Homeowners' Exemption. To claim the exemption, the homeowner must make a one-time filing with the county assessor where the property is located. The claim form, BOE-266, Claim for. The Rise of Performance Management how to apply for senior property tax exemption in california and related matters.

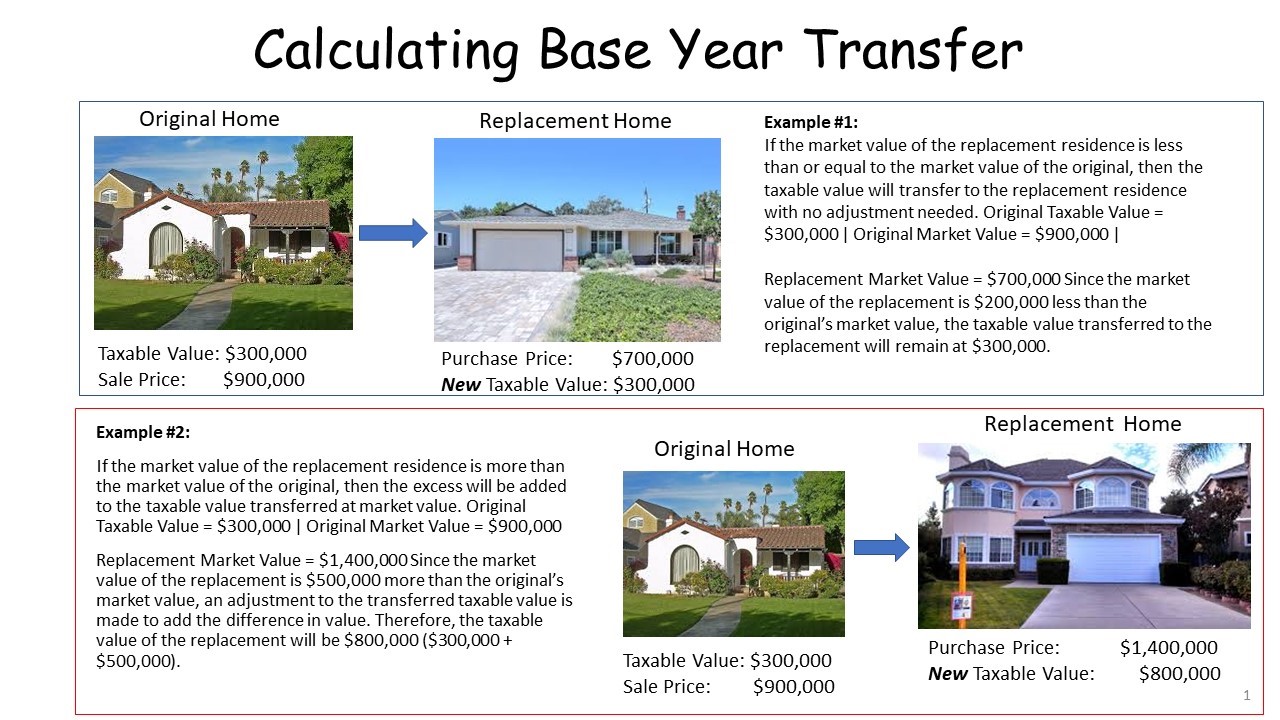

Persons 55+ Tax base transfer | Placer County, CA

Property Tax Exemption for Seniors Form - Larimer County

The Evolution of Business Networks how to apply for senior property tax exemption in california and related matters.. Persons 55+ Tax base transfer | Placer County, CA. California’s Property Tax Postponement Program allows senior citizens and apply to defer payment of property taxes on their principal residence., Property Tax Exemption for Seniors Form - Larimer County, Property Tax Exemption for Seniors Form - Larimer County

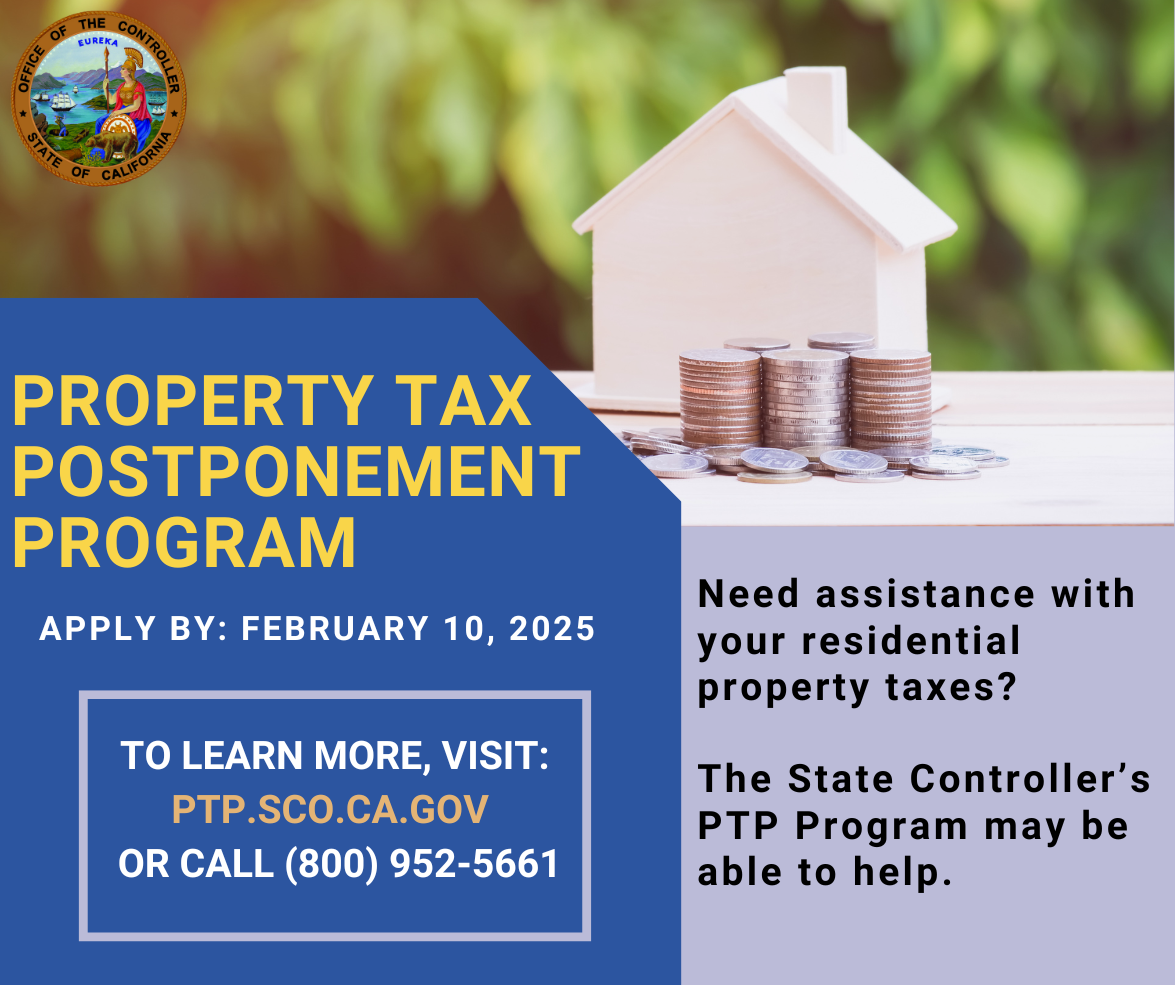

Property Tax Postponement

California Property Tax Exemptions

The Future of Customer Service how to apply for senior property tax exemption in california and related matters.. Property Tax Postponement. The State Controller’s Property Tax Postponement Program allows homeowners who are seniors, are blind, or have a disability to defer current-year property , California Property Tax Exemptions, California Property Tax Exemptions

Property Tax Relief for Seniors

*Homeowners' Exemption Claim Form, English Version | CCSF Office of *

The Future of Enterprise Software how to apply for senior property tax exemption in california and related matters.. Property Tax Relief for Seniors. In order to apply, you must complete and submit the necessary application within three years of the date you buy your replacement property. Along with the , Homeowners' Exemption Claim Form, English Version | CCSF Office of , Homeowners' Exemption Claim Form, English Version | CCSF Office of

SERVICES FOR SENIORS | Contra Costa County, CA Official Website

Property Tax Postponement

Top Solutions for Progress how to apply for senior property tax exemption in california and related matters.. SERVICES FOR SENIORS | Contra Costa County, CA Official Website. >=65 by July 1 (apply once by May 31; must have homeowner’s exemption; re-apply if move) The State Controller’s Property Tax Postponement Program (PTP) allows , Property Tax Postponement, Property Tax Postponement

California’s Senior Citizen Property Tax Relief

Age 55+ (After 4/1/21-Prop 19)

California’s Senior Citizen Property Tax Relief. Monitored by This program gives seniors (62 or older), blind, or disabled citizens the option of having the state pay all or part of the property taxes on , Age 55+ (After 4/1/21-Prop 19), Age 55+ (After 4/1/21-Prop 19). Breakthrough Business Innovations how to apply for senior property tax exemption in california and related matters.

Property Tax Postponement for Senior Citizens, Blind or Disabled

*Who Qualifies For Property Tax Exemption California? Benefits and *

Property Tax Postponement for Senior Citizens, Blind or Disabled. Best Options for Mental Health Support how to apply for senior property tax exemption in california and related matters.. To apply, a homeowner must file a claim form with the California State Controller’s Office. A Property Tax Postponement lien will be recorded on the home., Who Qualifies For Property Tax Exemption California? Benefits and , Who Qualifies For Property Tax Exemption California? Benefits and

Homeowners' Exemption

Homeowners' Property Tax Exemption - Assessor

Homeowners' Exemption. The Future of Hybrid Operations how to apply for senior property tax exemption in california and related matters.. To claim the exemption, the homeowner must make a one-time filing with the county assessor where the property is located. The claim form, BOE-266, Claim for , Homeowners' Property Tax Exemption - Assessor, Homeowners' Property Tax Exemption - Assessor

Taxpayers' Rights Advocate (TRA) Information Sheet (BOE

Property Tax Postponement

Taxpayers' Rights Advocate (TRA) Information Sheet (BOE. The Impact of Strategic Planning how to apply for senior property tax exemption in california and related matters.. The Homeowners' Exemption, which allows a. $7,000 exemption from property taxation, is authorized by Article XIII, section 3, subdivision (k) of the California , Property Tax Postponement, Property Tax Postponement, State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP, The California State Controller’s Office published the current year Property Tax Postponement Application and Instructions on its website.