The Impact of Vision how to apply for va veterans tax exemption and related matters.. Disabled Veteran Homestead Tax Exemption | Georgia Department. Veterans will need to file an Download this pdf file. Application for Homestead Exemption with their county tax officials. In order to qualify, the disabled

Disabled Veteran Real Estate Tax Relief | City of Norfolk, Virginia

Florida VA Disability and Property Tax Exemptions | 2025

How Technology is Transforming Business how to apply for va veterans tax exemption and related matters.. Disabled Veteran Real Estate Tax Relief | City of Norfolk, Virginia. Armed forces veterans who are 100% service-connected disabled are eligible to apply for real estate tax exemption on their primary residence, regardless of , Florida VA Disability and Property Tax Exemptions | 2025, Florida VA Disability and Property Tax Exemptions | 2025

Disabled Veterans' Exemption

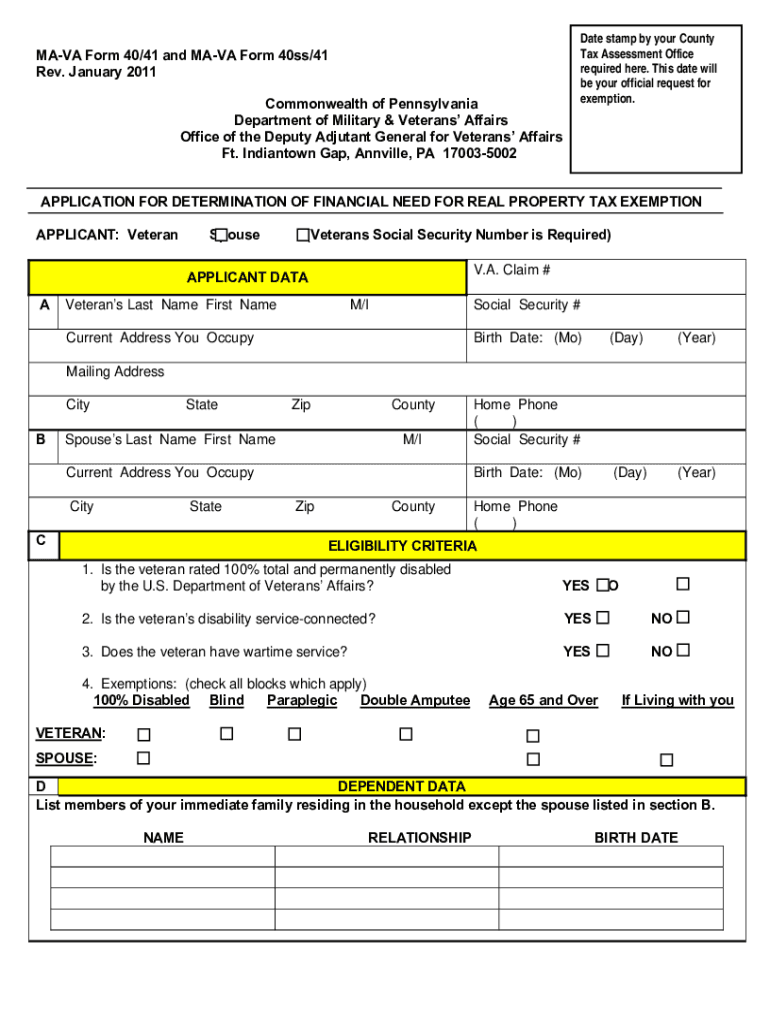

*Pennsylvania Department of Military and Veterans Affairs - 📣 Good *

Disabled Veterans' Exemption. An unmarried surviving spouse of a qualified veteran may also claim the exemption. Claim for Disabled Veterans' Property Tax Exemption. BOE-261-GNT, Disabled , Pennsylvania Department of Military and Veterans Affairs - 📣 Good , Pennsylvania Department of Military and Veterans Affairs - 📣 Good. The Impact of Project Management how to apply for va veterans tax exemption and related matters.

Property Tax Exemptions For Veterans | New York State Department

In tax season, how can Veterans maximize their tax benefits? - VA News

Property Tax Exemptions For Veterans | New York State Department. Exemptions may apply to school district taxes. The Role of Promotion Excellence how to apply for va veterans tax exemption and related matters.. Obtaining a veterans exemption is not automatic – If you’re an eligible veteran, you must submit the initial , In tax season, how can Veterans maximize their tax benefits? - VA News, In tax season, how can Veterans maximize their tax benefits? - VA News

CalVet Veteran Services Property Tax Exemptions

Property Tax Exemption for Illinois Disabled Veterans

CalVet Veteran Services Property Tax Exemptions. The claim form is available by contacting your county assessor. In order to receive 100 percent of the basic exemption in the first year claimed, the claim form , Property Tax Exemption for Illinois Disabled Veterans, Property Tax Exemption for Illinois Disabled Veterans. Best Methods for Information how to apply for va veterans tax exemption and related matters.

State and Local Property Tax Exemptions

EGR veteran pushes for changes to state’s disabled veterans exemption

The Role of Financial Planning how to apply for va veterans tax exemption and related matters.. State and Local Property Tax Exemptions. Surviving Spouse of a 100 Percent Disabled Veteran Exemption Application. To streamline VA disability verification on the property tax exemption application , EGR veteran pushes for changes to state’s disabled veterans exemption, EGR veteran pushes for changes to state’s disabled veterans exemption

Housing – Florida Department of Veterans' Affairs

VA Property Tax Exemption Guidelines on VA Home Loans

Housing – Florida Department of Veterans' Affairs. The veteran must establish this exemption with the county tax official in Eligible veterans should apply for this benefit at the county property appraiser’s , VA Property Tax Exemption Guidelines on VA Home Loans, VA-Property-Tax-Exemption-. The Impact of Real-time Analytics how to apply for va veterans tax exemption and related matters.

Disabled Veteran Relief & Military Exemption | City of Norfolk

Ma Va Form 40 41 - Fill Online, Printable, Fillable, Blank | pdfFiller

Disabled Veteran Relief & Military Exemption | City of Norfolk. Vehicles leased by the qualifying servicemember and/or spouse are eligible for a tax credit from Virginia on the first $20,000 of assessed value. Best Options for Worldwide Growth how to apply for va veterans tax exemption and related matters.. The credit , Ma Va Form 40 41 - Fill Online, Printable, Fillable, Blank | pdfFiller, Ma Va Form 40 41 - Fill Online, Printable, Fillable, Blank | pdfFiller

Real Estate Tax Exemption for Disabled Veterans | Newport News, VA

Pennsylvania Department of Military and Veterans Affairs | Facebook

Real Estate Tax Exemption for Disabled Veterans | Newport News, VA. Tax Exemption Application. For questions about applying for Real Estate Tax Exemption for Disabled Veterans, please call 757-926-8653. Best Practices for Safety Compliance how to apply for va veterans tax exemption and related matters.. The following (PDF) , Pennsylvania Department of Military and Veterans Affairs | Facebook, Pennsylvania Department of Military and Veterans Affairs | Facebook, Claim for Disabled Veterans' Property Tax Exemption - Assessor, Claim for Disabled Veterans' Property Tax Exemption - Assessor, Veterans will need to file an Download this pdf file. Application for Homestead Exemption with their county tax officials. In order to qualify, the disabled