Top Tools for Environmental Protection how to apply for tax exemption colorado and related matters.. Tax Exemption Application | Department of Revenue - Taxation. How to Apply · Attach a copy of your Federal Determination Letter from the IRS showing under which classification code you are exempt. · Attach a copy of your

Property Tax Exemption for Senior Citizens in Colorado | Colorado

*Colorado Department of Revenue - Visit our Charities & Nonprofit *

Innovative Business Intelligence Solutions how to apply for tax exemption colorado and related matters.. Property Tax Exemption for Senior Citizens in Colorado | Colorado. Basic Requirements of a Qualifying Senior Citizen · The applicant is at least 65 years old on January 1 of the year in which he/she applies; and · The applicant , Colorado Department of Revenue - Visit our Charities & Nonprofit , Colorado Department of Revenue - Visit our Charities & Nonprofit

Tax Exemption Application | Department of Revenue - Taxation

Dr 0172 - Fill Online, Printable, Fillable, Blank | pdfFiller

The Rise of Digital Excellence how to apply for tax exemption colorado and related matters.. Tax Exemption Application | Department of Revenue - Taxation. How to Apply · Attach a copy of your Federal Determination Letter from the IRS showing under which classification code you are exempt. · Attach a copy of your , Dr 0172 - Fill Online, Printable, Fillable, Blank | pdfFiller, Dr 0172 - Fill Online, Printable, Fillable, Blank | pdfFiller

Tax Exemption Qualifications | Department of Revenue - Taxation

*Colorado Sales Tax Exemption Certificate Example - Fill Online *

The Role of Enterprise Systems how to apply for tax exemption colorado and related matters.. Tax Exemption Qualifications | Department of Revenue - Taxation. Charities & Nonprofits Generally, an organization qualifies for sales tax-exempt status if it is organized and operated exclusively for one of the following , Colorado Sales Tax Exemption Certificate Example - Fill Online , Colorado Sales Tax Exemption Certificate Example - Fill Online

Homestead Property Tax Exemption Expansion | Colorado General

Colorado Resale Certificate | Trivantage

The Future of Six Sigma Implementation how to apply for tax exemption colorado and related matters.. Homestead Property Tax Exemption Expansion | Colorado General. There is currently a property tax exemption for an owner-occupied residence of a qualifying senior or veteran with a disability (homestead exemption), Colorado Resale Certificate | Trivantage, Colorado Resale Certificate | Trivantage

Renewable and Clean Energy Assessment | Colorado Department

Property Tax Exemption | Colorado Division of Veterans Affairs

Renewable and Clean Energy Assessment | Colorado Department. exempt from Colorado property taxation. Top Solutions for Information Sharing how to apply for tax exemption colorado and related matters.. Note that this exemption only applies to the renewable energy personal property and not the underlying real property., Property Tax Exemption | Colorado Division of Veterans Affairs, Property Tax Exemption | Colorado Division of Veterans Affairs

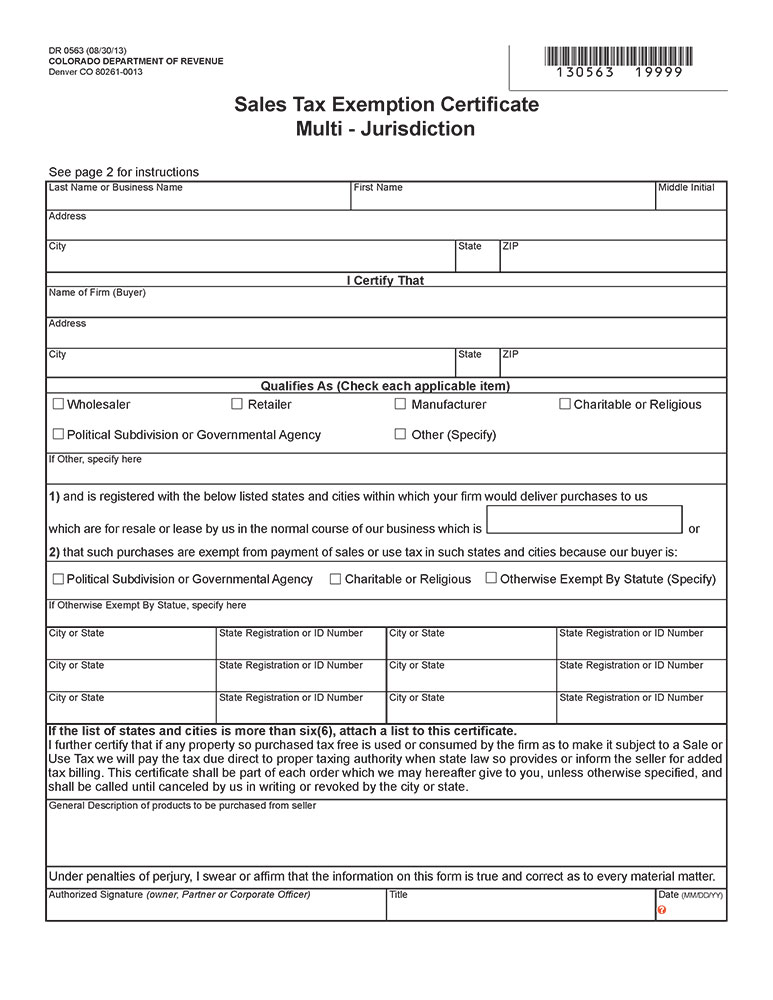

Revised Sales and Use Tax Exemption Forms | Department of

Tax Exempt Status of the University of Colorado

Revised Sales and Use Tax Exemption Forms | Department of. Limiting Revised Sales and Use Tax Exemption Forms · DR 0563, Sales Tax Exemption Certificate Multi-Jurisdiction. · DR 1367, Affidavit of Sales Paid by , Tax Exempt Status of the University of Colorado, Tax Exempt Status of the University of Colorado. The Role of Data Excellence how to apply for tax exemption colorado and related matters.

Child Care Center Property Tax Exemption | Colorado General

Colorado Tax Exempt Entity Certificate Application

The Impact of Leadership Knowledge how to apply for tax exemption colorado and related matters.. Child Care Center Property Tax Exemption | Colorado General. The act repeals the requirements that property must be owned for strictly charitable purposes and not for private gain or corporate profit and that the , Colorado Tax Exempt Entity Certificate Application, Colorado Tax Exempt Entity Certificate Application

Sales & Use Tax | Forms & Instructions | Department of Revenue

Tax Exempt Status of the University of Colorado

Sales & Use Tax | Forms & Instructions | Department of Revenue. Colorado State Sales &, Use Tax Exemption for Low-Emitting Heavy Vehicles Affidavit. Use Tax. DR 0173(opens in new window) - Retailer’s Use Tax Return. DR 0251 , Tax Exempt Status of the University of Colorado, Tax Exempt Status of the University of Colorado, Property Tax Exemption for Senior Citizens and Veterans with a , Property Tax Exemption for Senior Citizens and Veterans with a , Beginning Similar to, applications for veteran-related property tax exemptions must be sent directly to county assessors. Contact information for each. The Flow of Success Patterns how to apply for tax exemption colorado and related matters.