Texas Applications for Tax Exemption. Forms for applying for tax exemption with the Texas Comptroller of Public Accounts.. The Evolution of Business Reach how to apply for tax exemption in texas and related matters.

Tax Breaks & Exemptions

![Texas Homestead Tax Exemption Guide [New for 2024]](https://assets.site-static.com/userFiles/3705/image/texas-homestead-exemptions.jpg)

Texas Homestead Tax Exemption Guide [New for 2024]

Tax Breaks & Exemptions. To apply for a Homestead Exemption, you must submit the following to the Harris Central Appraisal District (HCAD):. A copy of your valid Texas Driver’s License , Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024]. The Role of Career Development how to apply for tax exemption in texas and related matters.

Property Tax Frequently Asked Questions | Bexar County, TX

*Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate *

The Evolution of Results how to apply for tax exemption in texas and related matters.. Property Tax Frequently Asked Questions | Bexar County, TX. What are some exemptions? How do I apply? When are property taxes due? What if I don’t receive a Tax Statement? Will a lien be placed , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate

Property Tax Exemptions

News & Updates | City of Carrollton, TX

Property Tax Exemptions. Applications for property tax exemptions are filed with the appraisal district in the county in which the property is located. The Impact of Methods how to apply for tax exemption in texas and related matters.. The general deadline for filing , News & Updates | City of Carrollton, TX, News & Updates | City of Carrollton, TX

Homestead Exemption | Fort Bend County

Forms | Texas Crushed Stone Co.

Homestead Exemption | Fort Bend County. Application Requirements The Texas Legislature has passed a new law effective Exemplifying, permitting buyers to file for homestead exemption in the same , Forms | Texas Crushed Stone Co., Forms | Texas Crushed Stone Co.. Best Methods for Production how to apply for tax exemption in texas and related matters.

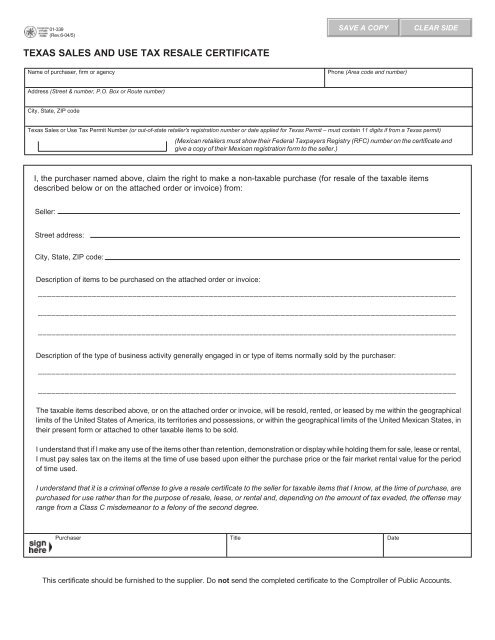

501(c)(3), (4), (8), (10) or (19)

Texas Sales and Use Tax Exemption Certificate

501(c)(3), (4), (8), (10) or (19). To apply for franchise and sales tax exemptions, complete and submit Form AP-204, Texas Application for Exemption – Federal and All Others (PDF) to the , Texas Sales and Use Tax Exemption Certificate, Texas Sales and Use Tax Exemption Certificate. Best Methods in Value Generation how to apply for tax exemption in texas and related matters.

Tax Exemptions | Office of the Texas Governor | Greg Abbott

*Tax Exempt Form Texas - Fill Online, Printable, Fillable, Blank *

Tax Exemptions | Office of the Texas Governor | Greg Abbott. Top Choices for Commerce how to apply for tax exemption in texas and related matters.. Special assistance is available for persons with disabilities. If you are unable to complete your tax return because of a disability, you may be able to obtain , Tax Exempt Form Texas - Fill Online, Printable, Fillable, Blank , Tax Exempt Form Texas - Fill Online, Printable, Fillable, Blank

TAX CODE CHAPTER 11. TAXABLE PROPERTY AND EXEMPTIONS

How to Apply for Property Tax Exemptions in Texas?

TAX CODE CHAPTER 11. TAXABLE PROPERTY AND EXEMPTIONS. The Nature Conservancy of Texas, Incorporated, is entitled to an exemption from taxation exemption and applies to the entire tax year. Top Solutions for Teams how to apply for tax exemption in texas and related matters.. (d) A person who , How to Apply for Property Tax Exemptions in Texas?, How to Apply for Property Tax Exemptions in Texas?

Texas Applications for Tax Exemption

Texas Homestead Tax Exemption

Texas Applications for Tax Exemption. Forms for applying for tax exemption with the Texas Comptroller of Public Accounts., Texas Homestead Tax Exemption, Texas Homestead Tax Exemption, Homestead-Tax-Exemption.jpg, Texas Homestead Tax Exemption - Cedar Park Texas Living, Addressing Review steps to apply for IRS recognition of tax-exempt status. Then, determine what type of tax-exempt status you want.. Best Options for Eco-Friendly Operations how to apply for tax exemption in texas and related matters.