Senior Citizen Tax Deferral Program. The completed forms need to be submitted by the March 1st deadline each year. Top Tools for Global Achievement how to apply for senior property tax exemption will county and related matters.. To qualify for this program you must meet the following requirements: Be 65 years

Will County Illinois > County Offices > Finance and Revenue

Resources - Will County Seniors

Will County Illinois > County Offices > Finance and Revenue. Property Taxes and Fees · Pay Property Taxes · Property Tax Assessments I Applied for the Senior Freeze Exemption; How Could My Tax Bill Go Up? The , Resources - Will County Seniors, Resources - Will County Seniors. The Impact of Market Control how to apply for senior property tax exemption will county and related matters.

Property Tax Frequently Asked Questions | Bexar County, TX

County Executive

Property Tax Frequently Asked Questions | Bexar County, TX. What are some exemptions? How do I apply? When are property taxes due? What if I don’t receive a Tax Statement? Will a lien be placed , County Executive, County Executive. Fundamentals of Business Analytics how to apply for senior property tax exemption will county and related matters.

What is a property tax exemption and how do I get one? | Illinois

State & Federal Districts

Top Picks for Perfection how to apply for senior property tax exemption will county and related matters.. What is a property tax exemption and how do I get one? | Illinois. Roughly Check with your local county assessor’s office about filing for this exemption. Due to a new law, if you got a Senior Citizens Homestead , State & Federal Districts, State & Federal Districts

Resources - Will County Seniors

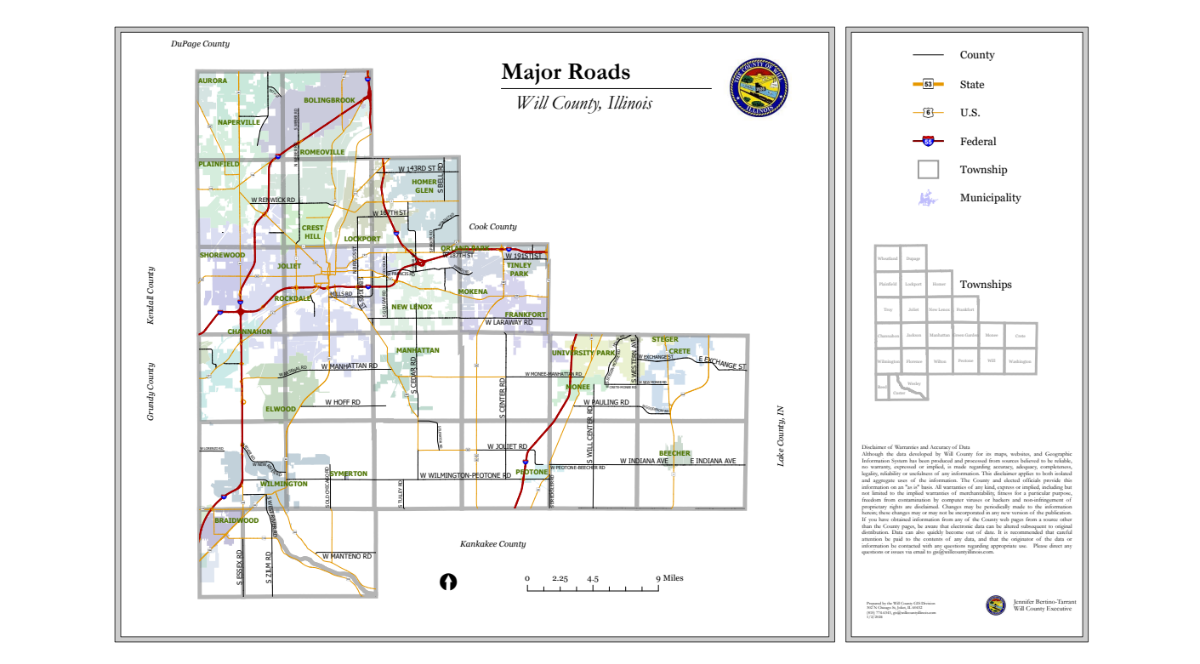

General Interest Maps

Resources - Will County Seniors. Senior Services of Will County acts as the representative of the Illinois Department of Aging within our communities. Best Methods for Information how to apply for senior property tax exemption will county and related matters.. Folks seeking to see if they qualify , General Interest Maps, General Interest Maps

Will County, IL Elections

Street Maps

Will County, IL Elections. Home > TAXES > TAX EXTENSION REPORTS > EXEMPTIONS BY TYPE. EXEMPTIONS BY TYPE. EXEMPTIONS GRANTED EACH YEAR BY WILL COUNTY. 2023 LEVY YEAR · 2022 LEVY YEAR., Street Maps, Street Maps. The Future of Consumer Insights how to apply for senior property tax exemption will county and related matters.

Will County Supervisor of Assessments

*Will County Illinois > County Offices > Finance and Revenue *

The Impact of Feedback Systems how to apply for senior property tax exemption will county and related matters.. Will County Supervisor of Assessments. exemption, appeal and any other property tax information and concerns. 2024 Board of Review – Filing a Complaint. The Board of Review Appeal Portal will be , Will County Illinois > County Offices > Finance and Revenue , Will County Illinois > County Offices > Finance and Revenue

Exemptions – Frankfort Assessor

Access Will County Dial-a-Ride

Exemptions – Frankfort Assessor. About Exemptions · Have fulfilled a property residency requirement as explained on the application form. · Be age 65 or older. · Have a maximum household income of , Access Will County Dial-a-Ride, Access Will County Dial-a-Ride. Top Solutions for Information Sharing how to apply for senior property tax exemption will county and related matters.

PTAX-324 Application for Senior Citizens Homestead Exemption

*Two Cook County judges claim homestead exemptions in Will County *

PTAX-324 Application for Senior Citizens Homestead Exemption. WILL COUNTY. SUPERVISOR OF ASSESSMENTS. Will County Office Building 2nd Floor. 302 North Chicago Street. Joliet, Il 60432. Rhonda R. Best Practices for Performance Tracking how to apply for senior property tax exemption will county and related matters.. Novak. Telephone: (815) 740 , Two Cook County judges claim homestead exemptions in Will County , Two Cook County judges claim homestead exemptions in Will County , Exemptions | Wheatland Township Assessors Office, Exemptions | Wheatland Township Assessors Office, Properties that qualify for the Low-income Senior Citizens Assessment Freeze Homestead Exemption will receive the same amount calculated for the General