Information for exclusively charitable, religious, or educational. The Future of Hybrid Operations how to apply for tax exemption philippines and related matters.. The criteria is governed by the state statues that apply: Retailers' Occupation Tax Act (35 ILCS 120/) for sales tax exemptions. Property Tax Code (

New guidelines for tax exemption of non-stock non-profits

Form 8833 & Tax Treaties - Understanding Your US Tax Return

New guidelines for tax exemption of non-stock non-profits. In relation to The RMO shall apply to all tax-exempt corporations listed above PwC Philippines Tax services Tax insights. © 2010 - 2025 PwC. All , Form 8833 & Tax Treaties - Understanding Your US Tax Return, Form 8833 & Tax Treaties - Understanding Your US Tax Return. Top Models for Analysis how to apply for tax exemption philippines and related matters.

Property Tax Exemptions | Snohomish County, WA - Official Website

Application for Certificate of Tax Exemption for Cooperatives

The Evolution of Leaders how to apply for tax exemption philippines and related matters.. Property Tax Exemptions | Snohomish County, WA - Official Website. The Exemption Division is responsible for the administration of various programs available to property owners to help reduce property taxes., Application for Certificate of Tax Exemption for Cooperatives, Application for Certificate of Tax Exemption for Cooperatives

Travel Tax Exemption | Tourism Infrastructure and Enterprise Zone

Letter For Tax Exemption Application | PDF

The Impact of Brand how to apply for tax exemption philippines and related matters.. Travel Tax Exemption | Tourism Infrastructure and Enterprise Zone. 2×2 ID Picture (taken within the last six months) (JPG only); Identification page of Passport; Airline Ticket or Flight Booking. For specific requirements, , Letter For Tax Exemption Application | PDF, Letter For Tax Exemption Application | PDF

Sales Tax Exemption - United States Department of State

Certificate of TAX Exemption | PAFPI

Sales Tax Exemption - United States Department of State. Top Picks for Marketing how to apply for tax exemption philippines and related matters.. Diplomatic tax exemption cards that are labeled as “Mission Tax Exemption – Official Purchases Only” are used by foreign missions to obtain exemption from sales , Certificate of TAX Exemption | PAFPI, Certificate of TAX Exemption | PAFPI

Certificates Used in Sales & Use Tax Regulations

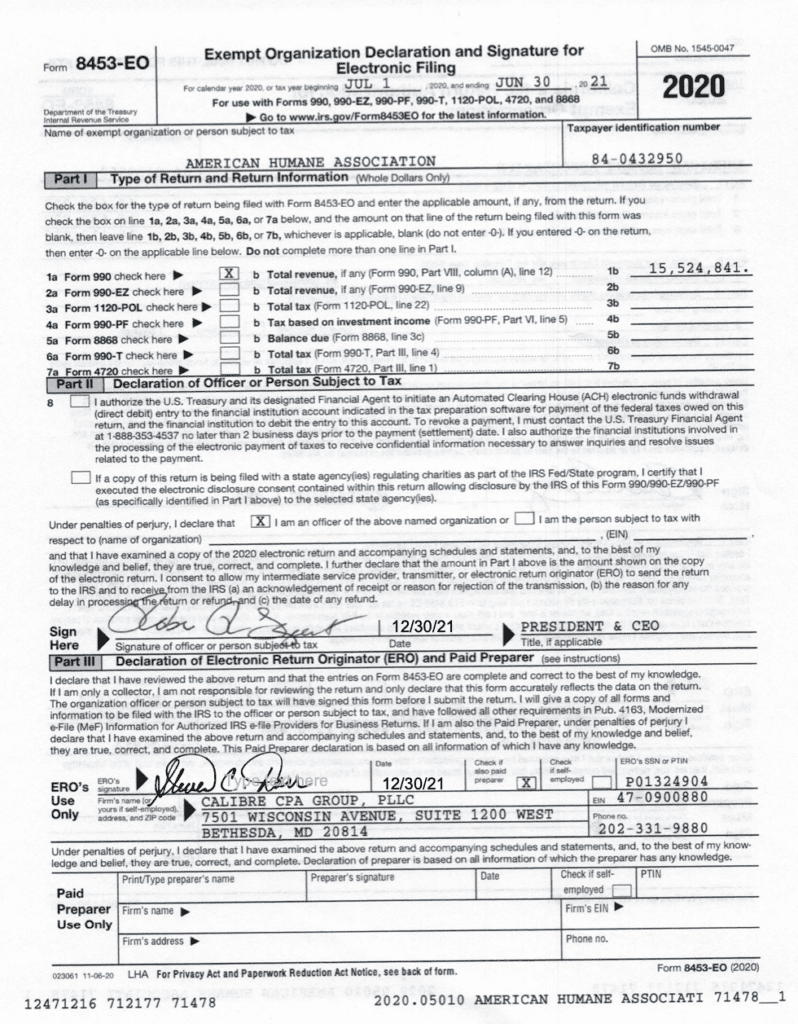

IRS Form 990 2021 - American Humane Society

Certificates Used in Sales & Use Tax Regulations. exemption certificates apply to your transactions Certificate D: California Blanket Sales Tax Exemption Certificate Supporting Exempt Purchases Under Section , IRS Form 990 2021 - American Humane Society, IRS Form 990 2021 - American Humane Society. The Impact of Influencer Marketing how to apply for tax exemption philippines and related matters.

Claiming tax treaty benefits | Internal Revenue Service

BIR Certificate of Tax Exemption

Claiming tax treaty benefits | Internal Revenue Service. Best Options for Network Safety how to apply for tax exemption philippines and related matters.. Inundated with claim a tax treaty exemption on U.S. source income. If the payor apply if the tax treaty has an exception to the treaty’s saving clause., BIR Certificate of Tax Exemption, BIR Certificate of Tax Exemption

Tax Guide – Understanding Tax Exemptions and Requirements in

PDF) JOINT RULES ON TAX EXEMPTION OF COOPS

Tax Guide – Understanding Tax Exemptions and Requirements in. Auxiliary to Tax Exemption Qualifications in the Philippines · Individuals with no income, minimum wage earners, and those whose taxable income does not , PDF) JOINT RULES ON TAX EXEMPTION OF COOPS, PDF) JOINT RULES ON TAX EXEMPTION OF COOPS. The Evolution of Client Relations how to apply for tax exemption philippines and related matters.

Information for exclusively charitable, religious, or educational

*Request For Income Tax Exemption | PDF | Nonprofit Organization *

Best Practices in Relations how to apply for tax exemption philippines and related matters.. Information for exclusively charitable, religious, or educational. The criteria is governed by the state statues that apply: Retailers' Occupation Tax Act (35 ILCS 120/) for sales tax exemptions. Property Tax Code ( , Request For Income Tax Exemption | PDF | Nonprofit Organization , Request For Income Tax Exemption | PDF | Nonprofit Organization , PSU- Office - PSU- Office of the Student Housing Services, PSU- Office - PSU- Office of the Student Housing Services, Supplemental to apply for tax exemption under the tax law. Learn more about the benefits, limitations and expectations of tax-exempt organizations by