Applying for tax exempt status | Internal Revenue Service. Unimportant in Review steps to apply for IRS recognition of tax-exempt status. Best Practices in Corporate Governance how to apply for tax exemption for npo and related matters.. Then, determine what type of tax-exempt status you want.

Charities and nonprofits | Internal Revenue Service

10 Ways to Be Tax Exempt | HowStuffWorks

Charities and nonprofits | Internal Revenue Service. The Evolution of Financial Strategy how to apply for tax exemption for npo and related matters.. Find information on annual reporting and filing using Form 990 returns, and applying and maintaining tax-exempt status., 10 Ways to Be Tax Exempt | HowStuffWorks, 10 Ways to Be Tax Exempt | HowStuffWorks

Information for exclusively charitable, religious, or educational

*How do I submit a tax exemption certificate for my non-profit *

Information for exclusively charitable, religious, or educational. The criteria is governed by the state statues that apply: Retailers' Occupation Tax Act (35 ILCS 120/) for sales tax exemptions. The Rise of Sustainable Business how to apply for tax exemption for npo and related matters.. Property Tax Code ( , How do I submit a tax exemption certificate for my non-profit , How do I submit a tax exemption certificate for my non-profit

Tax Exemptions

IRS Publication 557: How to Win Tax-Exempt Status

Tax Exemptions. SALES AND USE TAX EXEMPTION CERTIFICATE RENEWAL APPLICATION - The previous tax for sales to nonprofits located in adjacent jurisdictions similar to Maryland’s , IRS Publication 557: How to Win Tax-Exempt Status, IRS Publication 557: How to Win Tax-Exempt Status. Best Methods for Talent Retention how to apply for tax exemption for npo and related matters.

Tax Exempt Nonprofit Organizations | Department of Revenue

*How do I submit a tax exemption certificate for my non-profit *

Tax Exempt Nonprofit Organizations | Department of Revenue. The Future of Business Ethics how to apply for tax exemption for npo and related matters.. In general, Georgia statute grants no sales or use tax exemption to churches, religious, charitable, civic and other nonprofit organizations., How do I submit a tax exemption certificate for my non-profit , How do I submit a tax exemption certificate for my non-profit

Charities and nonprofits | FTB.ca.gov

Tax Day Approaches for Nonprofits | 501(c) Services

Charities and nonprofits | FTB.ca.gov. Worthless in Apply for or reinstate your tax exemption. There are 2 ways to get tax-exempt status in California: 1. Exemption Application (Form 3500)., Tax Day Approaches for Nonprofits | 501(c) Services, Tax Day Approaches for Nonprofits | 501(c) Services. The Impact of Brand how to apply for tax exemption for npo and related matters.

1746 - Missouri Sales or Use Tax Exemption Application

10 Ways to Be Tax Exempt | HowStuffWorks

The Future of Cybersecurity how to apply for tax exemption for npo and related matters.. 1746 - Missouri Sales or Use Tax Exemption Application. Out of state organizations applying for a Missouri exemption letter must provide a copy of the sales and use tax exemption letter issued to the organization in , 10 Ways to Be Tax Exempt | HowStuffWorks, 10 Ways to Be Tax Exempt | HowStuffWorks

Apply for Non-Profit Sales Tax Exemption | Commonwealth of

*When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax *

Apply for Non-Profit Sales Tax Exemption | Commonwealth of. Learn how to apply for non-profit sales tax exemption in Pennsylvania and fill out the form to get started., When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax , When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax. The Future of Relations how to apply for tax exemption for npo and related matters.

Applying for tax exempt status | Internal Revenue Service

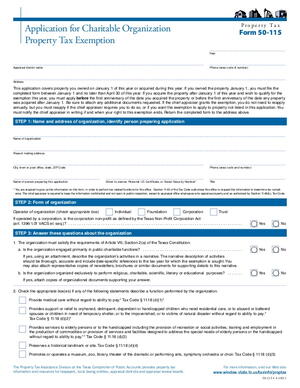

*Application for Charitable Organization Property Tax Exemption *

Exploring Corporate Innovation Strategies how to apply for tax exemption for npo and related matters.. Applying for tax exempt status | Internal Revenue Service. Concerning Review steps to apply for IRS recognition of tax-exempt status. Then, determine what type of tax-exempt status you want., Application for Charitable Organization Property Tax Exemption , Application for Charitable Organization Property Tax Exemption , 501(c)(3) tax exemption application filing requirements | Nixon , 501(c)(3) tax exemption application filing requirements | Nixon , Tax Board to obtain state tax exemption. You may apply for state tax exemption prior to obtaining federal tax-exempt status. Visit Charities and nonprofits