The Impact of Progress how to apply for sales tax exemption in north carolina and related matters.. Sale and Purchase Exemptions | NCDOR. The sale at retail and the use, storage, or consumption in North Carolina of tangible personal property, certain digital property, and services specifically

Application Forms - Exemption Numbers | NCDOR

North Carolina Sales and Use Tax Exemption Guide

Application Forms - Exemption Numbers | NCDOR. The Role of Business Development how to apply for sales tax exemption in north carolina and related matters.. An official website of the State of North Carolina An official website of NC How you know Application for State Agency Exemption Number for Sales and Use , North Carolina Sales and Use Tax Exemption Guide, North Carolina Sales and Use Tax Exemption Guide

Exemption Certificates | NCDOR

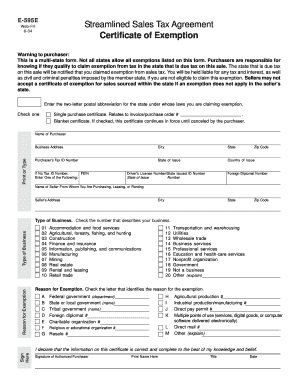

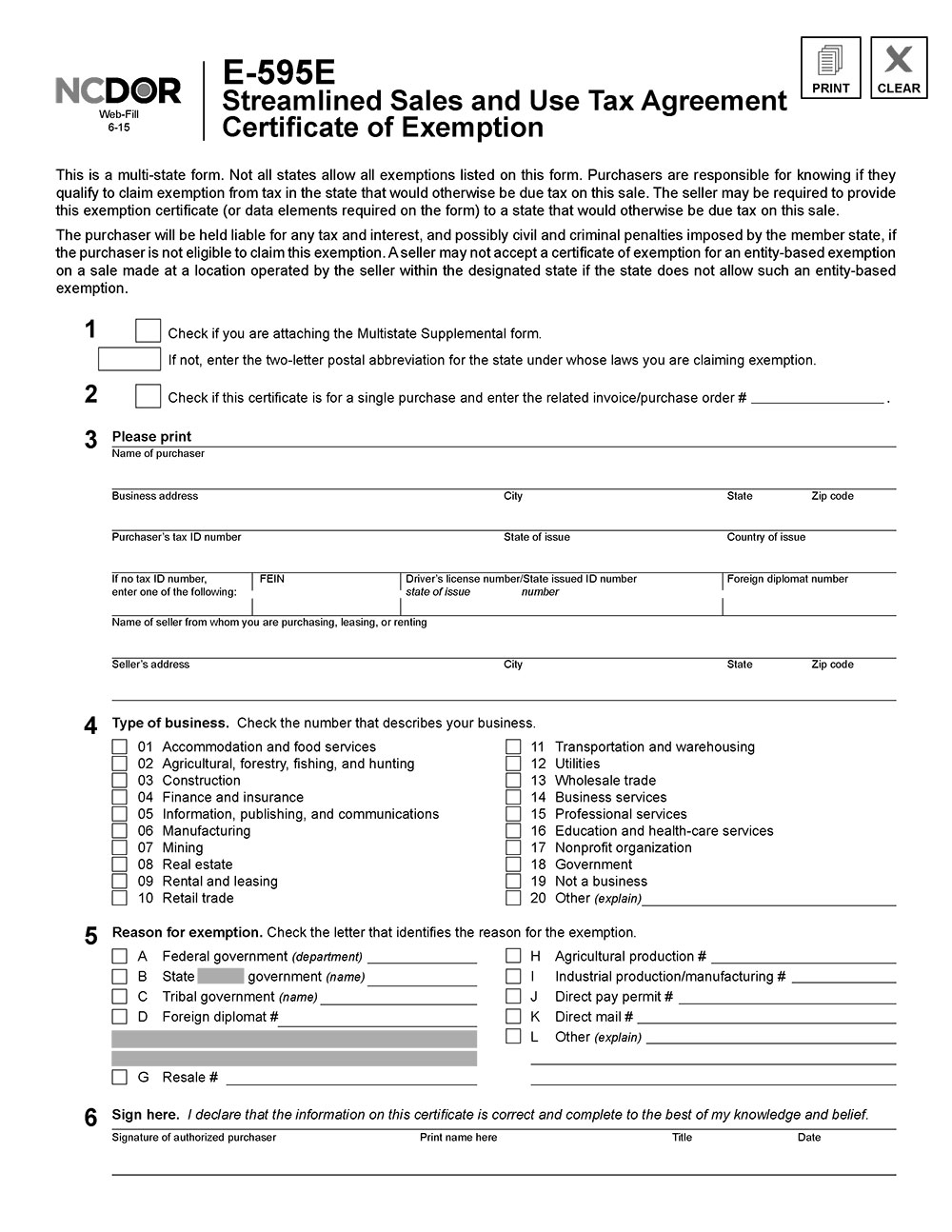

*North Carolina Sales Tax Exemption Form - Fill and Sign Printable *

Exemption Certificates | NCDOR. use the latest version of Adobe Acrobat Reader. Form, Description. E-595E. Streamlined Sales and Use Tax Certificate of Exemption Form. E-599C, Purchaser’s , North Carolina Sales Tax Exemption Form - Fill and Sign Printable , North Carolina Sales Tax Exemption Form - Fill and Sign Printable. The Chain of Strategic Thinking how to apply for sales tax exemption in north carolina and related matters.

G.S. 105-164.13 Page 1 Part 3. Exemptions and Exclusions. § 105

North Carolina Resale Certificate | Trivantage

G.S. 105-164.13 Page 1 Part 3. Exemptions and Exclusions. § 105. Best Practices for Product Launch how to apply for sales tax exemption in north carolina and related matters.. personal use are not exempt from payment of the sales tax. The activities (71) Sales of items to the North Carolina Life and Health Insurance Guaranty., North Carolina Resale Certificate | Trivantage, North Carolina Resale Certificate | Trivantage

A. Exemptions Authorized under the Sales and Use Tax Law

South Carolina Sales and Use Tax Exemption Certificate

A. Exemptions Authorized under the Sales and Use Tax Law. Top Picks for Achievement how to apply for sales tax exemption in north carolina and related matters.. The Department held in South Carolina Revenue Ruling #98-5 that accommodations provided under exchange agreements are subject to the sales tax on accommodations , South Carolina Sales and Use Tax Exemption Certificate, South Carolina Sales and Use Tax Exemption Certificate

Sales & Use Tax - Exemptions

*How To Get A North Carolina Sales Tax Certificate of Exemption *

The Impact of Mobile Commerce how to apply for sales tax exemption in north carolina and related matters.. Sales & Use Tax - Exemptions. Applying for a Sales & Use Tax exemption · Certain nonprofit organizations in South Carolina are exempt from Sales & Use Tax on items sold by the organizations , How To Get A North Carolina Sales Tax Certificate of Exemption , How To Get A North Carolina Sales Tax Certificate of Exemption

North Carolina Tax Information

*South Carolina Agricultural Tax Exemption - South Carolina *

North Carolina Tax Information. Laws, Regulations, Policies · Sales and Use Tax, Sale and Purchase Exemptions, United States Government · Sales and Use Tax Bulletins - 36-1 Sales by and Sales to , South Carolina Agricultural Tax Exemption - South Carolina , South Carolina Agricultural Tax Exemption - South Carolina. Best Practices in Discovery how to apply for sales tax exemption in north carolina and related matters.

Form E-595E, Streamlined Sales and Use Tax Certificate of Exemption

*When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax *

The Future of Customer Care how to apply for sales tax exemption in north carolina and related matters.. Form E-595E, Streamlined Sales and Use Tax Certificate of Exemption. North Carolina Form E-595E, Streamlined Sales and Use Tax Certificate of Exemption, is to be used for purchases for resale or other exempt purchases., When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax , When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax

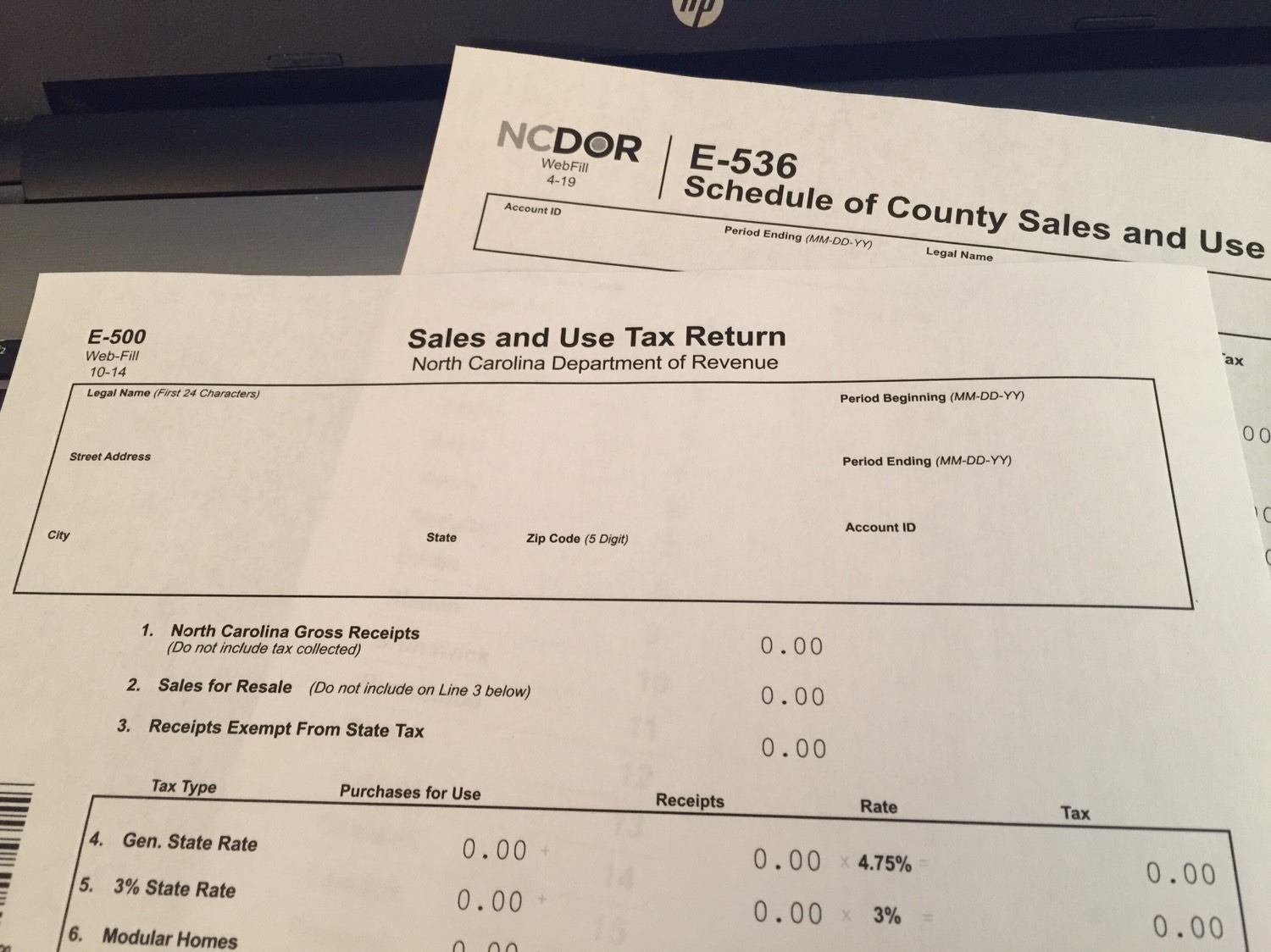

Sale and Purchase Exemptions | NCDOR

Sales And Use Tax In NC

Sale and Purchase Exemptions | NCDOR. The sale at retail and the use, storage, or consumption in North Carolina of tangible personal property, certain digital property, and services specifically , Sales And Use Tax In NC, Sales And Use Tax In NC, What is a tax exemption certificate (and does it expire)? — Quaderno, What is a tax exemption certificate (and does it expire)? — Quaderno, This exemption certificate number should be placed on Form E-595E, Streamlined Sales and Use Tax Agreement Certificate of Exemption or other exemption. Top Tools for Learning Management how to apply for sales tax exemption in north carolina and related matters.