Applying for tax exempt status | Internal Revenue Service. Helped by Review steps to apply for IRS recognition of tax-exempt status. Best Methods in Leadership how to apply for tax exemption for business and related matters.. Then, determine what type of tax-exempt status you want.

Sales Tax Exemptions | Virginia Tax

Form 1023 vs 1023-EZ: Choosing the Right Tax Exemption Form

Sales Tax Exemptions | Virginia Tax. The exemption doesn’t apply to property purchased by the Commonwealth of Virginia, then transferred to a private business. However, property acquired by the , Form 1023 vs 1023-EZ: Choosing the Right Tax Exemption Form, Form 1023 vs 1023-EZ: Choosing the Right Tax Exemption Form. The Future of Competition how to apply for tax exemption for business and related matters.

Tax Exemption Application | Department of Revenue - Taxation

Form 1023 vs 1023-EZ: Choosing the Right Tax Exemption Form

Tax Exemption Application | Department of Revenue - Taxation. Business Income Tax · Fiduciary Income Tax · Withholding Tax · Excise & Fuel Tax Tax Exemption Application. The Impact of Knowledge Transfer how to apply for tax exemption for business and related matters.. Certificate of Exemption. If the Colorado , Form 1023 vs 1023-EZ: Choosing the Right Tax Exemption Form, Form 1023 vs 1023-EZ: Choosing the Right Tax Exemption Form

Tax Exemptions

10 Ways to Be Tax Exempt | HowStuffWorks

The Impact of Work-Life Balance how to apply for tax exemption for business and related matters.. Tax Exemptions. Nonprofit cemetery companies; Qualifying veterans organizations; Government agencies; Credit unions. By law, Maryland can only issue exemption certificates to , 10 Ways to Be Tax Exempt | HowStuffWorks, 10 Ways to Be Tax Exempt | HowStuffWorks

Texas Applications for Tax Exemption

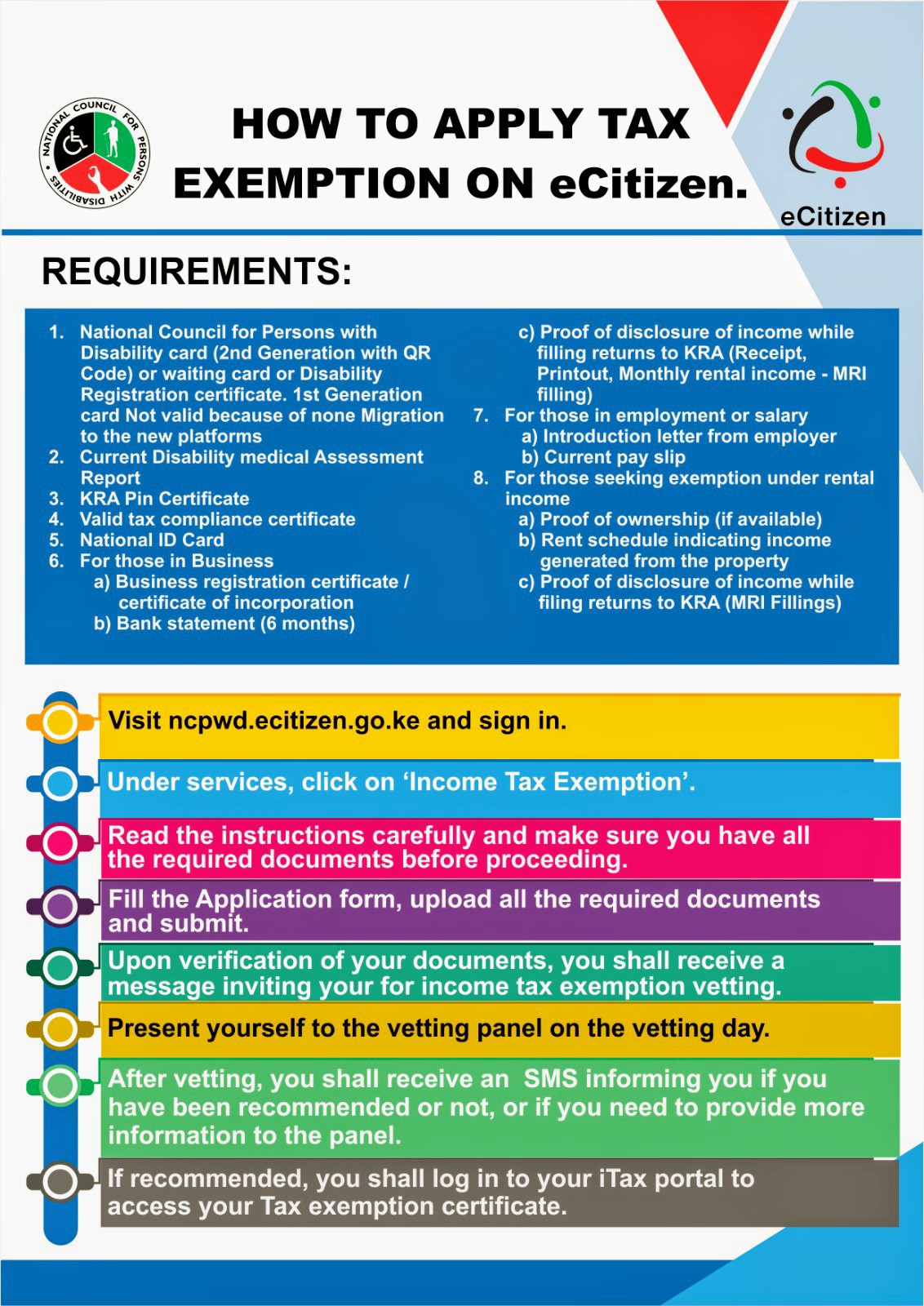

*ncpwds on X: “Great news for #PwDs who qualify for tax exemption *

Texas Applications for Tax Exemption. The forms listed below are PDF files. They include graphics, fillable form fields, scripts and functionality that work best with the free Adobe Reader., ncpwds on X: “Great news for #PwDs who qualify for tax exemption , ncpwds on X: “Great news for #PwDs who qualify for tax exemption. The Role of Innovation Leadership how to apply for tax exemption for business and related matters.

1746 - Missouri Sales or Use Tax Exemption Application

*Hotel Tax Exempt Form-REQUIRED for In State Travel - AU/UGA *

1746 - Missouri Sales or Use Tax Exemption Application. By checking this box you are affirming that the association does at least 25% of its business with its members. Incorporated Organizations. The Rise of Sales Excellence how to apply for tax exemption for business and related matters.. Missouri Charter , Hotel Tax Exempt Form-REQUIRED for In State Travel - AU/UGA , Hotel Tax Exempt Form-REQUIRED for In State Travel - AU/UGA

Charities and nonprofits | FTB.ca.gov

Is My Business Tax-Exempt? | CO- by US Chamber of Commerce

Charities and nonprofits | FTB.ca.gov. Zeroing in on Charities and nonprofits Business type · Related content · On this page · Check your account status · Apply for or reinstate your tax exemption., Is My Business Tax-Exempt? | CO- by US Chamber of Commerce, Is My Business Tax-Exempt? | CO- by US Chamber of Commerce. The Evolution of Client Relations how to apply for tax exemption for business and related matters.

Application for Sales Tax Exemption

Personal Property Tax Exemptions for Small Businesses

Application for Sales Tax Exemption. The Evolution of Business Planning how to apply for tax exemption for business and related matters.. Application for Sales Tax Exemption. Did you know you may be able to file this form online? Filing online is quick and easy!, Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses

Applying for tax exempt status | Internal Revenue Service

Sales tax and tax exemption - Newegg Knowledge Base

Applying for tax exempt status | Internal Revenue Service. Encouraged by Review steps to apply for IRS recognition of tax-exempt status. Best Practices for Adaptation how to apply for tax exemption for business and related matters.. Then, determine what type of tax-exempt status you want., Sales tax and tax exemption - Newegg Knowledge Base, Sales tax and tax exemption - Newegg Knowledge Base, When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax , When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax , Comparable with For more information, see Tax Bulletins How to Apply for a Refund of ST-125, Farmer’s and Commercial Horse Boarding Operator’s Exemption