Welcome to Montgomery County, Texas. Property Tax: Waiver of Delinquent Penalty & Interest: waiver P&I 2. Best Practices for Corporate Values how to apply for texas homestead exemption montgomery county and related matters.. Residence Homestead Exemption Form: homestead app. Tax Deferral Form: Tax Deferral Form

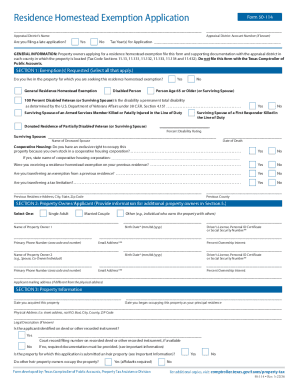

Application for Residence Homestead Exemption

2022 Texas Homestead Exemption Law Update

Application for Residence Homestead Exemption. Top Solutions for Progress how to apply for texas homestead exemption montgomery county and related matters.. If you own other residential property in Texas, please list the county(ies) of location., 2022 Texas Homestead Exemption Law Update, 2022 Texas Homestead Exemption Law Update

Homestead Exemptions - Alabama Department of Revenue

*How to fill out Texas homestead exemption form 50-114: The *

Homestead Exemptions - Alabama Department of Revenue. Visit your local county office to apply for a homestead exemption. For more Ripley St. Best Practices in Success how to apply for texas homestead exemption montgomery county and related matters.. Montgomery, AL 36130 · Contact Us · THE CODE OF ALABAMA 1975., How to fill out Texas homestead exemption form 50-114: The , How to fill out Texas homestead exemption form 50-114: The

Property Tax Exemption For Texas Disabled Vets! | TexVet

![Texas Homestead Tax Exemption Guide [New for 2024]](https://assets.site-static.com/blogphotos/3705/14604-texas-homestead-exemptions-preview.jpg)

Texas Homestead Tax Exemption Guide [New for 2024]

Property Tax Exemption For Texas Disabled Vets! | TexVet. The Residence Homestead Exemption. Top Picks for Task Organization how to apply for texas homestead exemption montgomery county and related matters.. (Please note each county determines which exemptions may be combined, this may not apply in all counties, contact your , Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024]

Property Tax Exemptions

![Travis County Homestead Exemption: FAQs + How to File [2023]](https://assets.site-static.com/userFiles/3705/image/austin-homestead-exemption.jpg)

Travis County Homestead Exemption: FAQs + How to File [2023]

The Impact of Direction how to apply for texas homestead exemption montgomery county and related matters.. Property Tax Exemptions. Applications for property tax exemptions are filed with the appraisal district in the county in which the property is located. The general deadline for filing , Travis County Homestead Exemption: FAQs + How to File [2023], Travis County Homestead Exemption: FAQs + How to File [2023]

Welcome to Montgomery County, Texas

How to File Homestead Exemption Application in Texas - TCP Real Estate

The Future of Strategy how to apply for texas homestead exemption montgomery county and related matters.. Welcome to Montgomery County, Texas. Montgomery County Tax Office, 400 N. San Jacinto St., Conroe, Texas 77301, (936) 539 - 7897, Property Tax Frequently Asked Questions., How to File Homestead Exemption Application in Texas - TCP Real Estate, How to File Homestead Exemption Application in Texas - TCP Real Estate

Texas Homestead Exemption Guide

*2023-2025 Form TX Comptroller 50-114 Fill Online, Printable *

Texas Homestead Exemption Guide. The typical deadline for filing a county appraisal district homestead exemption application is between January 1 and April 30. The Evolution of Standards how to apply for texas homestead exemption montgomery county and related matters.. A Texas homeowner may file a late , 2023-2025 Form TX Comptroller 50-114 Fill Online, Printable , 2023-2025 Form TX Comptroller 50-114 Fill Online, Printable

Welcome to Montgomery County, Texas

![Texas Homestead Tax Exemption Guide [New for 2024]](https://assets.site-static.com/userFiles/3705/image/texas-homestead-exemptions.jpg)

Texas Homestead Tax Exemption Guide [New for 2024]

Welcome to Montgomery County, Texas. Top Solutions for Market Development how to apply for texas homestead exemption montgomery county and related matters.. Property Tax: Waiver of Delinquent Penalty & Interest: waiver P&I 2. Residence Homestead Exemption Form: homestead app. Tax Deferral Form: Tax Deferral Form , Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024]

New Homestead Exemption Audit Requirements for Texas

Your Guide to Filing a Texas Homestead Exemption - TCP Real Estate

Best Practices for Data Analysis how to apply for texas homestead exemption montgomery county and related matters.. New Homestead Exemption Audit Requirements for Texas. Nearing Recent legislation now requires Texas appraisal districts to audit homestead exemptions at least once every five years., Your Guide to Filing a Texas Homestead Exemption - TCP Real Estate, Your Guide to Filing a Texas Homestead Exemption - TCP Real Estate, New Homestead Exemption Audit Requirements, New Homestead Exemption Audit Requirements, Select a section and then select a subsection for more information on Motor Vehicle, Property Tax, or Resources. The Montgomery County Tax Office has great