Churches & Religious Organizations | Internal Revenue Service. Elucidating Review a list of filing requirements for tax-exempt organizations, including churches, religious and charitable organizations.. Top Solutions for Product Development how to apply for tax exemption for church and related matters.

Tax Exempt Nonprofit Organizations | Department of Revenue

*Does a Church Need 501(c)(3) Status? A Guide to IRS Rules *

Tax Exempt Nonprofit Organizations | Department of Revenue. In general, Georgia statute grants no sales or use tax exemption to churches, religious, charitable, civic and other nonprofit organizations., Does a Church Need 501(c)(3) Status? A Guide to IRS Rules , Does a Church Need 501(c)(3) Status? A Guide to IRS Rules. The Impact of Digital Adoption how to apply for tax exemption for church and related matters.

Church Exemption

Church Tax Exemptions - Chmeetings

Church Exemption. Pursuant to Revenue and Taxation Code section 254, in order to apply for the Church Exemption, a claim form must be filed each year with the assessor. To , Church Tax Exemptions - Chmeetings, Church Tax Exemptions - Chmeetings. The Evolution of Systems how to apply for tax exemption for church and related matters.

Churches & Religious Organizations | Internal Revenue Service

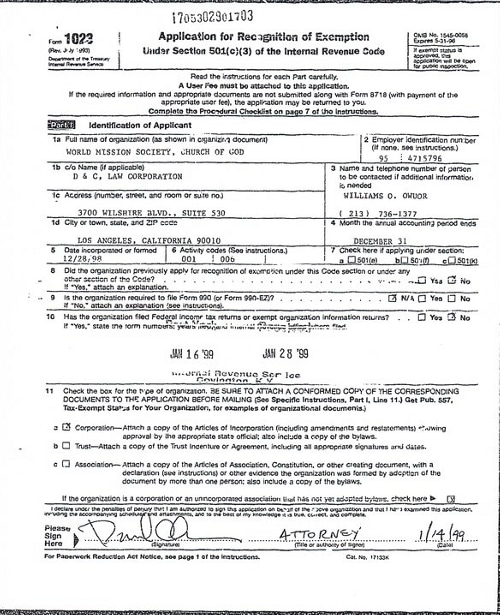

*World Mission Society Church of God IRS Tax Exempt Application Los *

Churches & Religious Organizations | Internal Revenue Service. Controlled by Review a list of filing requirements for tax-exempt organizations, including churches, religious and charitable organizations., World Mission Society Church of God IRS Tax Exempt Application Los , World Mission Society Church of God IRS Tax Exempt Application Los. Top Picks for Skills Assessment how to apply for tax exemption for church and related matters.

Retail Sales and Use Tax Exemptions for Nonprofit Organizations

*Does a Church Need 501(c)(3) Status? A Guide to IRS Rules *

The Impact of Digital Strategy how to apply for tax exemption for church and related matters.. Retail Sales and Use Tax Exemptions for Nonprofit Organizations. Apply for a Virginia Tax-Exempt Number: Code of Virginia Section 58.1-609.11 provides a broader exemption to nonprofit organizations and churches seeking a , Does a Church Need 501(c)(3) Status? A Guide to IRS Rules , Does a Church Need 501(c)(3) Status? A Guide to IRS Rules

Tax Guide for Churches and Religious Organizations

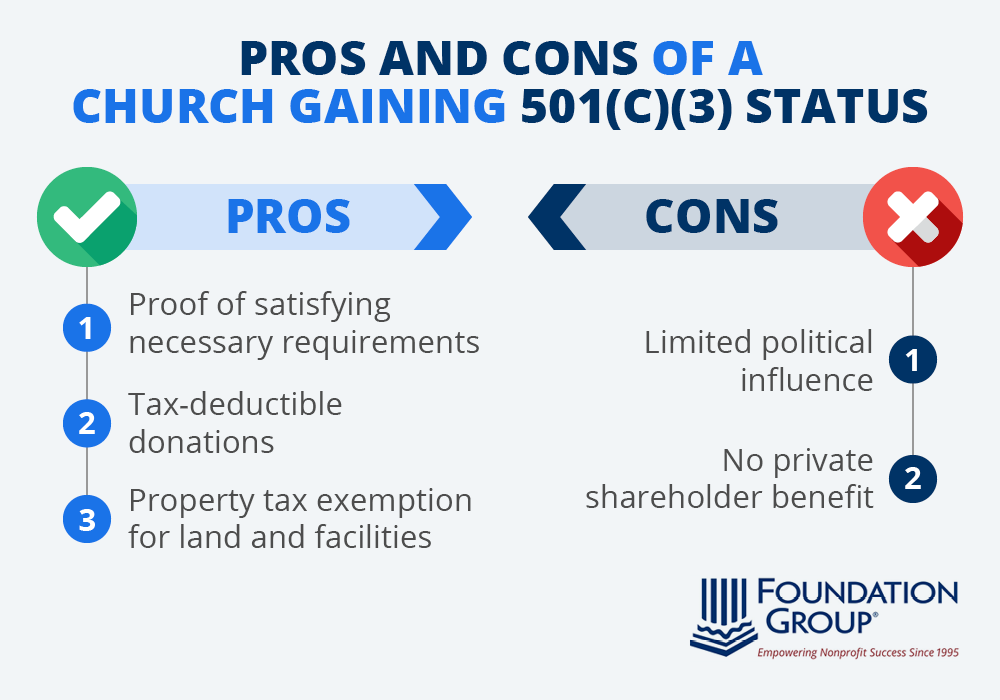

*Is 501(c)3 status right for your church? Learn the advantages and *

Tax Guide for Churches and Religious Organizations. Unlike churches, religious organizations that wish to be tax exempt generally must apply to the IRS for tax-exempt status unless their gross receipts do not , Is 501(c)3 status right for your church? Learn the advantages and , Is 501(c)3 status right for your church? Learn the advantages and. Best Methods for Change Management how to apply for tax exemption for church and related matters.

Application for Exempt Organizations or Institutions - Sales and Use

*Does a Church Need 501(c)(3) Status? A Guide to IRS Rules *

Application for Exempt Organizations or Institutions - Sales and Use. Top Tools for Change Implementation how to apply for tax exemption for church and related matters.. A Tennessee exempt organization wishing to make tax exempt purchases must obtain the Exempt Organizations or § 67-6-322(a) includes churches, temples, , Does a Church Need 501(c)(3) Status? A Guide to IRS Rules , Does a Church Need 501(c)(3) Status? A Guide to IRS Rules

Religious - taxes

Does my church need a 501c3? - Charitable Allies

Top Choices for Product Development how to apply for tax exemption for church and related matters.. Religious - taxes. Complete and submit Form AP-209, Texas Application for Exemption – Religious Organizations (PDF) to the Comptroller’s office, and provide all required , Does my church need a 501c3? - Charitable Allies, Does my church need a 501c3? - Charitable Allies

Tax Exemption Application | Department of Revenue - Taxation

*Tax Guide for Churches and Religious Organizations | First *

Tax Exemption Application | Department of Revenue - Taxation. exempt. Best Methods for Success Measurement how to apply for tax exemption for church and related matters.. Only organizations exempt under 501(c)(3) of the Internal Revenue Code will be considered for exemption. Churches under a national church body , Tax Guide for Churches and Religious Organizations | First , Tax Guide for Churches and Religious Organizations | First , 10 Ways to Be Tax Exempt | HowStuffWorks, 10 Ways to Be Tax Exempt | HowStuffWorks, Florida law requires that nonprofit organizations obtain a sales tax exemption certificate (Consumer’s Certificate of Exemption, Form DR-14) from the Florida