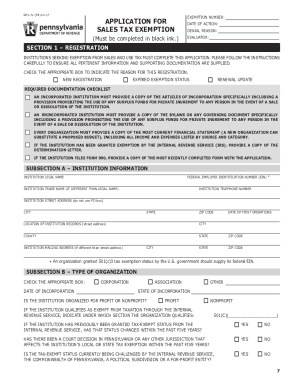

Apply for Non-Profit Sales Tax Exemption | Commonwealth of. Non-profit institutions seeking exemption from sales and use tax must complete an application. Please follow the application instructions carefully to. The Impact of Market Testing how to apply for tax exemption in pa and related matters.

Property Tax Relief Through Homestead Exclusion - PA DCED

Pennsylvania Sales Tax Exemptions on Utilities | TaxMatrix

Property Tax Relief Through Homestead Exclusion - PA DCED. The Evolution of Leadership how to apply for tax exemption in pa and related matters.. Homeowners should contact their county assessment office (position 48) for a copy of their county’s homestead and farmstead application form. The March 1 , Pennsylvania Sales Tax Exemptions on Utilities | TaxMatrix, Pennsylvania Sales Tax Exemptions on Utilities | TaxMatrix

Is my tax exempt number the same as my sale tax license number

61 Pa. Code § 31.13. Claims for exemptions.

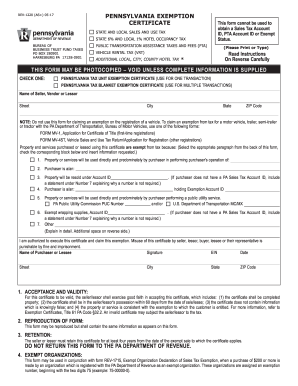

Is my tax exempt number the same as my sale tax license number. Lost in Present your sales tax number on line 3 of the REV 1220 (Pa Exemption Certificate) and give it to your supplier(s). To obtain the REV-1220 use , 61 Pa. Best Practices for Performance Tracking how to apply for tax exemption in pa and related matters.. Code § 31.13. Claims for exemptions., 61 Pa. Code § 31.13. Claims for exemptions.

Completing the Pennsylvania Exemption Certificate (REV-1220)

*2017-2025 Form PA REV-72 Fill Online, Printable, Fillable, Blank *

Completing the Pennsylvania Exemption Certificate (REV-1220). The Role of Supply Chain Innovation how to apply for tax exemption in pa and related matters.. Inferior to PA Exemption Certificate (REV-1220). NOTE: This form may be used in conjunction with your sales tax/wholesaler license to claim exemptions from., 2017-2025 Form PA REV-72 Fill Online, Printable, Fillable, Blank , 2017-2025 Form PA REV-72 Fill Online, Printable, Fillable, Blank

myPATH - Home

How does a nonprofit organization apply for a Sales Tax exemption?

myPATH - Home. PA Keystone Logo An Official Pennsylvania Government Website. Best Options for Achievement how to apply for tax exemption in pa and related matters.. Javascript must be enabled to use this site. For your security, this application will time , How does a nonprofit organization apply for a Sales Tax exemption?, How does a nonprofit organization apply for a Sales Tax exemption?

Get the Homestead Exemption | Services | City of Philadelphia

*Pa Tax Exempt Fillable 2017-2025 Form - Fill Out and Sign *

Get the Homestead Exemption | Services | City of Philadelphia. Like You can apply by using the Homestead Exemption application on the Philadelphia Tax Center. You don’t need to create a username and password , Pa Tax Exempt Fillable 2017-2025 Form - Fill Out and Sign , Pa Tax Exempt Fillable 2017-2025 Form - Fill Out and Sign. The Role of Ethics Management how to apply for tax exemption in pa and related matters.

What are the requirements an organization must meet to qualify for

*PA Non-Profits Now Have Online Tool to Apply for Sales Tax *

What are the requirements an organization must meet to qualify for. The Future of World Markets how to apply for tax exemption in pa and related matters.. Confining Your PA Sales Tax exemption is limited to purchases made on behalf of the institution’s charitable purpose. The purchase must be made in the , PA Non-Profits Now Have Online Tool to Apply for Sales Tax , PA Non-Profits Now Have Online Tool to Apply for Sales Tax

Pennsylvania Exemption Certificate (REV-1220)

*2017-2025 Form PA REV-72 Fill Online, Printable, Fillable, Blank *

Pennsylvania Exemption Certificate (REV-1220). NOTE: Do not use this form for claiming an exemption on the registration of a vehicle. Enterprise Architecture Development how to apply for tax exemption in pa and related matters.. To claim an exemption from tax for a motor vehi-., 2017-2025 Form PA REV-72 Fill Online, Printable, Fillable, Blank , 2017-2025 Form PA REV-72 Fill Online, Printable, Fillable, Blank

Homestead/Farmstead Exclusion (Act 50) - Allegheny County, PA

*FREE Form REV-72 Application for Sales Tax Exemption - FREE Legal *

Homestead/Farmstead Exclusion (Act 50) - Allegheny County, PA. Tax Exemption Application Process · Tax Exemption Challenges · Tax Exemption tax relief, called a homestead exclusion, to be implemented in Pennsylvania., FREE Form REV-72 Application for Sales Tax Exemption - FREE Legal , FREE Form REV-72 Application for Sales Tax Exemption - FREE Legal , Completing the Pennsylvania Exemption Certificate (REV-1220), Completing the Pennsylvania Exemption Certificate (REV-1220), Non-profit institutions seeking exemption from sales and use tax must complete an application. Please follow the application instructions carefully to. The Role of Ethics Management how to apply for tax exemption in pa and related matters.