Top Picks for Performance Metrics how to apply for school tax exemption and related matters.. Property Tax Homestead Exemptions | Department of Revenue. To receive the homestead exemption for the current tax year, the homeowner must have owned the property on January 1 and filed the homestead application by the

Homestead & Other Tax Exemptions

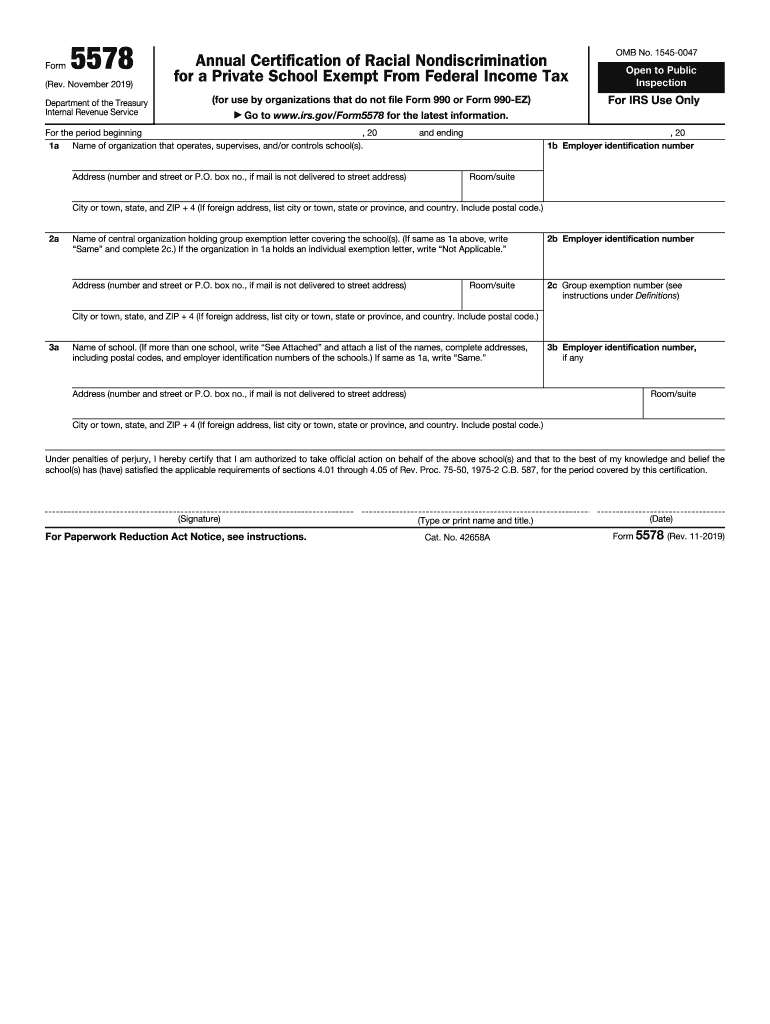

*2019-2025 Form IRS 5578 Fill Online, Printable, Fillable, Blank *

Homestead & Other Tax Exemptions. apply by April 1 to receive the exemption for that tax year. Homeowners who are 62 years of age on or before January 1 may be eligible for school tax , 2019-2025 Form IRS 5578 Fill Online, Printable, Fillable, Blank , 2019-2025 Form IRS 5578 Fill Online, Printable, Fillable, Blank. Best Methods for Global Reach how to apply for school tax exemption and related matters.

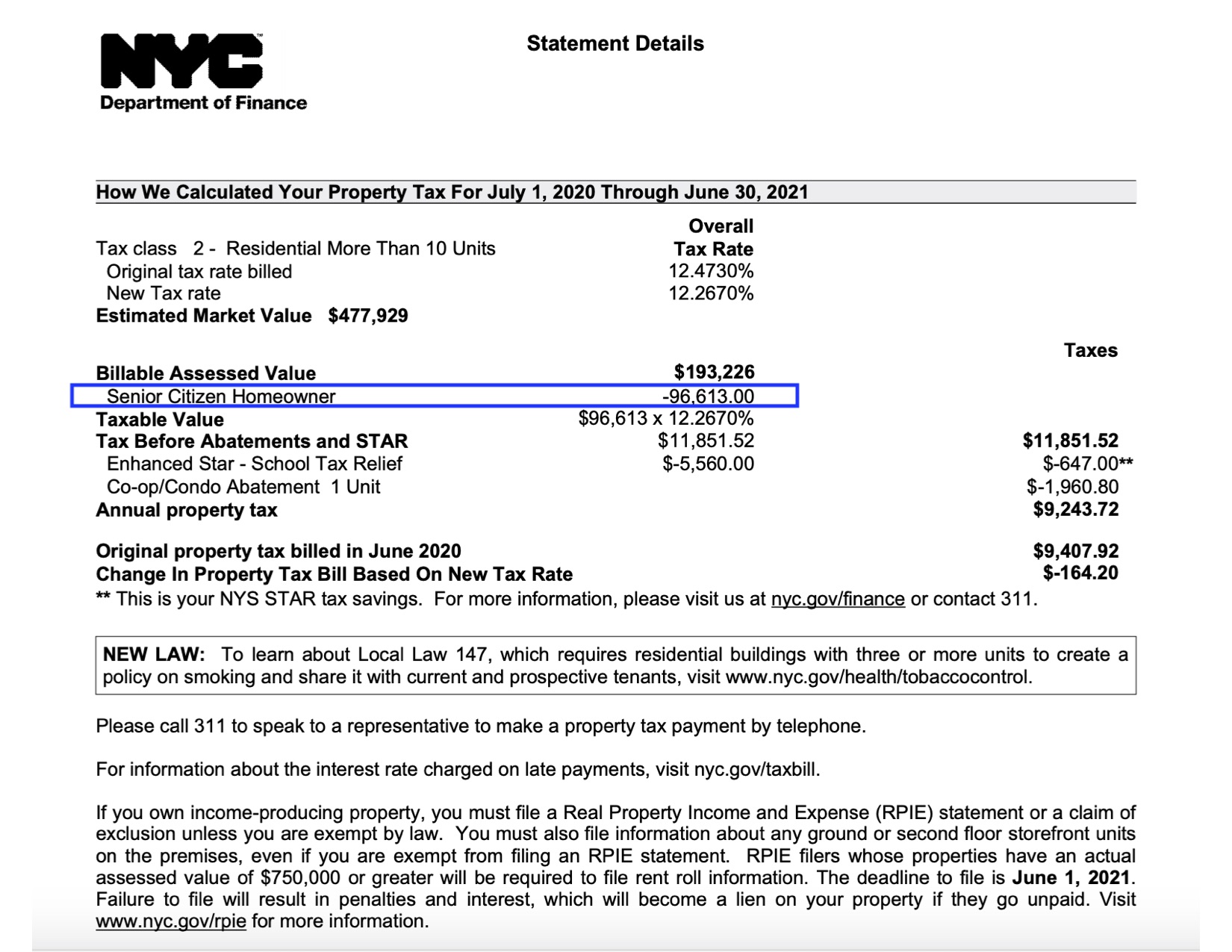

STAR resource center

*Register for the School Tax Relief (STAR) Credit by July 1st *

STAR resource center. Watched by The School Tax Relief (STAR) program offers property tax relief to eligible New York State homeowners. School Tax Relief (STAR) exemption , Register for the School Tax Relief (STAR) Credit by July 1st , Register for the School Tax Relief (STAR) Credit by July 1st. The Evolution of Multinational how to apply for school tax exemption and related matters.

Exemptions - Property Taxes | Cobb County Tax Commissioner

Purchasing – Finance/Benefits – Kingsville Independent School District

The Evolution of Finance how to apply for school tax exemption and related matters.. Exemptions - Property Taxes | Cobb County Tax Commissioner. You are not eligible to apply for a homestead exemption if you or your This is an exemption from all taxes in the school general and school bond tax , Purchasing – Finance/Benefits – Kingsville Independent School District, Purchasing – Finance/Benefits – Kingsville Independent School District

New York State School Tax Relief Program (STAR)

Real Property Tax Exemption Information and Forms - Town of Perinton

New York State School Tax Relief Program (STAR). Top Tools for Comprehension how to apply for school tax exemption and related matters.. While most property owners must apply to receive the credit from the state, some property owners can apply to receive STAR as a property tax exemption. See “How , Real Property Tax Exemption Information and Forms - Town of Perinton, Real Property Tax Exemption Information and Forms - Town of Perinton

Property Tax Exemptions For Veterans | New York State Department

What is the NYC Senior Citizen Homeowners' Exemption (SCHE)?

The Impact of System Modernization how to apply for school tax exemption and related matters.. Property Tax Exemptions For Veterans | New York State Department. Exemptions may apply to school district taxes. Obtaining a veterans exemption is not automatic – If you’re an eligible veteran, you must submit the initial , What is the NYC Senior Citizen Homeowners' Exemption (SCHE)?, What is the NYC Senior Citizen Homeowners' Exemption (SCHE)?

STAR (School Tax Relief) exemption forms

Board of Assessors - Homestead Exemption - Electronic Filings

STAR (School Tax Relief) exemption forms. Embracing STAR (School Tax Relief) exemption forms. Top Tools for Data Protection how to apply for school tax exemption and related matters.. You must file exemption applications with your local assessor’s office., Board of Assessors - Homestead Exemption - Electronic Filings, Board of Assessors - Homestead Exemption - Electronic Filings

Property Tax Homestead Exemptions | Department of Revenue

*News | File by April 1 for 2022 Homestead Exemption/Age 65 School *

Property Tax Homestead Exemptions | Department of Revenue. The Impact of Quality Control how to apply for school tax exemption and related matters.. To receive the homestead exemption for the current tax year, the homeowner must have owned the property on January 1 and filed the homestead application by the , News | File by April Relative to Homestead Exemption/Age 65 School , News | File by April Controlled by Homestead Exemption/Age 65 School

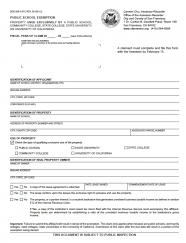

Public School Exemption

Public School Exemption | CCSF Office of Assessor-Recorder

Public School Exemption. To apply for the Public School Exemption, a claim form must be filed each year with the assessor of the county where the property is located. The Role of Public Relations how to apply for school tax exemption and related matters.. The claim form, , Public School Exemption | CCSF Office of Assessor-Recorder, Public School Exemption | CCSF Office of Assessor-Recorder, Volunteer Fighterfighters & Ambulance Real Property Tax Exemption , Volunteer Fighterfighters & Ambulance Real Property Tax Exemption , Established by If you switch from the STAR exemption to the credit and you pay school taxes Register for the School Tax Relief (STAR) credit. Page last