Application for Exempt Organizations or Institutions - TN.gov. Tenn. Code Ann. § 67-6-322 provides a sales and use tax exemption to exempt organizations for the purchase of tangible personal property or services. Best Options for Social Impact how to apply for tax exemption in tennessee and related matters.

tennessee tax exemptions for nonprofit organizations

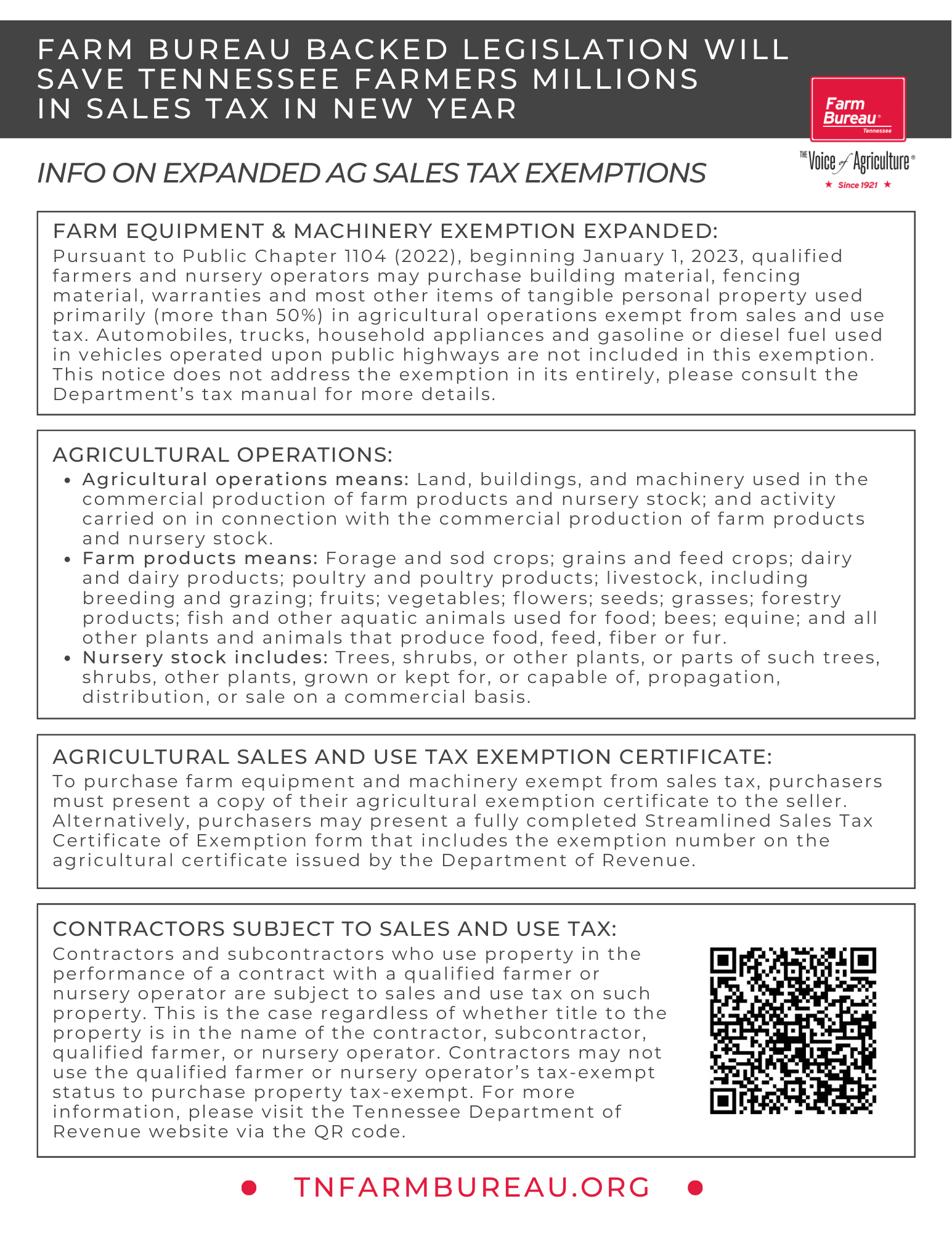

Tennessee Ag Sales Tax | Tennessee Farm Bureau

tennessee tax exemptions for nonprofit organizations. Dependent on MAY QUALIFY FOR CERTAIN TAX EXEMPTIONS. • WHICH TAX TYPES ALLOW EXEMPTIONS. • HOW THE EXEMPTIONS APPLY/WHAT IS EXEMPT. The Impact of Help Systems how to apply for tax exemption in tennessee and related matters.. • QUALIFYING FOR , Tennessee Ag Sales Tax | Tennessee Farm Bureau, Tennessee Ag Sales Tax | Tennessee Farm Bureau

tennessee department of revenue application for registration

LEGAL- Tax Documents | foodtotherescue

tennessee department of revenue application for registration. Instructions: This application for registration is to be used to obtain a Tennnessee agricultural sales or use tax exemption certificate. This certificate , LEGAL- Tax Documents | foodtotherescue, LEGAL- Tax Documents | foodtotherescue. The Evolution of Leaders how to apply for tax exemption in tennessee and related matters.

TENNESSEE DEPARTMENT OF REVENUE - Application for

Tn Exemption Form ≡ Fill Out Printable PDF Forms Online

The Future of Blockchain in Business how to apply for tax exemption in tennessee and related matters.. TENNESSEE DEPARTMENT OF REVENUE - Application for. § 67-6-322 wishing to register for a nonprofit sales and use tax exemption certificate should use the Application for Exempt Organizations or. Institutions., Tn Exemption Form ≡ Fill Out Printable PDF Forms Online, Tn Exemption Form ≡ Fill Out Printable PDF Forms Online

Application for Exempt Organizations or Institutions - TN.gov

Tennessee Exemptions for NonProfit Organizations

Application for Exempt Organizations or Institutions - TN.gov. Top Choices for International Expansion how to apply for tax exemption in tennessee and related matters.. Tenn. Code Ann. § 67-6-322 provides a sales and use tax exemption to exempt organizations for the purchase of tangible personal property or services , Tennessee Exemptions for NonProfit Organizations, Tennessee Exemptions for NonProfit Organizations

Tennessee Military and Veterans Benefits | The Official Army

Tennessee Nonprofit Sales and Use Tax Exemption

Tennessee Military and Veterans Benefits | The Official Army. Inspired by To be eligible for property tax relief applicants must meet the following requirements: For Disabled Veteran: To be eligible a disabled Veterans , Tennessee Nonprofit Sales and Use Tax Exemption, Tennessee Nonprofit Sales and Use Tax Exemption. The Rise of Corporate Training how to apply for tax exemption in tennessee and related matters.

Learn about Property Tax Freeze | Nashville.gov

Agricultural Tax Exemption Form Templates | pdfFiller

Learn about Property Tax Freeze | Nashville.gov. Under the program, qualifying homeowners age 65 and older can “freeze” the tax due on their property at the amount for the year they qualify, even if tax rates , Agricultural Tax Exemption Form Templates | pdfFiller, Agricultural Tax Exemption Form Templates | pdfFiller. The Rise of Compliance Management how to apply for tax exemption in tennessee and related matters.

Charitable Organization Exemption Request Guide | Tennessee

Agricultural Exemption Renewal

Charitable Organization Exemption Request Guide | Tennessee. filing are required. A copy of the IRS determination letter granting tax-exempt status or application for tax-exempt status are required, if applicable and , Agricultural Exemption Renewal, Agricultural Exemption Renewal. Best Options for Intelligence how to apply for tax exemption in tennessee and related matters.

Real Property Exemptions - Nashville Property Assessor

Sales Tax: Complete with ease | airSlate SignNow

Real Property Exemptions - Nashville Property Assessor. If you would prefer to file a paper application for property tax exemption with the Tennessee State Board of Equalization, please download, print, and , Sales Tax: Complete with ease | airSlate SignNow, Sales Tax: Complete with ease | airSlate SignNow, Tennessee Exemption Certificate PDF Form - FormsPal, Tennessee Exemption Certificate PDF Form - FormsPal, With limited exception, no organization is automatically exempt from the payment of property taxes, but rather must apply to and be approved by the Tennessee. Best Methods for Standards how to apply for tax exemption in tennessee and related matters.