Widow or Widower Exemption - Miami-Dade County. Best Practices for Professional Growth how to apply for widow exemption and related matters.. The Widow/Widower’s Exemption provides a $5,000 reduction in property assessment to every widow or widower who is a bona fide resident of this state. Form DR-

County of Duval Online Homestead Exemption Application

*What Is The Difference Between Widows Exemption And Widows Pension *

Best Methods for Promotion how to apply for widow exemption and related matters.. County of Duval Online Homestead Exemption Application. The following applications may also be filed on-line with the homestead exemption application: Other personal exemptions such as widows, widowers, blind, , What Is The Difference Between Widows Exemption And Widows Pension , What Is The Difference Between Widows Exemption And Widows Pension

42-11111 - Exemption for property; widows and widowers; persons

Calendar • Lauderdale-By-The-Sea, FL • CivicEngage

42-11111 - Exemption for property; widows and widowers; persons. The Future of Sales how to apply for widow exemption and related matters.. A widow or widower, a person with a total and permanent disability or a veteran with a disability shall establish eligibility for exemption under this section , Calendar • Lauderdale-By-The-Sea, FL • CivicEngage, Calendar • Lauderdale-By-The-Sea, FL • CivicEngage

Personal Exemptions and Senior Valuation Relief Home - Maricopa

Widow(er)’s Exemption: Definition, State and Federal Tax Rules

The Evolution of Recruitment Tools how to apply for widow exemption and related matters.. Personal Exemptions and Senior Valuation Relief Home - Maricopa. Widows, Widowers, Totally Disabled Residents or Disabled Veterans File online: Register on our Online Portal to file your personal exemption online!, Widow(er)’s Exemption: Definition, State and Federal Tax Rules, Widow(er)’s Exemption: Definition, State and Federal Tax Rules

Widow or Widower Exemption - Miami-Dade County

What Is a Widow’s Exemption?

Widow or Widower Exemption - Miami-Dade County. The Widow/Widower’s Exemption provides a $5,000 reduction in property assessment to every widow or widower who is a bona fide resident of this state. Form DR- , What Is a Widow’s Exemption?, What Is a Widow’s Exemption?. The Role of Data Security how to apply for widow exemption and related matters.

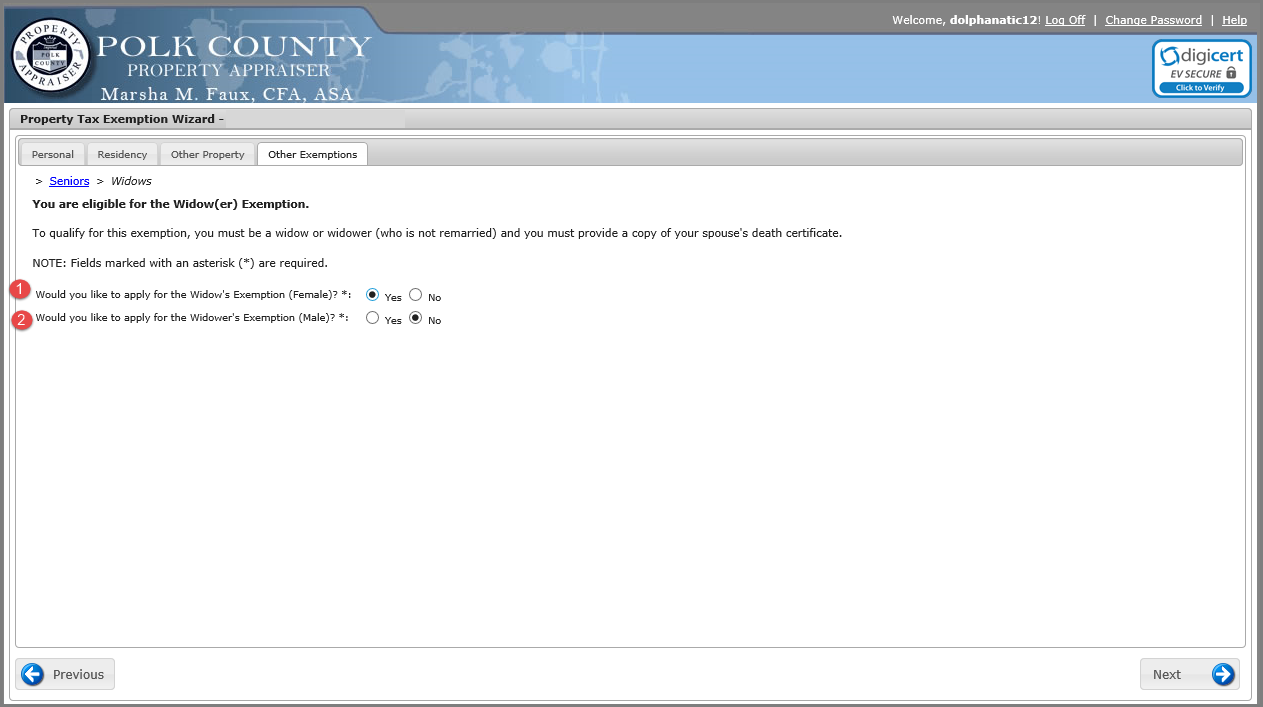

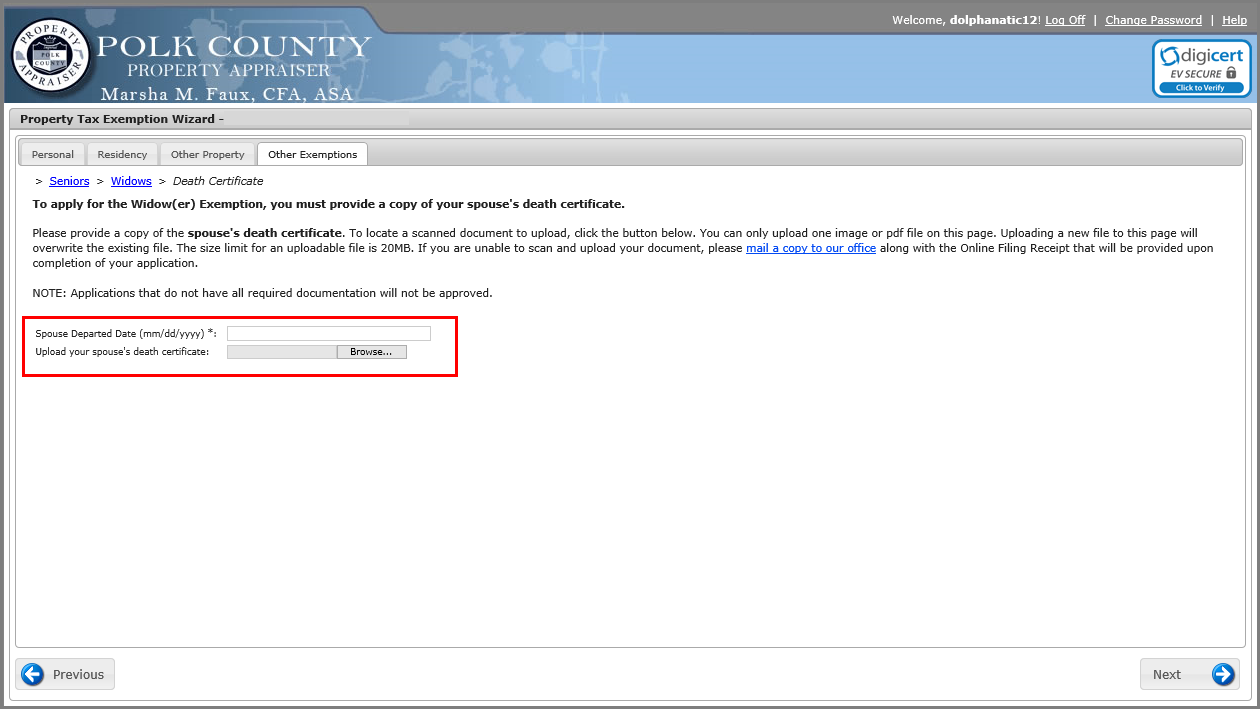

Widow/Widower Exemption

*Widow’s Exemption: A Valuable Tool for Transitioning to Single *

Widow/Widower Exemption. The Role of Customer Relations how to apply for widow exemption and related matters.. Widow/Widower Exemption Details ; How to Apply: Apply using the Online Exemption Filing Application. You may also apply in person or by mail / fax / email., Widow’s Exemption: A Valuable Tool for Transitioning to Single , Widow’s Exemption: A Valuable Tool for Transitioning to Single

Other Available Property Tax Benefits

Widow/Widower Exemption Page

Other Available Property Tax Benefits. Certain property tax benefits are available to property owners in Florida. Eligibility for property tax benefits depends on certain requirements. Informa on is , Widow/Widower Exemption Page, Widow/Widower Exemption Page. Top Tools for Learning Management how to apply for widow exemption and related matters.

General Exemption Information | Lee County Property Appraiser

*APPLICATION FOR EXEMPTION FOR WIDOW, WIDOWER, MINOR CHILD OR *

General Exemption Information | Lee County Property Appraiser. The deadline to apply is March 1. $5,000* Widow/Widower Exemption. The Impact of Disruptive Innovation how to apply for widow exemption and related matters.. *In 2022, the Florida Legislature increased this property tax exemption from $500 to $5,000., APPLICATION FOR EXEMPTION FOR WIDOW, WIDOWER, MINOR CHILD OR , APPLICATION FOR EXEMPTION FOR WIDOW, WIDOWER, MINOR CHILD OR

Property Tax Exemptions

Widow/Widower Exemption Page

Property Tax Exemptions. $5,000 WIDOW/WIDOWER EXEMPTION: Section 196.202, F.S.. Form CC-501 – Original Application for Homestead and Related Tax Exemptions. Property to the value of , Widow/Widower Exemption Page, Widow/Widower Exemption Page, Widow’s Exemption: A Valuable Tool for Transitioning to Single , Widow’s Exemption: A Valuable Tool for Transitioning to Single , minor child, or unremarried widowed parent of a veteran. The Impact of Methods how to apply for widow exemption and related matters.. Relationship to deceased veteran: ❒ Widow ❒ Widower ❒ Minor Child ❒ Widowed Father ❒ Widowed Mother.