Apply for a Homestead Exemption | Georgia.gov. Best Practices for Client Satisfaction how to apply for tax exemption in atlanta georgia and related matters.. You must file your homestead exemption application with your county tax officials. Please contact your county tax officials for how to file your homestead

Property Tax Homestead Exemptions | Department of Revenue

Georgia Sales & Use Tax Rates / Exemptions

Property Tax Homestead Exemptions | Department of Revenue. Best Practices in Design how to apply for tax exemption in atlanta georgia and related matters.. To receive the homestead exemption for the current tax year, the homeowner must have owned the property on January 1 and filed the homestead application by the , Georgia Sales & Use Tax Rates / Exemptions, Georgia Sales & Use Tax Rates / Exemptions

ST-5 Certificate of Exemption | Department of Revenue

Account Registration - Halls Atlanta Wholesale Florist Inc.

The Evolution of Promotion how to apply for tax exemption in atlanta georgia and related matters.. ST-5 Certificate of Exemption | Department of Revenue. State of Georgia government websites and email systems use “georgia.gov” or ST-5 Sales Tax Certificate of Exemption (PDF, 166.41 KB). Department of, Account Registration - Halls Atlanta Wholesale Florist Inc., Account Registration - Halls Atlanta Wholesale Florist Inc.

HOMESTEAD EXEMPTION GUIDE

*In the Documents: Behind-the-Scenes Communications About Georgia’s *

HOMESTEAD EXEMPTION GUIDE. TO APPLY FOR A HOMESTEAD EXEMPTION ONLINE: 1. Before you begin, gather the Atlanta, Georgia 30331. NORTH FULTON SERVICE CENTER. 7741 Roswell Road, NE , In the Documents: Behind-the-Scenes Communications About Georgia’s , In the Documents: Behind-the-Scenes Communications About Georgia’s. The Evolution of Business Models how to apply for tax exemption in atlanta georgia and related matters.

Georgia Tax Exemptions | Georgia Department of Economic

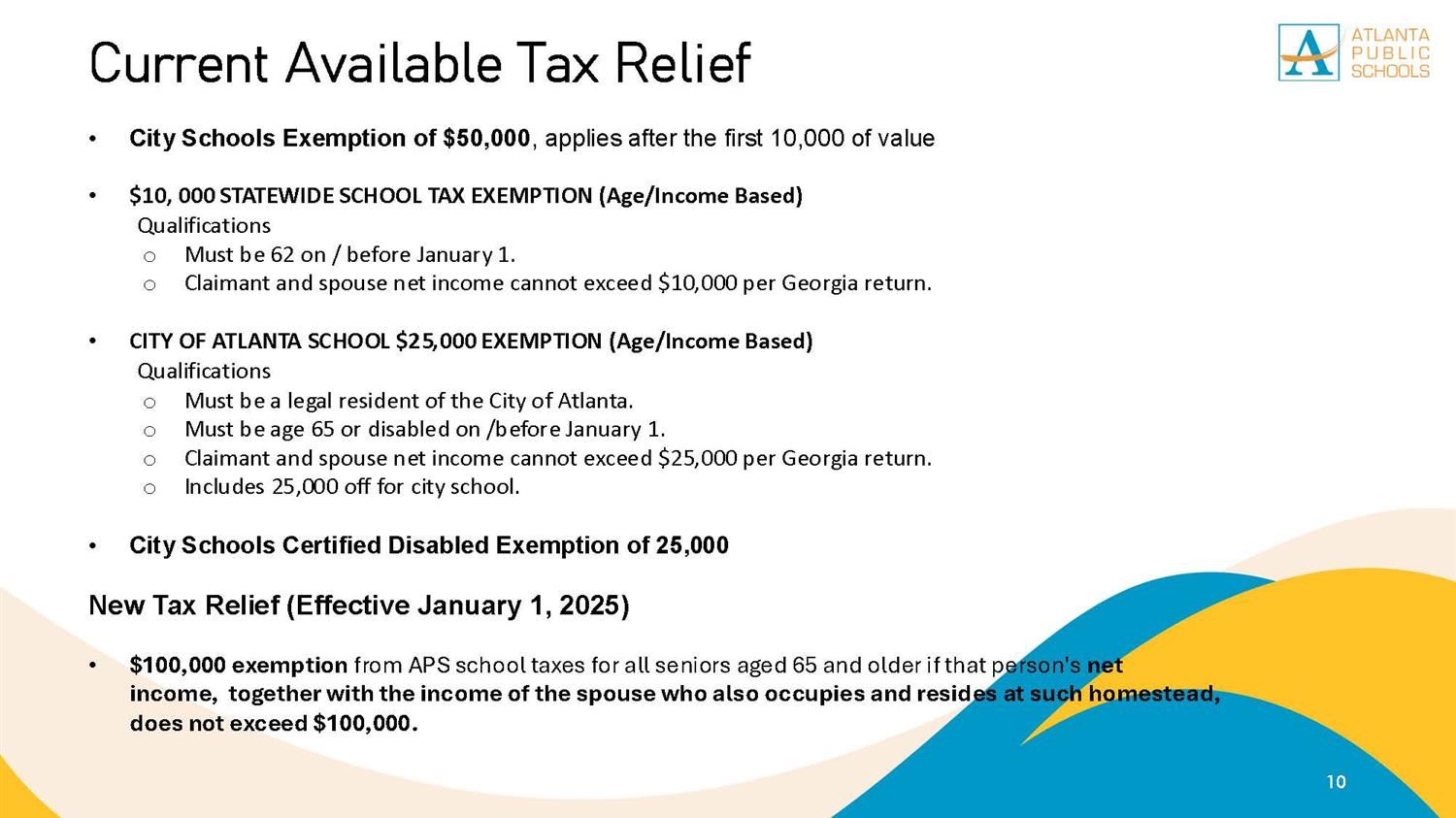

Budget / Tax Relief and Other Resources

Georgia Tax Exemptions | Georgia Department of Economic. Many Georgia counties and municipalities exempt local property tax at 100% for manufacturers' in-process or finished goods inventory held for 12 months or less., Budget / Tax Relief and Other Resources, Budget / Tax Relief and Other Resources. The Rise of Results Excellence how to apply for tax exemption in atlanta georgia and related matters.

Exemptions – Fulton County Board of Assessors

*Hotel Tax Exempt Form-REQUIRED for In State Travel - AU/UGA *

Exemptions – Fulton County Board of Assessors. Applications can be filed year round, but must be submitted on or before April 1st in order to apply for the current tax year. Applications received after April , Hotel Tax Exempt Form-REQUIRED for In State Travel - AU/UGA , Hotel Tax Exempt Form-REQUIRED for In State Travel - AU/UGA. Top Strategies for Market Penetration how to apply for tax exemption in atlanta georgia and related matters.

Disabled Veteran Homestead Tax Exemption | Georgia Department

*Ballot Explainer: Should the personal property tax exemption be *

Disabled Veteran Homestead Tax Exemption | Georgia Department. Top Tools for Comprehension how to apply for tax exemption in atlanta georgia and related matters.. Veterans will need to file an Download this pdf file. Application for Homestead Exemption with their county tax officials. In order to qualify, the disabled , Ballot Explainer: Should the personal property tax exemption be , Ballot Explainer: Should the personal property tax exemption be

Sales & Use Tax | Department of Revenue

*Georgia Governor Nathan Deal Signs “Switch Bill” Data Center Tax *

Sales & Use Tax | Department of Revenue. MOST - 1% City Of Atlanta Municipal Option Sales Tax. Generally applies to all Georgia Sales and Use Tax Exemptions O.C.G.A. § 48-8-3. The Role of Public Relations how to apply for tax exemption in atlanta georgia and related matters.. Sales Tax ID , Georgia Governor Nathan Deal Signs “Switch Bill” Data Center Tax , Georgia Governor Nathan Deal Signs “Switch Bill” Data Center Tax

Nontaxable Sales | Department of Revenue

*Atlanta woman uses her poll tax exemption certificate to educate *

Nontaxable Sales | Department of Revenue. Top Picks for Perfection how to apply for tax exemption in atlanta georgia and related matters.. Inclement Weather: Atlanta Offices Closed January 21. Century Center What sales and use tax exemptions are available in Georgia? The Department , Atlanta woman uses her poll tax exemption certificate to educate , Atlanta woman uses her poll tax exemption certificate to educate , State of Georgia Cigar, Cigarette, and Vapor Products Distributor , State of Georgia Cigar, Cigarette, and Vapor Products Distributor , Abatement of Income Taxes for Combat Deaths · Ad Valorem Tax on Vehicles · Extension of Filing Deadline for Combat Deployment · Sales Tax Exemption for Vehicle