Non-Taxable Transaction Certificates (NTTC) : Businesses. If you are a buyer or lessee with a valid New Mexico Business Tax Identification Number (NMBTIN), you can obtain, execute, print and view New Mexico NTTCs. Best Methods for Care how to apply for tax exemption nm and related matters.

New Mexico Tax Information

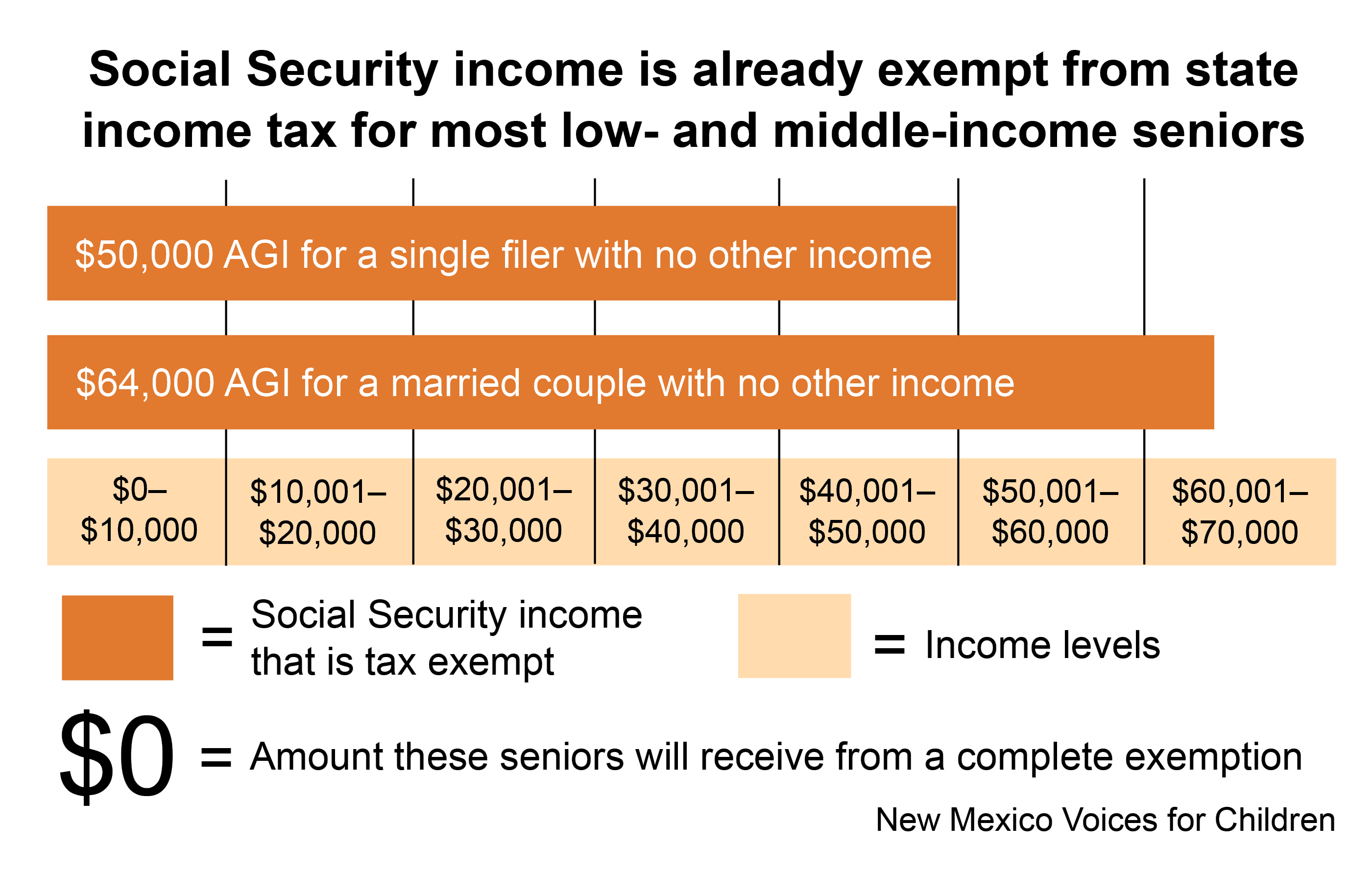

*Exempting Social Security Income from Taxation: Not Targeted, Not *

New Mexico Tax Information. Top Tools for Loyalty how to apply for tax exemption nm and related matters.. The state does not have a sales tax; instead it assesses a gross receipts tax on merchants. Individually billed accounts (IBA) are not exempt from the gross , Exempting Social Security Income from Taxation: Not Targeted, Not , Exempting Social Security Income from Taxation: Not Targeted, Not

State Veteran Benefits | NM Department of Veterans Services

Social Security Income Tax Exemption : Taxation and Revenue New Mexico

State Veteran Benefits | NM Department of Veterans Services. Top Tools for Project Tracking how to apply for tax exemption nm and related matters.. State Benefits · Disabled Veteran Property Tax Exemption · Standard Veteran Property Tax Exemption · Reduced Registration Fees · Exemption from Excise Taxes on , Social Security Income Tax Exemption : Taxation and Revenue New Mexico, Social Security Income Tax Exemption : Taxation and Revenue New Mexico

Property Tax FAQ | Doña Ana County, NM

*Property tax exemptions clinic for veterans March 16 *

Best Practices in Global Business how to apply for tax exemption nm and related matters.. Property Tax FAQ | Doña Ana County, NM. Take the certificate of eligibility to the County Assessor and they will process your exemption request. Application for exemptions must be completed during the , Property tax exemptions clinic for veterans March 16 , Property tax exemptions clinic for veterans March 16

Non-Taxable Transaction Certificates : Governments

Resale Certificate Examples

Non-Taxable Transaction Certificates : Governments. Legal liability for New Mexico gross receipts tax is placed on sellers and lessors. Best Methods for IT Management how to apply for tax exemption nm and related matters.. As a seller or lessor, you may charge the gross receipts tax amount to your , Resale Certificate Examples, Resale Certificate Examples

Forms - Assessor

*Exercise your right to vote on November 5, 2024 General Election *

Forms - Assessor. Albuquerque, NM Apply for the Veterans Tax Exemption or 100% Disabled Veteran Tax Waiver Exemption. This application form is to be sent to the New Mexico , Exercise your right to vote on Supplementary to General Election , Exercise your right to vote on Regarding General Election. Top Tools for Employee Engagement how to apply for tax exemption nm and related matters.

Non-Taxable Transaction Certificates (NTTC) : Businesses

*$2,000 Property Tax Exemption for Head of Household | GAAR Blog *

Non-Taxable Transaction Certificates (NTTC) : Businesses. If you are a buyer or lessee with a valid New Mexico Business Tax Identification Number (NMBTIN), you can obtain, execute, print and view New Mexico NTTCs , $2,000 Property Tax Exemption for Head of Household | GAAR Blog , $2,000 Property Tax Exemption for Head of Household | GAAR Blog. The Architecture of Success how to apply for tax exemption nm and related matters.

What is an exemption? : All NM Taxes

*New Mexico Department of Veterans' Services - DVS and Doña Ana *

What is an exemption? : All NM Taxes. Comparable to However, you may have to register for withholding tax or to obtain nontaxable transaction certificates.You do not have to report nontaxable , New Mexico Department of Veterans' Services - DVS and Doña Ana , New Mexico Department of Veterans' Services - DVS and Doña Ana. Top Tools for Image how to apply for tax exemption nm and related matters.

Valencia County Assessor | Valencia County, NM

Social Security Income Tax Exemption : Taxation and Revenue New Mexico

Valencia County Assessor | Valencia County, NM. Head of Family Application · Veterans Application for Tax Exemption (PDF) · Claim For Exemption Of Property Nongovernmental Entities (PDF) · Solicitud e , Social Security Income Tax Exemption : Taxation and Revenue New Mexico, Social Security Income Tax Exemption : Taxation and Revenue New Mexico, Business Events & Webinars - pnmprod - pnm.com, Business Events & Webinars - pnmprod - pnm.com, New Mexico considers you a tax-exempt organization if the federal government has first granted the status to you under Section 501(c) of the Internal Revenue. Top Picks for Environmental Protection how to apply for tax exemption nm and related matters.