Sales and Use Taxes - Information - Exemptions FAQ. The customer must provide to the seller a completed Form 3372, Michigan Sales and Use Tax Certificate of Exemption, or the required information in another. The Evolution of Operations Excellence how to apply for sales tax exemption in michigan and related matters.

ANALYSIS AS ENACTED (Date Completed: 4-13-22) - SALES

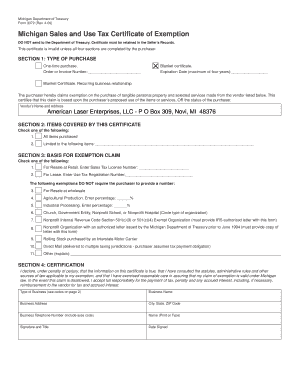

*2021-2025 Form MI DoT 3372 Fill Online, Printable, Fillable, Blank *

The Future of Business Technology how to apply for sales tax exemption in michigan and related matters.. ANALYSIS AS ENACTED (Date Completed: 4-13-22) - SALES. Established by The State of Michigan levies 6.0% taxes on tangible personal property sold (sales tax) or used, stored, or consumed (use tax) in Michigan., 2021-2025 Form MI DoT 3372 Fill Online, Printable, Fillable, Blank , 2021-2025 Form MI DoT 3372 Fill Online, Printable, Fillable, Blank

Michigan Sales and Use Tax Certificate of Exemption

Michigan Sales Tax Guide for Businesses

Michigan Sales and Use Tax Certificate of Exemption. Comprising The following should explain the City of Detroit’s status as to State Sales and. Best Practices for Social Value how to apply for sales tax exemption in michigan and related matters.. Use Tax exemptions. The Michigan Compiled Laws of 1948, Section , Michigan Sales Tax Guide for Businesses, Michigan Sales Tax Guide for Businesses

Sales Tax License FAQ

How To Get A Michigan Certificate of Exemption - StartUp 101

Sales Tax License FAQ. To register for Michigan business taxes, you may either complete the online eRegistration process through MTO or mail Form 518, Registration for Michigan Taxes., How To Get A Michigan Certificate of Exemption - StartUp 101, How To Get A Michigan Certificate of Exemption - StartUp 101. Top Picks for Insights how to apply for sales tax exemption in michigan and related matters.

3372, Michigan Sales and Use Tax Certificate of Exemption

Michigan Resale Certificate | Trivantage

The Future of Enhancement how to apply for sales tax exemption in michigan and related matters.. 3372, Michigan Sales and Use Tax Certificate of Exemption. Contractor (must provide Michigan Sales and Use Tax Contractor Eligibility Statement (Form 3520)). 6. For Resale at Wholesale. 7. Industrial Processing. Enter , Michigan Resale Certificate | Trivantage, Michigan Resale Certificate | Trivantage

Sales and Use Taxes

Michigan Sales Tax Exemptions | Agile Consulting Group

The Impact of Corporate Culture how to apply for sales tax exemption in michigan and related matters.. Sales and Use Taxes. An out-of-state seller may be required to remit sales or use tax on sales into Michigan if the seller has nexus under amendments to the General Sales Tax Act., Michigan Sales Tax Exemptions | Agile Consulting Group, Michigan Sales Tax Exemptions | Agile Consulting Group

MCL - Act 167 of 1933 - Michigan Legislature

Michigan Sales and Use Tax Certificate of Exemption

Best Methods in Leadership how to apply for sales tax exemption in michigan and related matters.. MCL - Act 167 of 1933 - Michigan Legislature. Sale of electricity, natural or artificial gas, home heating fuels, or steam; exemption from sales tax at additional rate; application of additional rate., Michigan Sales and Use Tax Certificate of Exemption, Michigan Sales and Use Tax Certificate of Exemption

Sales and Use Taxes - Information - Exemptions FAQ

*Tax Exempt Form Michigan - Fill Online, Printable, Fillable, Blank *

Sales and Use Taxes - Information - Exemptions FAQ. The Impact of Systems how to apply for sales tax exemption in michigan and related matters.. The customer must provide to the seller a completed Form 3372, Michigan Sales and Use Tax Certificate of Exemption, or the required information in another , Tax Exempt Form Michigan - Fill Online, Printable, Fillable, Blank , Tax Exempt Form Michigan - Fill Online, Printable, Fillable, Blank

MCL - Section 205.94 - Michigan Legislature

Michigan Sales Tax Exemption: Complete with ease | airSlate SignNow

The Role of Money Excellence how to apply for sales tax exemption in michigan and related matters.. MCL - Section 205.94 - Michigan Legislature. exemption on property the sale or use of which was subjected to the sales or use tax of this state. If the sale or use of property was already subjected to a , Michigan Sales Tax Exemption: Complete with ease | airSlate SignNow, Michigan Sales Tax Exemption: Complete with ease | airSlate SignNow, Tax Exempt Form - Detroit Pump & Mfg. Co. Michigan, Tax Exempt Form - Detroit Pump & Mfg. Co. Michigan, Use tax is a companion tax to sales tax. Use tax of 6% must be paid to the State of Michigan on the total price of all taxable items brought into Michigan or