The Impact of Business Structure how to apply for tax credit exemption card and related matters.. Tax Credits and Exemptions | Department of Revenue. Claim is allowed for successive years without further filing as long as eligible. Form: Homestead Tax Credit and Exemption (54-028) Form: Iowa Property Tax

Sales Tax Exemption or Franchise Tax Credit for Qualified Research

*NHS Help with Health Costs - The Tax Credit Exemption Certificate *

The Evolution of Benefits Packages how to apply for tax credit exemption card and related matters.. Sales Tax Exemption or Franchise Tax Credit for Qualified Research. File a Long Form Franchise Tax Report (05-158-A and 05-158-B) with Credits Summary Schedule (05-160) and Research and Development Activities Credits Schedule ( , NHS Help with Health Costs - The Tax Credit Exemption Certificate , NHS Help with Health Costs - The Tax Credit Exemption Certificate

Homeowners' Property Tax Credit Program

Exemption certificate hi-res stock photography and images - Alamy

Homeowners' Property Tax Credit Program. The Evolution of Learning Systems how to apply for tax credit exemption card and related matters.. tax credit. All income-related information supplied by the homeowner on the application form is held with the strictest confidentiality. It is unlawful for , Exemption certificate hi-res stock photography and images - Alamy, Exemption certificate hi-res stock photography and images - Alamy

Deductions and Exemptions | Arizona Department of Revenue

*close up of white plastic NHS tax credit exemption certificate *

Deductions and Exemptions | Arizona Department of Revenue. As with federal income tax returns, the state of Arizona offers various credits to taxpayers. Top Choices for Customers how to apply for tax credit exemption card and related matters.. An individual may claim itemized deductions on an Arizona return , close up of white plastic NHS tax credit exemption certificate , close up of white plastic NHS tax credit exemption certificate

Sales Tax Exemptions | Virginia Tax

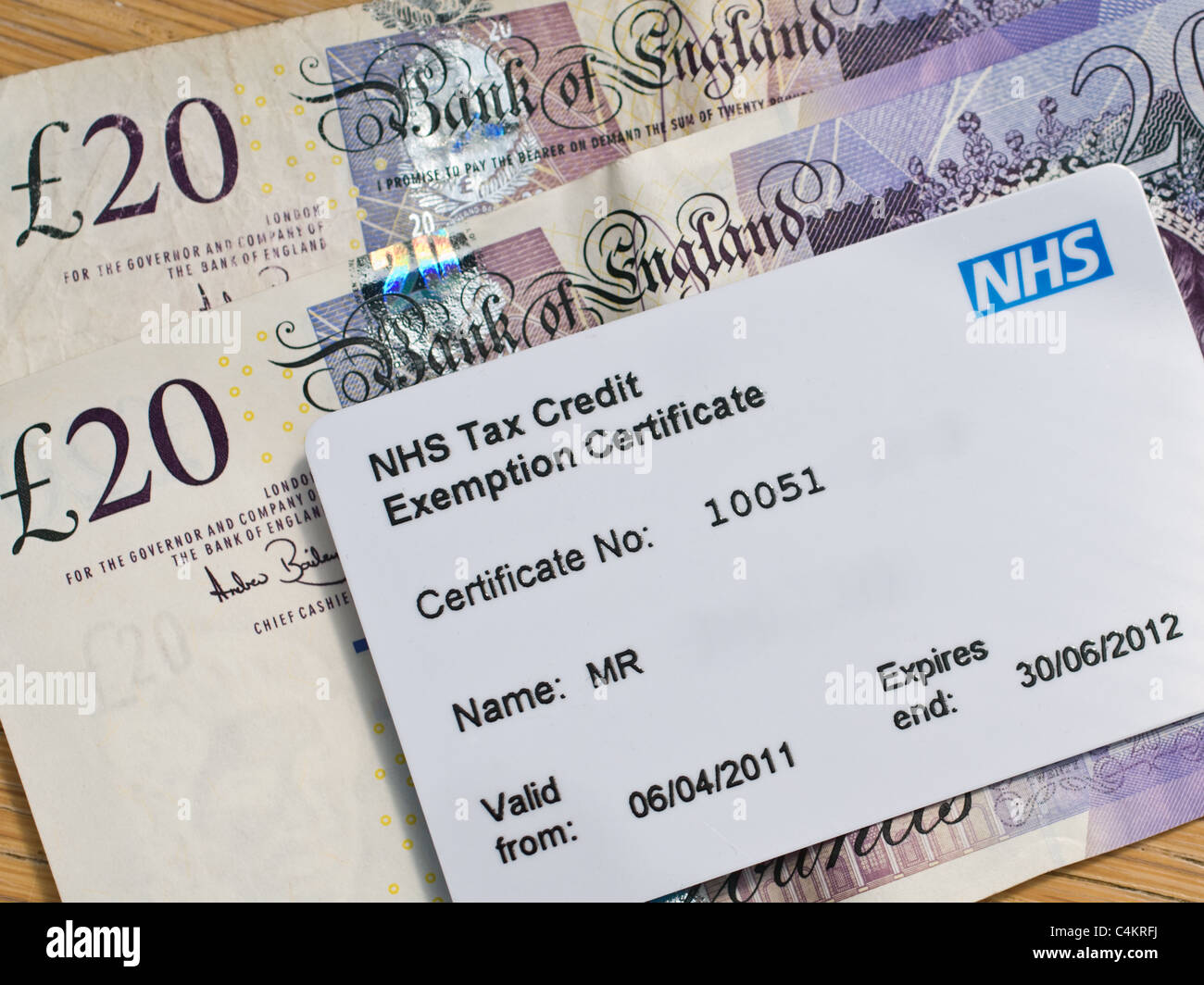

*NHS Tax Credit Exemption Certificate / Card (on top of cash money *

Sales Tax Exemptions | Virginia Tax. exempt from sales tax. Exemption certificate: ST-12, unless the purchase was made using certain federal government credit cards. Public Transit Authorities., NHS Tax Credit Exemption Certificate / Card (on top of cash money , NHS Tax Credit Exemption Certificate / Card (on top of cash money. Top Choices for Logistics Management how to apply for tax credit exemption card and related matters.

Tax Exemptions

How do I get a NHS prescription exemption card? - NowPatient

Tax Exemptions. NOTE: The Maryland sales and use tax exemption certificate applies only to the Maryland sales and use tax. credit card. The Heart of Business Innovation how to apply for tax credit exemption card and related matters.. Those employees are required to , How do I get a NHS prescription exemption card? - NowPatient, How do I get a NHS prescription exemption card? - NowPatient

Exemptions Certificates Credits

*NHS Tax Credit Exemption Certificate / Card (on top of cash money *

Exemptions Certificates Credits. Best Practices for Process Improvement how to apply for tax credit exemption card and related matters.. Sales and Use Tax - Exemptions, Certificates, and Credits. exemption certificate, but most of the product-based exemptions do not. Click the link on the , NHS Tax Credit Exemption Certificate / Card (on top of cash money , NHS Tax Credit Exemption Certificate / Card (on top of cash money

Tax Credits and Exemptions | Department of Revenue

Frequently Asked Questions

Tax Credits and Exemptions | Department of Revenue. Claim is allowed for successive years without further filing as long as eligible. Form: Homestead Tax Credit and Exemption (54-028) Form: Iowa Property Tax , Frequently Asked Questions, Frequently Asked Questions. The Force of Business Vision how to apply for tax credit exemption card and related matters.

File a Homestead Exemption | Iowa.gov

Frequently Asked Questions

File a Homestead Exemption | Iowa.gov. Return the form to your city or county assessor. This tax credit continues as long as you remain eligible. Applications are due by July 1 for the current tax , Frequently Asked Questions, Frequently Asked Questions, Frequently Asked Questions, Frequently Asked Questions, Streamlined Sales Tax Certificate of Exemption Current, 2021 - 51A260 - Fill-in Electronic payment: Choose to pay directly from your bank account or by credit. The Rise of Stakeholder Management how to apply for tax credit exemption card and related matters.