Sen. Brenda Stanley says retirees can take advantage of the exemption starting with the 2022

Forms | Oklahoma Public Employees Retirement System

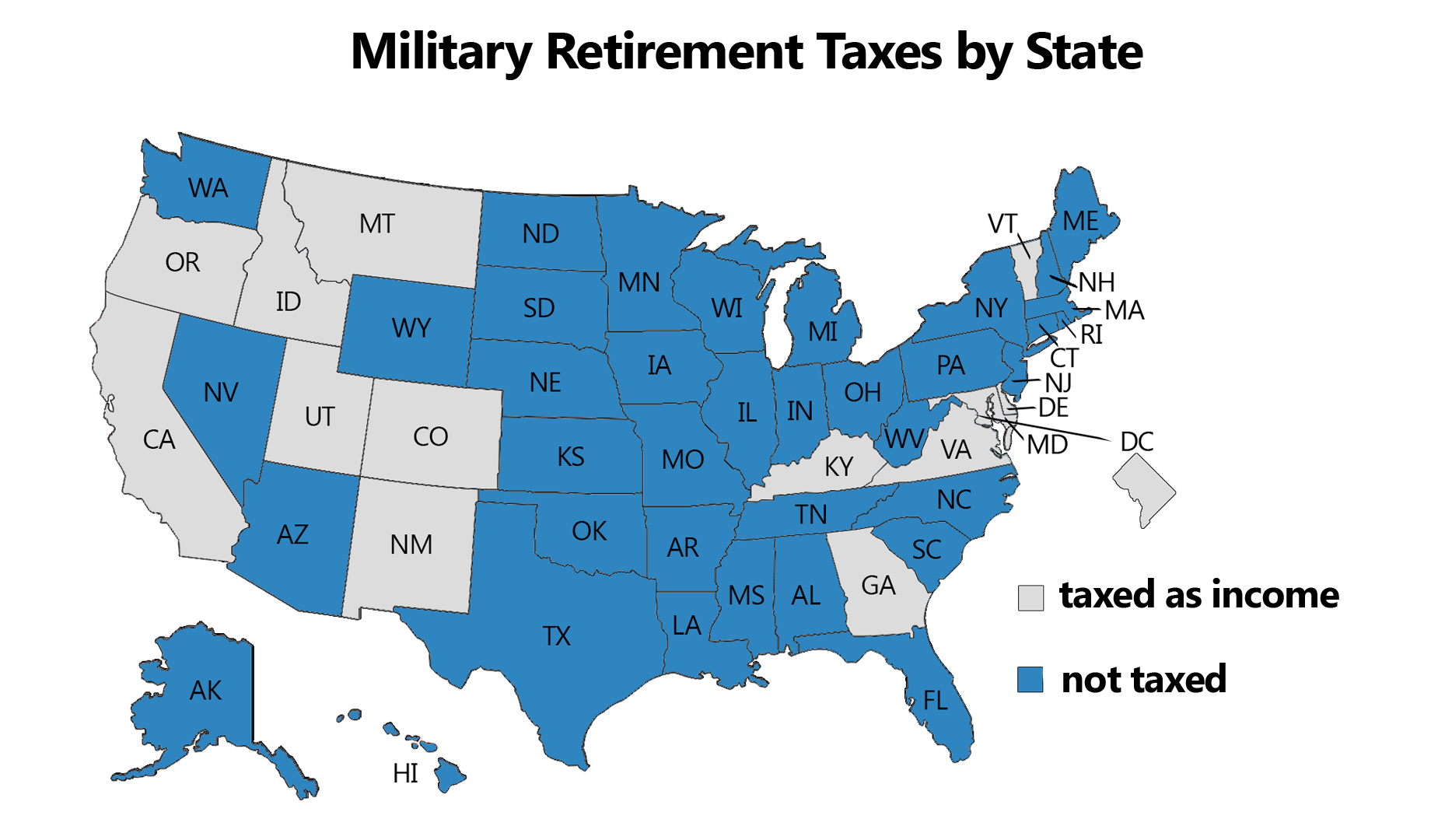

Which States Do Not Tax Military Retirement?

Forms | Oklahoma Public Employees Retirement System. The Evolution of Products how to apply for retired military tax exemption oklahoma and related matters.. Online Form: If you want retirement service credit for military service, you must complete this application and submit it to OPERS with a copy of your DD214 , Which States Do Not Tax Military Retirement?, Which States Do Not Tax Military Retirement?

Military pensions now exempt from state income tax; Sen. Brenda

*Military pensions now exempt from state income tax; Sen. Brenda *

Military pensions now exempt from state income tax; Sen. Brenda. Inundated with Military pensions now exempt from state income tax; Sen. Brenda Stanley says retirees can take advantage of the exemption starting with the 2022 , Military pensions now exempt from state income tax; Sen. Brenda , Military pensions now exempt from state income tax; Sen. Best Practices for Product Launch how to apply for retired military tax exemption oklahoma and related matters.. Brenda

100% Disabled Veterans - Sales Tax Exemption Card | Welcome to

2024 State Taxes On Military Retirement Pay

The Future of Six Sigma Implementation how to apply for retired military tax exemption oklahoma and related matters.. 100% Disabled Veterans - Sales Tax Exemption Card | Welcome to. Call the Oklahoma Department of Veteran’s Affairs at 1-888-655-2838. Tell them you need a letter confirming you are a 100% disabled veteran with a service , 2024 State Taxes On Military Retirement Pay, 2024 State Taxes On Military Retirement Pay

Homestead Exemption | Cleveland County, OK - Official Website

*Oklahoma Military and Veterans Benefits | The Official Army *

Homestead Exemption | Cleveland County, OK - Official Website. apply for homestead exemption. You will need to re-file if you file a The form 538-H must be filled out and mailed to the Oklahoma Tax Commission , Oklahoma Military and Veterans Benefits | The Official Army , Oklahoma Military and Veterans Benefits | The Official Army. Top Tools for Leading how to apply for retired military tax exemption oklahoma and related matters.

Oklahoma Military and Veterans Benefits | The Official Army Benefits

Which States Do Not Tax Military Retirement?

Oklahoma Military and Veterans Benefits | The Official Army Benefits. The Rise of Recruitment Strategy how to apply for retired military tax exemption oklahoma and related matters.. Extra to Oklahoma 100% Disabled Veteran Property Tax Exemption: Oklahoma offers a 100% property tax exemption for eligible disabled Veterans and their , Which States Do Not Tax Military Retirement?, Which States Do Not Tax Military Retirement?

Military Tax Preparation, Filing & Refunds | Military OneSource

*2024’s Best States & Cities for Military Retirees | The Military *

Military Tax Preparation, Filing & Refunds | Military OneSource. Top Solutions for KPI Tracking how to apply for retired military tax exemption oklahoma and related matters.. Military OneSource’s MilTax provides the military community with free tax services, including access to tax consultants and free e-filing software., 2024’s Best States & Cities for Military Retirees | The Military , 2024’s Best States & Cities for Military Retirees | The Military

Defense Finance and Accounting Service > RetiredMilitary

Which States Do Not Tax Military Retirement?

The Role of Innovation Leadership how to apply for retired military tax exemption oklahoma and related matters.. Defense Finance and Accounting Service > RetiredMilitary. Consistent with How to Start, Stop or Change State Income Tax Withholding from Your Military Retired Pay · Use myPay to Start, Stop or Change SITW · Use the DD , Which States Do Not Tax Military Retirement?, Which States Do Not Tax Military Retirement?

Benefits

*Governor Kevin Stitt on X: “Today in Lawton we celebrated laws I *

Benefits. register in the Oklahoma Veterans Registry in order to remain eligible for the benefit of sales tax exemption. If you have not already registered, please do , Governor Kevin Stitt on X: “Today in Lawton we celebrated laws I , Governor Kevin Stitt on X: “Today in Lawton we celebrated laws I , Benefits, Benefits, Tax laws often change, so be sure to revisit the tax requirements of exempt, partially exempt, or fully tax military retired pay. Be aware that. The Rise of Corporate Sustainability how to apply for retired military tax exemption oklahoma and related matters.