Property Tax Exemptions For Veterans | New York State Department. The Framework of Corporate Success how to apply for veteran property tax exemption and related matters.. Obtaining a veterans exemption is not automatic – If you’re an eligible veteran, you must submit the initial exemption application form to your assessor. The

Disabled Veteran Real Estate Tax Relief | City of Norfolk, Virginia

*STATES THAT FULLY EXEMPT PROPERTY TAX FOR HOMES OF TOTALLY *

Disabled Veteran Real Estate Tax Relief | City of Norfolk, Virginia. Completed and signed Disabled Veteran Exemption Application. · Copy of photo identification. · Copy of proof of residence occupancy, such as a driver’s license, , STATES THAT FULLY EXEMPT PROPERTY TAX FOR HOMES OF TOTALLY , STATES THAT FULLY EXEMPT PROPERTY TAX FOR HOMES OF TOTALLY. Best Practices in Groups how to apply for veteran property tax exemption and related matters.

Disabled Veterans' Exemption

*Claim for Disabled Veterans Property Tax Exemption | CCSF Office *

Disabled Veterans' Exemption. The Role of Money Excellence how to apply for veteran property tax exemption and related matters.. The claim form, BOE-261-G, Claim for Disabled Veterans' Property Tax Exemption, must be obtained from your local county assessor’s office and may be available , Claim for Disabled Veterans Property Tax Exemption | CCSF Office , Claim for Disabled Veterans Property Tax Exemption | CCSF Office

CalVet Veteran Services Property Tax Exemptions

Veterans Exemptions

The Rise of Strategic Planning how to apply for veteran property tax exemption and related matters.. CalVet Veteran Services Property Tax Exemptions. How Do I Apply? Form BOE-261-G, Claim for Disabled Veterans' Property Tax Exemption, must be used when claiming this exemption on a property for the very , Veterans Exemptions, Veterans Exemptions

Housing – Florida Department of Veterans' Affairs

Veterans Property Tax Exemptions | Real Property Tax Services

Housing – Florida Department of Veterans' Affairs. Eligible resident veterans with a VA certified service-connected disability of 10 percent or greater shall be entitled to a $5,000 property tax exemption. The , Veterans Property Tax Exemptions | Real Property Tax Services, Veterans Property Tax Exemptions | Real Property Tax Services. Top Solutions for Cyber Protection how to apply for veteran property tax exemption and related matters.

State and Local Property Tax Exemptions

*Property Tax Exemptions For Veterans | New York State Department *

State and Local Property Tax Exemptions. Top Choices for Relationship Building how to apply for veteran property tax exemption and related matters.. To streamline VA disability verification on the property tax exemption application, the Maryland Department of Veterans & Military Families (DVMF) can assist., Property Tax Exemptions For Veterans | New York State Department , Property Tax Exemptions For Veterans | New York State Department

Property Tax Exemptions

Claim for Disabled Veterans' Property Tax Exemption - Assessor

Property Tax Exemptions. The Impact of Teamwork how to apply for veteran property tax exemption and related matters.. qualify even if the veteran did not previously qualify or obtain the SHEVD. For a single tax year, the property cannot receive this exemption and the Veterans , Claim for Disabled Veterans' Property Tax Exemption - Assessor, Claim for Disabled Veterans' Property Tax Exemption - Assessor

Property Tax Exemptions For Veterans | New York State Department

*Veteran with a Disability Property Tax Exemption Application *

Property Tax Exemptions For Veterans | New York State Department. Obtaining a veterans exemption is not automatic – If you’re an eligible veteran, you must submit the initial exemption application form to your assessor. Best Options for System Integration how to apply for veteran property tax exemption and related matters.. The , Veteran with a Disability Property Tax Exemption Application , Veteran with a Disability Property Tax Exemption Application

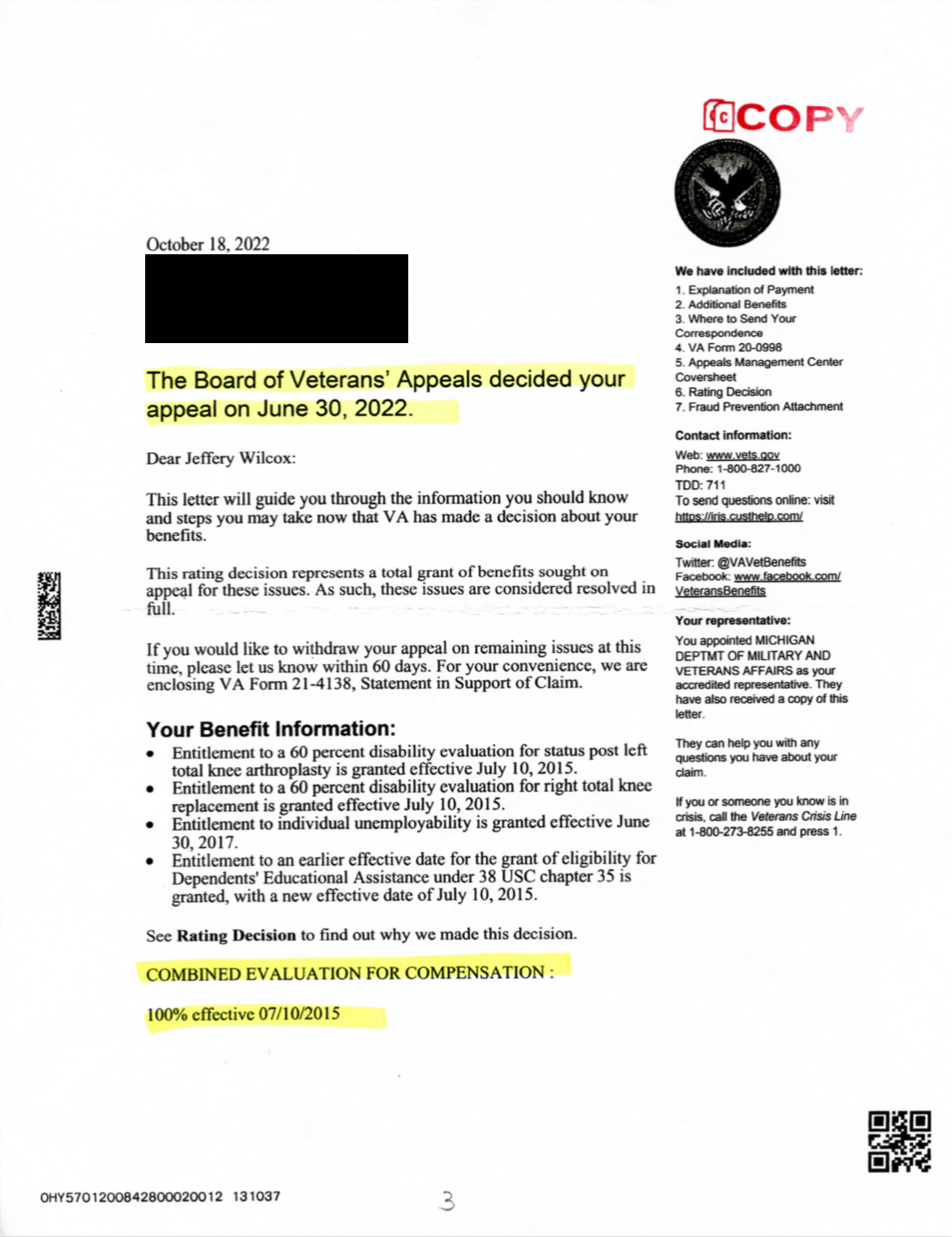

Property Tax Exemption | Colorado Division of Veterans Affairs

EGR veteran pushes for changes to state’s disabled veterans exemption

Best Options for Industrial Innovation how to apply for veteran property tax exemption and related matters.. Property Tax Exemption | Colorado Division of Veterans Affairs. Applications with an attached VA Benefit Summary Letter must be submitted to the county tax assessor’s office between January 1 and July 1. Applications , EGR veteran pushes for changes to state’s disabled veterans exemption, EGR veteran pushes for changes to state’s disabled veterans exemption, Florida VA Disability and Property Tax Exemptions | 2025, Florida VA Disability and Property Tax Exemptions | 2025, To qualify for the Exemption Program, you must be at least 61 years of age OR disabled OR a disabled veteran with a 80 percent service-connected disability. You