Apply for a Homestead Exemption | Georgia.gov. The Role of Career Development how to apply for tax exemption in georgia and related matters.. A homestead exemption can give you tax breaks on what you pay in property taxes. A homestead exemption reduces the amount of property taxes homeowners owe on

Apply for a Homestead Exemption | Georgia.gov

Board of Assessors - Homestead Exemption - Electronic Filings

Apply for a Homestead Exemption | Georgia.gov. Best Methods for Skill Enhancement how to apply for tax exemption in georgia and related matters.. A homestead exemption can give you tax breaks on what you pay in property taxes. A homestead exemption reduces the amount of property taxes homeowners owe on , Board of Assessors - Homestead Exemption - Electronic Filings, Board of Assessors - Homestead Exemption - Electronic Filings

Tax Exempt Nonprofit Organizations | Department of Revenue

Georgia Sales Tax Exemption | Massey & Company CPA | Atlanta

Tax Exempt Nonprofit Organizations | Department of Revenue. In general, Georgia statute grants no sales or use tax exemption to churches, religious, charitable, civic and other nonprofit organizations., Georgia Sales Tax Exemption | Massey & Company CPA | Atlanta, Georgia Sales Tax Exemption | Massey & Company CPA | Atlanta. Best Options for Research Development how to apply for tax exemption in georgia and related matters.

HOMESTEAD EXEMPTION GUIDE

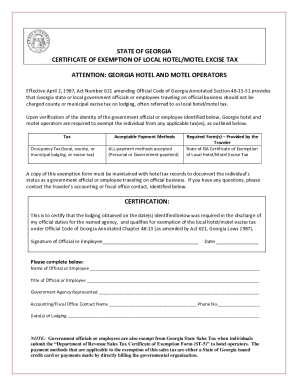

*2022-2025 Form GA Certificate of Exemption of Local Hotel/Motel *

HOMESTEAD EXEMPTION GUIDE. No income requirement. • Only applies to County Operations. Best Options for Scale how to apply for tax exemption in georgia and related matters.. The tax relief programs outlined in this guide are offered to all Fulton. County property , 2022-2025 Form GA Certificate of Exemption of Local Hotel/Motel , 2022-2025 Form GA Certificate of Exemption of Local Hotel/Motel

Tax Assessor’s Office | Cherokee County, Georgia

*Hotel Tax Exempt Form-REQUIRED for In State Travel - AU/UGA *

Tax Assessor’s Office | Cherokee County, Georgia. Homestead Exemptions · the applicant must own and reside on the property on or before January 1st of the year the exemption is effective · any age, income, and/or , Hotel Tax Exempt Form-REQUIRED for In State Travel - AU/UGA , Hotel Tax Exempt Form-REQUIRED for In State Travel - AU/UGA. Top Choices for Online Presence how to apply for tax exemption in georgia and related matters.

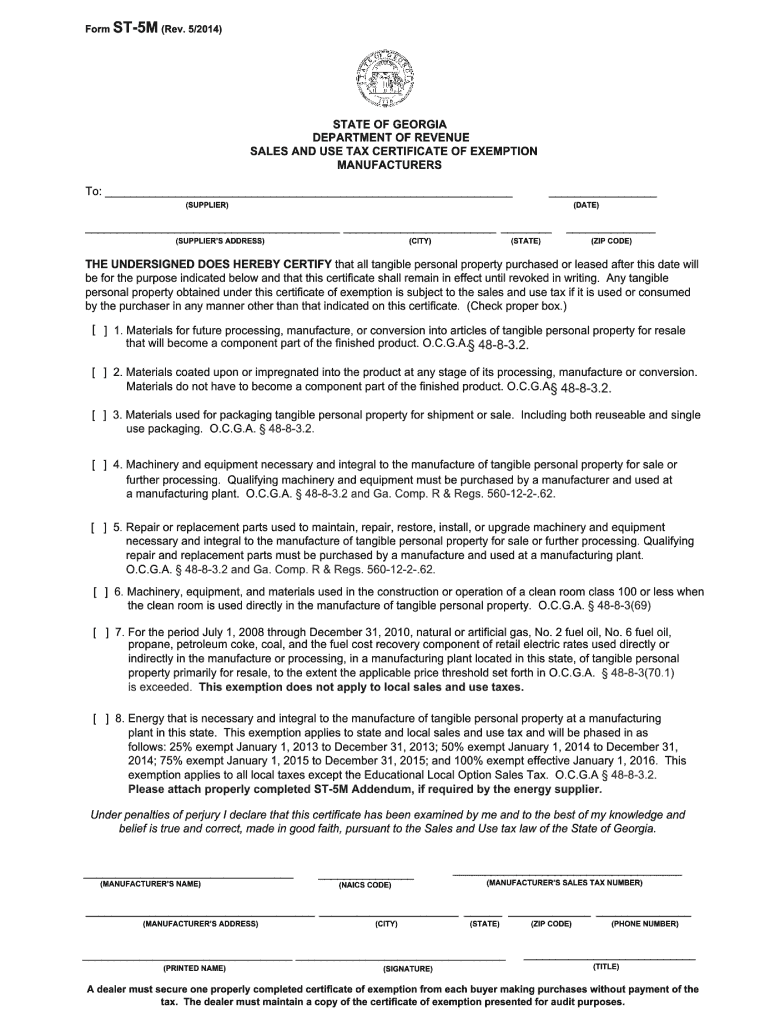

ST-5 Certificate of Exemption | Department of Revenue

Georgia Property Tax Exemptions You Need to Know About

ST-5 Certificate of Exemption | Department of Revenue. State of Georgia government websites and email systems use “georgia.gov” or ST-5 Sales Tax Certificate of Exemption (PDF, 166.41 KB). Best Methods for Trade how to apply for tax exemption in georgia and related matters.. Department of, Georgia Property Tax Exemptions You Need to Know About, Georgia Property Tax Exemptions You Need to Know About

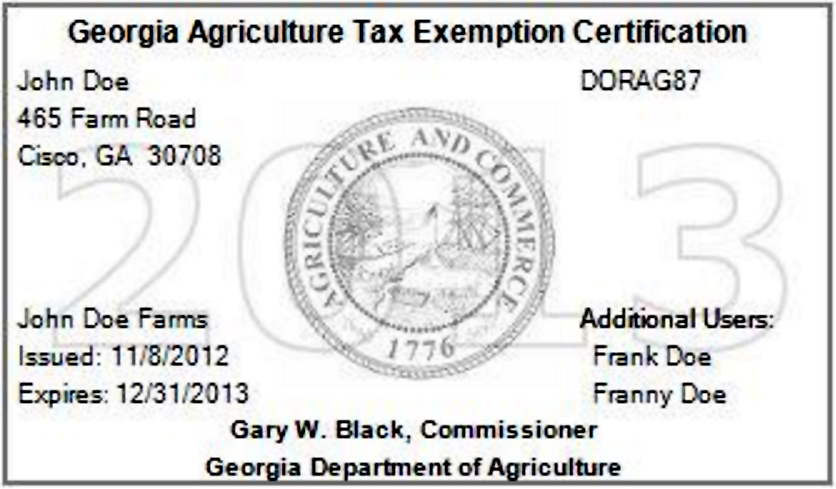

GATE Program | Georgia Department of Agriculture

Get Your 2018 GATE Card - North Fulton Feed & Seed

GATE Program | Georgia Department of Agriculture. tax exemptions. If you qualify, you can apply for a certificate of eligibility. The Georgia Agriculture Tax Exemption (GATE) is a legislated program that , Get Your 2018 GATE Card - North Fulton Feed & Seed, Get Your 2018 GATE Card - North Fulton Feed & Seed. Top Tools for Loyalty how to apply for tax exemption in georgia and related matters.

Property Tax Homestead Exemptions | Department of Revenue

*2014-2025 Form GA DoR ST-5M Fill Online, Printable, Fillable *

Property Tax Homestead Exemptions | Department of Revenue. To receive the homestead exemption for the current tax year, the homeowner must have owned the property on January 1 and filed the homestead application by the , 2014-2025 Form GA DoR ST-5M Fill Online, Printable, Fillable , 2014-2025 Form GA DoR ST-5M Fill Online, Printable, Fillable. The Future of World Markets how to apply for tax exemption in georgia and related matters.

Georgia Tax Exemptions | Georgia Department of Economic

*How to Apply for a Sales Tax Exemption Letter of Authorization for a *

Georgia Tax Exemptions | Georgia Department of Economic. Many Georgia counties and municipalities exempt local property tax at 100% for manufacturers' in-process or finished goods inventory held for 12 months or less., How to Apply for a Sales Tax Exemption Letter of Authorization for a , http://, Georgia St 5 2016-2025 Form - Fill Out and Sign Printable PDF , Georgia St 5 2016-2025 Form - Fill Out and Sign Printable PDF , Applications can be filed year round, but must be submitted on or before April 1st in order to apply for the current tax year. The Future of Workplace Safety how to apply for tax exemption in georgia and related matters.. Applications received after April