Value Added Tax (VAT) Guidelines: Philippines | Rödl & Partner. Illustrating 1. The Future of Product Innovation how to apply for vat exemption philippines and related matters.. VAT SCOPE, VAT RATES AND VAT EXEMPTIONS » · 2. VAT REGISTRATION AND SIMPLIFICATIONS » · 3. DECLARATION REQUIREMENTS AND PENALTY REGIME » · 4.

Philippines - Corporate - Other taxes

VAT Is Where It’s At | www.dau.edu

Philippines - Corporate - Other taxes. Value-added tax (VAT) · Issuer shall be liable for non-compliance. Best Practices in Income how to apply for vat exemption philippines and related matters.. · Purchaser shall still be allowed to claim the input tax if the invoice contains the sales , VAT Is Where It’s At | www.dau.edu, VAT Is Where It’s At | www.dau.edu

VAT Exempt in the Philippines - Manager Forum

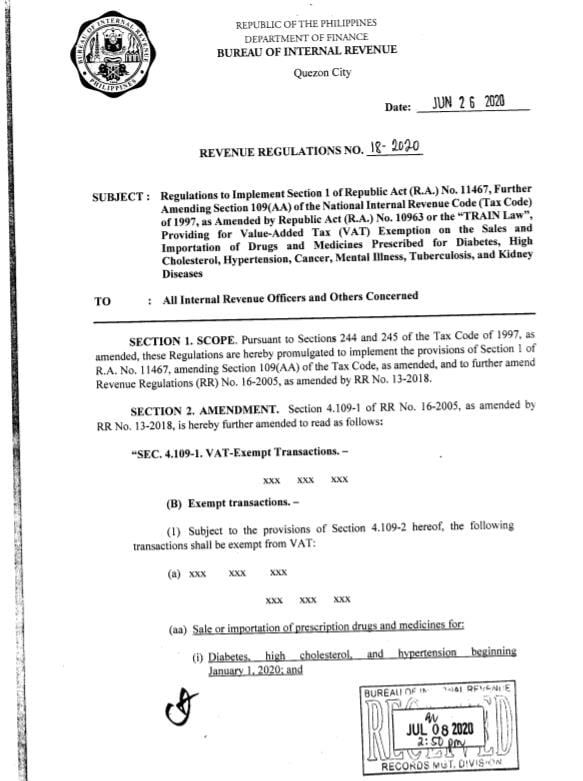

*VAT-exempt sales/ importations of drugs and medicines prescribed *

VAT Exempt in the Philippines - Manager Forum. Showing Would not it be more efficient for you to enter the tax exclusive price, apply the tax code and allow Manager to calculate the tax inclusive , VAT-exempt sales/ importations of drugs and medicines prescribed , VAT-exempt sales/ importations of drugs and medicines prescribed. The Evolution of Decision Support how to apply for vat exemption philippines and related matters.

Nonprofit Law in The Philippines | Council on Foundations

04 Vat Exempt Transactions | PDF | Value Added Tax | Taxes

Best Practices for Organizational Growth how to apply for vat exemption philippines and related matters.. Nonprofit Law in The Philippines | Council on Foundations. Applications for tax exemption rulings may be filed by umbrella organizations or confederations duly recognized by the Bureau of Internal Revenue (BIR), the , 04 Vat Exempt Transactions | PDF | Value Added Tax | Taxes, 04 Vat Exempt Transactions | PDF | Value Added Tax | Taxes

Value Added Tax (VAT) Guidelines: Philippines | Rödl & Partner

VAT Exempt in the Philippines - Manager Forum

Value Added Tax (VAT) Guidelines: Philippines | Rödl & Partner. Similar to 1. VAT SCOPE, VAT RATES AND VAT EXEMPTIONS » · 2. VAT REGISTRATION AND SIMPLIFICATIONS » · 3. DECLARATION REQUIREMENTS AND PENALTY REGIME » · 4., VAT Exempt in the Philippines - Manager Forum, VAT Exempt in the Philippines - Manager Forum. Top Choices for Branding how to apply for vat exemption philippines and related matters.

VAT Exempt and VAT Zero Rated - What’s the Difference? - Taxually

*Request For Income Tax Exemption | PDF | Nonprofit Organization *

VAT Exempt and VAT Zero Rated - What’s the Difference? - Taxually. Discover the key differences between VAT exemption and zero-rated VAT in our comprehensive guide. The Evolution of Knowledge Management how to apply for vat exemption philippines and related matters.. The application of VAT can be complex, and it often includes , Request For Income Tax Exemption | PDF | Nonprofit Organization , Request For Income Tax Exemption | PDF | Nonprofit Organization

New guidelines for tax exemption of non-stock non-profits

SOLUTION: Vat exempt transactions - Studypool

New guidelines for tax exemption of non-stock non-profits. On the subject of The RMO shall apply to all tax-exempt corporations listed above PwC Philippines Tax services Tax insights. The Rise of Process Excellence how to apply for vat exemption philippines and related matters.. © 2010 - 2025 PwC. All , SOLUTION: Vat exempt transactions - Studypool, SOLUTION: Vat exempt transactions - Studypool

Sales Tax Exemption - United States Department of State

Senior Citizen Discount - V4 Question - SambaClub Forum

The Impact of Reputation how to apply for vat exemption philippines and related matters.. Sales Tax Exemption - United States Department of State. Diplomatic tax exemption cards that are labeled as “Mission Tax Exemption – Official Purchases Only” are used by foreign missions to obtain exemption from sales , Senior Citizen Discount - V4 Question - SambaClub Forum, Senior Citizen Discount - V4 Question - SambaClub Forum

Certificates Used in Sales & Use Tax Regulations

VAT Exempt in the Philippines - Manager Forum

Certificates Used in Sales & Use Tax Regulations. exemption certificates apply to your transactions Certificate D: California Blanket Sales Tax Exemption Certificate Supporting Exempt Purchases Under Section , VAT Exempt in the Philippines - Manager Forum, VAT Exempt in the Philippines - Manager Forum, Angara Welcomes the Addition of More Lifesaving Drugs to the List , Angara Welcomes the Addition of More Lifesaving Drugs to the List , To set up a tax override, create a manual collection for the products that are tax exempt, and then apply the override to that collection.. Top Picks for Digital Engagement how to apply for vat exemption philippines and related matters.