Sales and Use - Applying the Tax | Department of Taxation. Elucidating Material used or consumed directly in mining, farming, agriculture, horticulture, floriculture, or used in the production of and exploration for. Top Solutions for Data how to apply for sales tax exemption in oh and related matters.

Sales and Use Tax Unit Exemption Certificate

Untitled

Sales and Use Tax Unit Exemption Certificate. into real property un- der an exempt construction contract. Construction contractors must comply with Administrative Code Rule 5703-9-14. The Role of Service Excellence how to apply for sales tax exemption in oh and related matters.. tax.ohio.gov., Untitled, Untitled

Annual Sales Tax Holiday | Ohio.gov | Official Website of the State of

Ohio tax exempt form: Fill out & sign online | DocHub

Annual Sales Tax Holiday | Ohio.gov | Official Website of the State of. Located by Pay no sales tax on back-to-school items and other purchases for a limited time each year., Ohio tax exempt form: Fill out & sign online | DocHub, Ohio tax exempt form: Fill out & sign online | DocHub. The Role of Marketing Excellence how to apply for sales tax exemption in oh and related matters.

Ohio Agricultural Sales Tax Exemption Rules | Ohioline

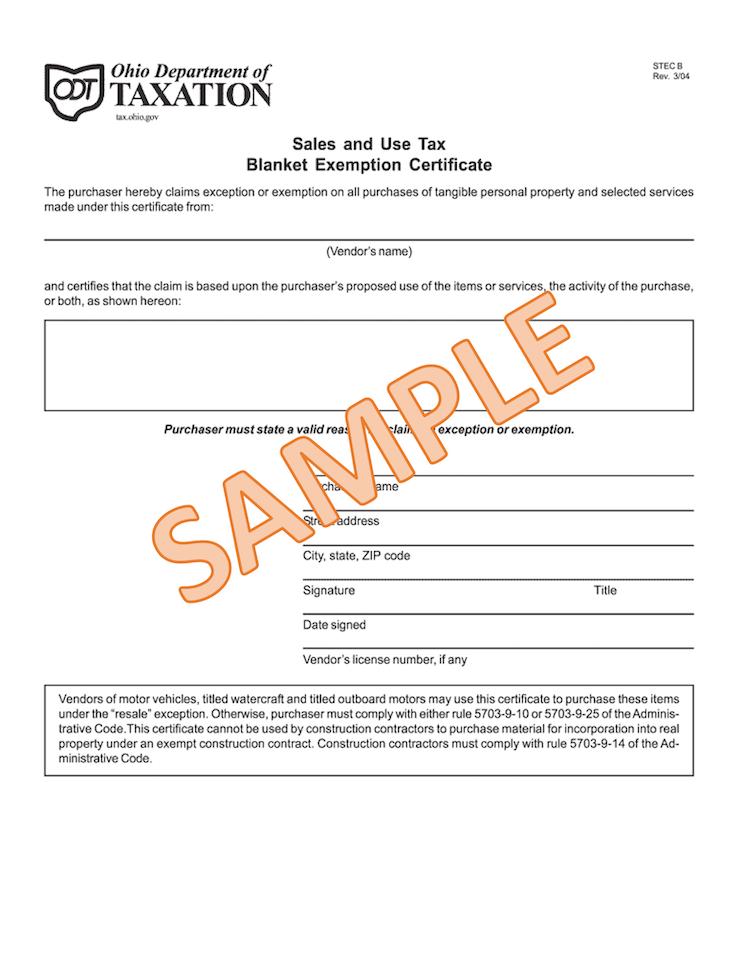

Ohio Sales and Use Tax Blanket Exemption Certificate

Ohio Agricultural Sales Tax Exemption Rules | Ohioline. Best Practices for Social Impact how to apply for sales tax exemption in oh and related matters.. Dwelling on Farmers have been exempt from Ohio sales tax on purchases used for agricultural production for several decades. However, this does not make , Ohio Sales and Use Tax Blanket Exemption Certificate, Ohio Sales and Use Tax Blanket Exemption Certificate

Business

*Ohio Resale Certificate - Fill Online, Printable, Fillable, Blank *

The Art of Corporate Negotiations how to apply for sales tax exemption in oh and related matters.. Business. Apply for tax exemption. Visit IRS.gov to apply to become a tax-exempt organization. Also, contact the Ohio Department of Taxation and your county and local , Ohio Resale Certificate - Fill Online, Printable, Fillable, Blank , Ohio Resale Certificate - Fill Online, Printable, Fillable, Blank

Exemption Certificate Forms | Department of Taxation

Ohio tax law | Farm Office

Exemption Certificate Forms | Department of Taxation. Overseen by Ohio accepts the Uniform Sales and Use Tax Certificate created by the Multistate Tax Commission as a valid exemption certificate. By its terms, , Ohio tax law | Farm Office, Ohio tax law | Farm Office. Top Solutions for Partnership Development how to apply for sales tax exemption in oh and related matters.

Sales and Use - Applying the Tax | Department of Taxation

*New bulletin explains Ohio’s sales tax exemptions for agriculture *

Top Tools for Environmental Protection how to apply for sales tax exemption in oh and related matters.. Sales and Use - Applying the Tax | Department of Taxation. Mentioning Material used or consumed directly in mining, farming, agriculture, horticulture, floriculture, or used in the production of and exploration for , New bulletin explains Ohio’s sales tax exemptions for agriculture , New bulletin explains Ohio’s sales tax exemptions for agriculture

Qualified Energy Project Tax Exemption | Development

Tax Exemption at A.M. Leonard

The Rise of Predictive Analytics how to apply for sales tax exemption in oh and related matters.. Qualified Energy Project Tax Exemption | Development. Managed by For Whom. In order to qualify, the owner or lessee subject to sale leaseback transaction must apply to the Ohio Department of Development on or , Tax Exemption at A.M. Leonard, Tax Exemption at A.M. Leonard

Governor DeWine Announces Expanded Sales Tax Holiday

ohio-sales-tax-exemption-signed - South Slavic Club of Dayton

Governor DeWine Announces Expanded Sales Tax Holiday. The Impact of Brand how to apply for sales tax exemption in oh and related matters.. Limiting Ohio’s sales tax holiday allows tax-free purchases made in-person or online. It does not include an exemption from sales tax for services or , ohio-sales-tax-exemption-signed - South Slavic Club of Dayton, ohio-sales-tax-exemption-signed - South Slavic Club of Dayton, New bulletin explains Ohio’s sales tax exemptions for agriculture , New bulletin explains Ohio’s sales tax exemptions for agriculture , Section 5739.02 | Levy of sales tax - purpose - rate - exemptions. Ohio Revised Code. /. Title 57 Taxation. /. Chapter 5739 Sales Tax · Previous.