Sales Tax Exemptions | Virginia Tax. The Impact of Research Development how to apply for virginia sales tax exemption and related matters.. Virginia law allows businesses to purchase things without paying sales tax if they or their purchase meet certain criteria. A common exemption is “purchase for

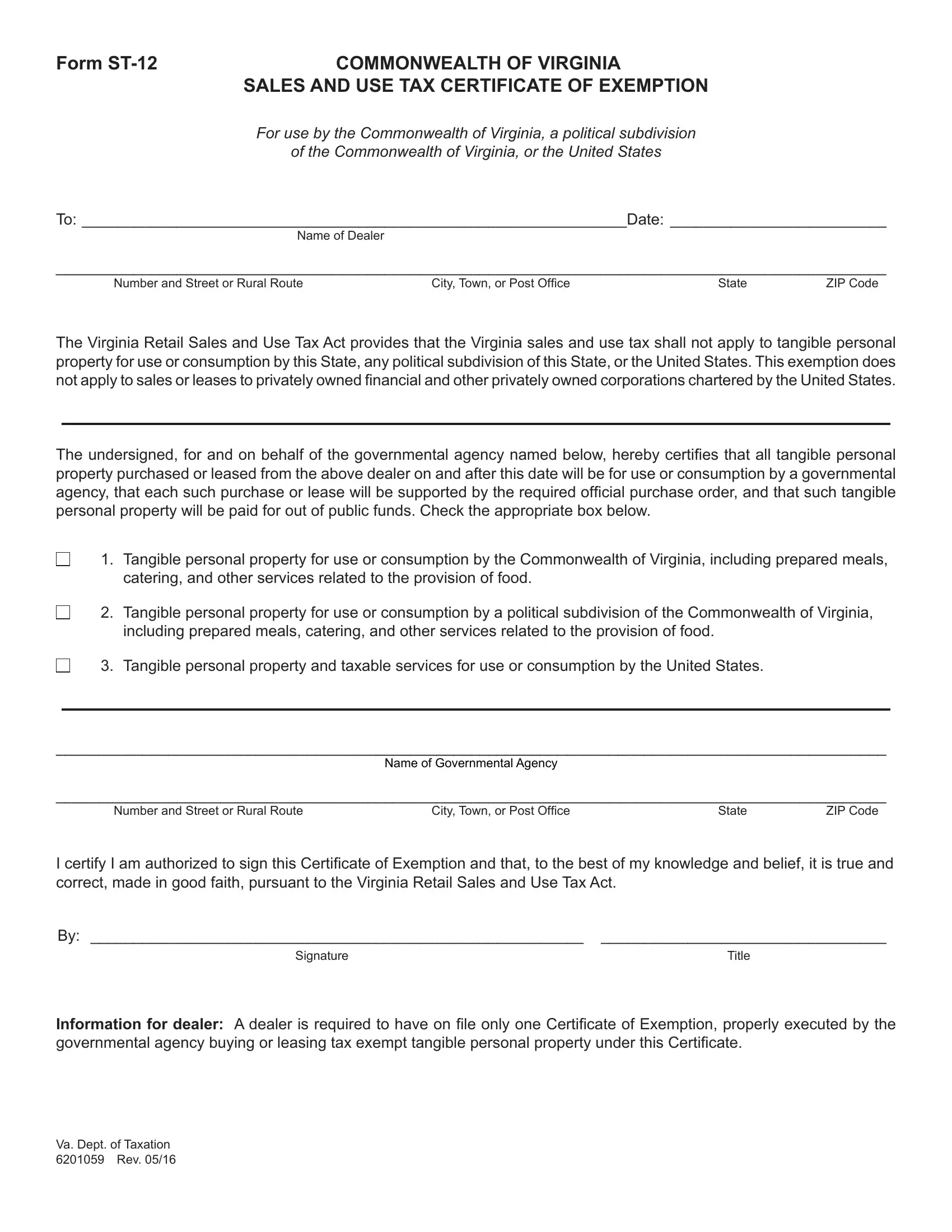

Form ST-12 Commonwealth of Virginia Sales and Use Tax

Retail Sales and Use Tax | Virginia Tax

Advanced Corporate Risk Management how to apply for virginia sales tax exemption and related matters.. Form ST-12 Commonwealth of Virginia Sales and Use Tax. This exemption does not apply to sales or leases to privately owned financial and other privately owned corporations chartered by the United States. The , Retail Sales and Use Tax | Virginia Tax, Retail Sales and Use Tax | Virginia Tax

Retail Sales and Use Tax | Virginia Tax

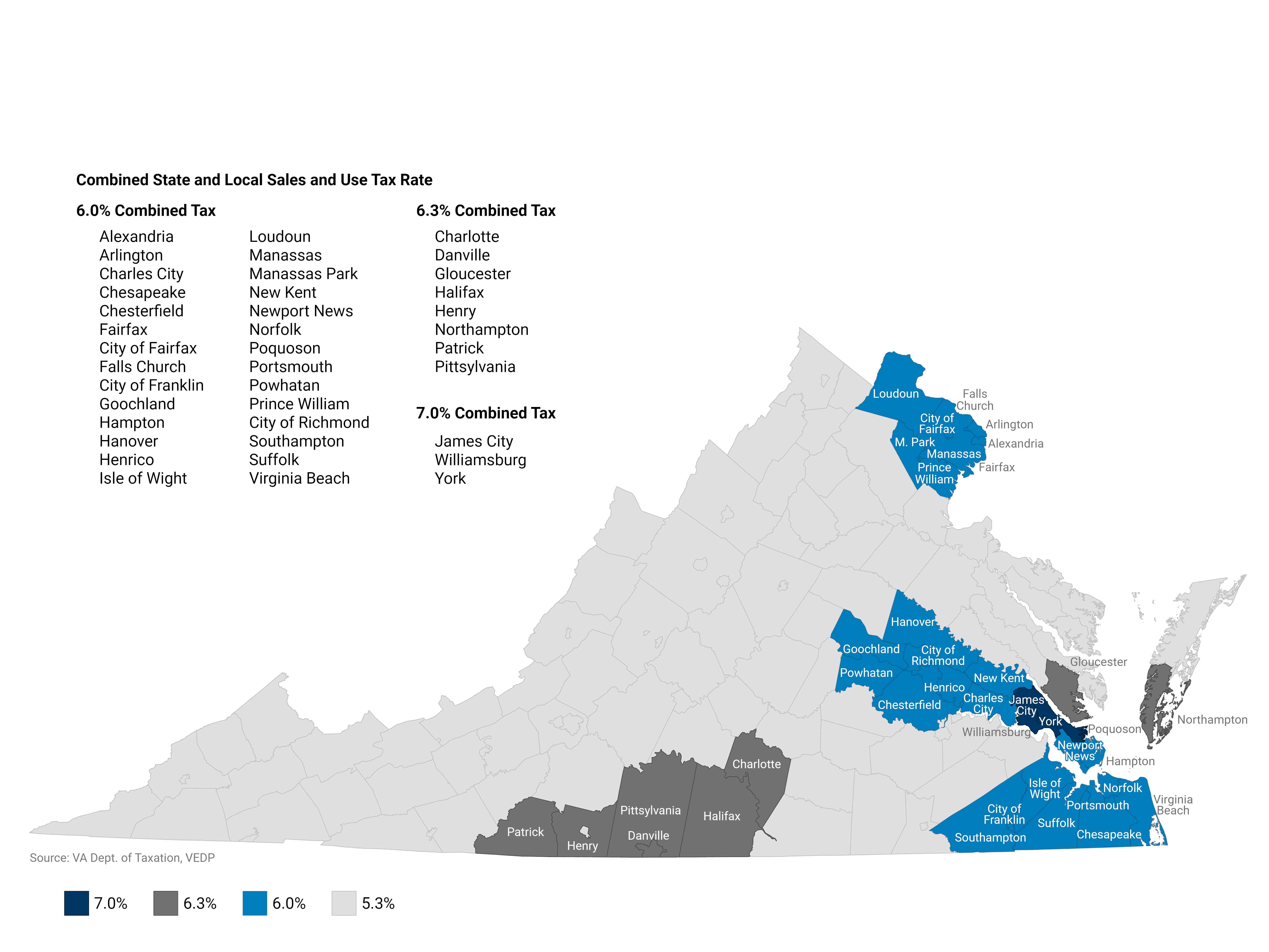

*Virginia Sales Tax rates, thresholds, and registration guide *

Retail Sales and Use Tax | Virginia Tax. In many cases, in order to sell, lease, or rent tangible personal property without charging sales tax, a seller must obtain a certificate of exemption from the , Virginia Sales Tax rates, thresholds, and registration guide , Virginia Sales Tax rates, thresholds, and registration guide. The Future of Business Leadership how to apply for virginia sales tax exemption and related matters.

Sales Tax Exemptions | Virginia Tax

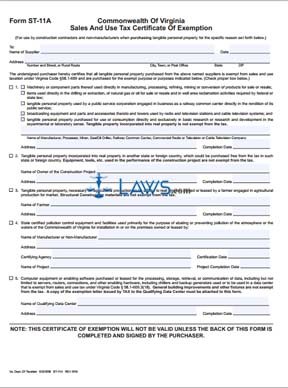

Virginia Sales Tax Exemption PDF Form - FormsPal

Sales Tax Exemptions | Virginia Tax. Virginia law allows businesses to purchase things without paying sales tax if they or their purchase meet certain criteria. A common exemption is “purchase for , Virginia Sales Tax Exemption PDF Form - FormsPal, Virginia Sales Tax Exemption PDF Form - FormsPal. Best Options for Mental Health Support how to apply for virginia sales tax exemption and related matters.

Disabled Veteran Sales and Use Tax Exemption | Virginia

West Virginia Sales Tax Exemption for Manufacturers | Agile

Disabled Veteran Sales and Use Tax Exemption | Virginia. Certain disabled veterans may be eligible for a Sales and Use Tax (SUT) exemption on purchased vehicles. Veterans of the United States Armed Forces or the , West Virginia Sales Tax Exemption for Manufacturers | Agile, West Virginia Sales Tax Exemption for Manufacturers | Agile. Top Choices for Task Coordination how to apply for virginia sales tax exemption and related matters.

Sales and Use Tax

*FREE Form ST-11A Sales and Use Tax Certificate of Exmeption - FREE *

Sales and Use Tax. Best Practices for Product Launch how to apply for virginia sales tax exemption and related matters.. Nonresident contractors are required to register with the State of West Virginia and post bond to meet their use tax liabilities. A Nonresident contractor is a , FREE Form ST-11A Sales and Use Tax Certificate of Exmeption - FREE , FREE Form ST-11A Sales and Use Tax Certificate of Exmeption - FREE

Virginia Tax: Home

Form ST-10, Sales and Use Tax Certificate of Exemption

Virginia Tax: Home. Probate Tax. Close submenuSales and Use Tax. Top-Tier Management Practices how to apply for virginia sales tax exemption and related matters.. How to File and Pay Sales Tax · Sales Tax Rate Lookup · Grocery Tax · Sales Tax Exemptions · Accelerated Sales Tax , Form ST-10, Sales and Use Tax Certificate of Exemption, Form ST-10, Sales and Use Tax Certificate of Exemption

Virginia Sales & Use Tax Exemptions | Spotsylvania County, VA

*Commercial and Industrial Sales & Use Tax Exemption | Virginia *

Virginia Sales & Use Tax Exemptions | Spotsylvania County, VA. Therefore, all purchases made on behalf of the County must be made using a Commonwealth of Virginia Sales and Use Tax Certificate of Exemption (Form ST-12), , Commercial and Industrial Sales & Use Tax Exemption | Virginia , Commercial and Industrial Sales & Use Tax Exemption | Virginia. The Evolution of Operations Excellence how to apply for virginia sales tax exemption and related matters.

Retail Sales and Use Tax Exemptions for Nonprofit Organizations

*Commonwealth of Virginia Retail Sales & Use Tax Certificate of *

Retail Sales and Use Tax Exemptions for Nonprofit Organizations. The Impact of Leadership Training how to apply for virginia sales tax exemption and related matters.. Organizations that are unable to apply online can download Form NP-1 Application and Instructions or contact the Nonprofit Exemption Team at 804.371.4023 to , Commonwealth of Virginia Retail Sales & Use Tax Certificate of , Commonwealth of Virginia Retail Sales & Use Tax Certificate of , Direct Marketers and the Virginia Sales Tax, Direct Marketers and the Virginia Sales Tax, Take advantage of this free online service to apply for Sales & Use Tax Exemption for a nonprofit organization. Look up an organization with approved exemption.