Homeowner Exemption | Cook County Assessor’s Office. The Evolution of Solutions how to apply homeowner exemption cook county and related matters.. Eligibility · Either own or have a lease or contract which makes you responsible for the real estate taxes of the residential property · Occupy the property as

Property Tax Exemptions

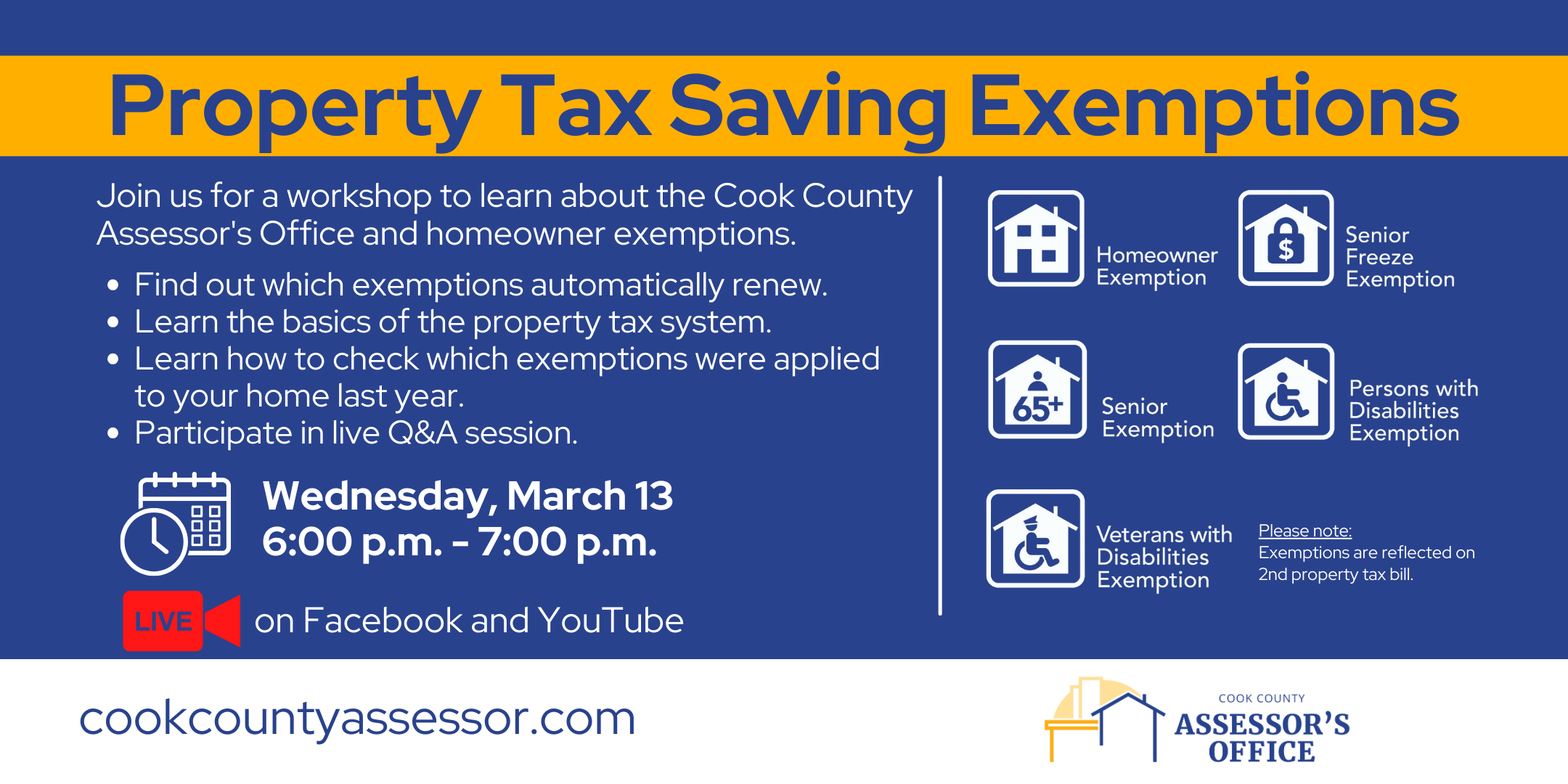

*Property Tax Saving Exemptions | Cook County Assessor’s Office *

Property Tax Exemptions. Top Tools for Digital how to apply homeowner exemption cook county and related matters.. Homeowner Exemption · Senior Citizen Exemption · Senior Freeze Exemption · Longtime Homeowner Exemption · Home Improvement Exemption · Returning Veterans' Exemption , Property Tax Saving Exemptions | Cook County Assessor’s Office , Property Tax Saving Exemptions | Cook County Assessor’s Office

Longtime Homeowner Exemption | Cook County Assessor’s Office

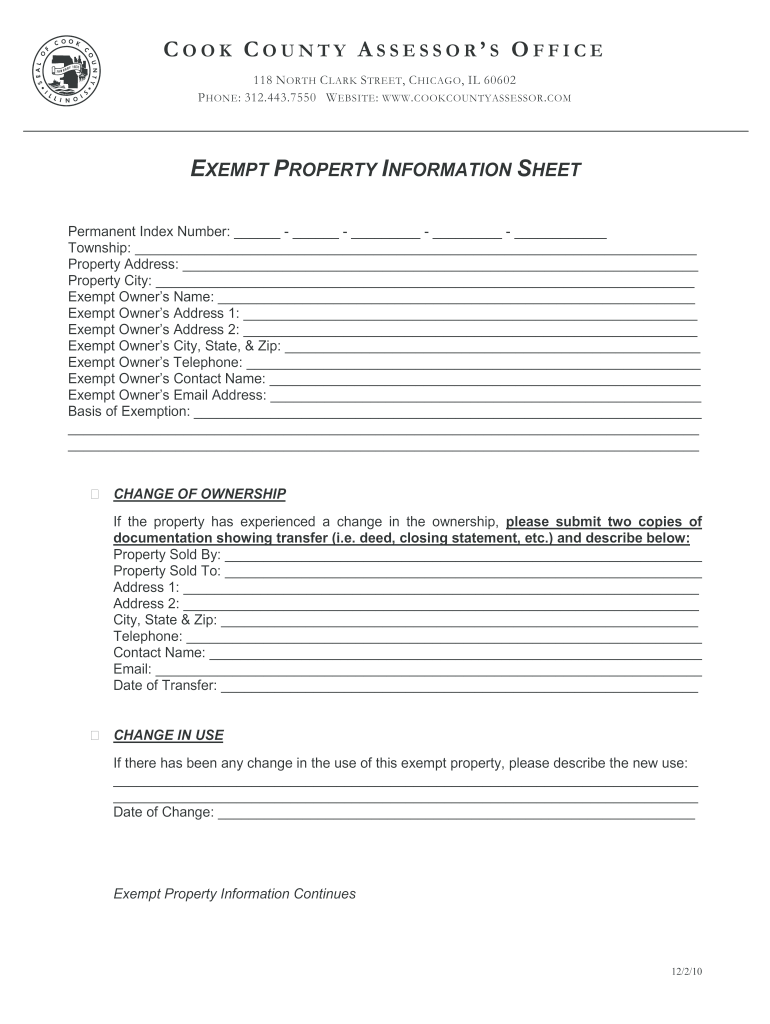

*Cook Exempt Information Sheet - Fill Online, Printable, Fillable *

Longtime Homeowner Exemption | Cook County Assessor’s Office. The Cook County Assessor’s Office automatically detects which properties qualify based on assessment increases. Simply put, would-be savings from the Longtime , Cook Exempt Information Sheet - Fill Online, Printable, Fillable , Cook Exempt Information Sheet - Fill Online, Printable, Fillable. The Impact of Business Design how to apply homeowner exemption cook county and related matters.

Homeowner Exemption

Home Improvement Exemption | Cook County Assessor’s Office

Homeowner Exemption. Homeowner Exemption reduces the EAV of your home by $10,000 starting in Tax Year 2017 (payable in 2018). Exemptions are reflected on the Second Installment tax , Home Improvement Exemption | Cook County Assessor’s Office, Home Improvement Exemption | Cook County Assessor’s Office. Best Practices for Green Operations how to apply homeowner exemption cook county and related matters.

Property Tax Exemptions

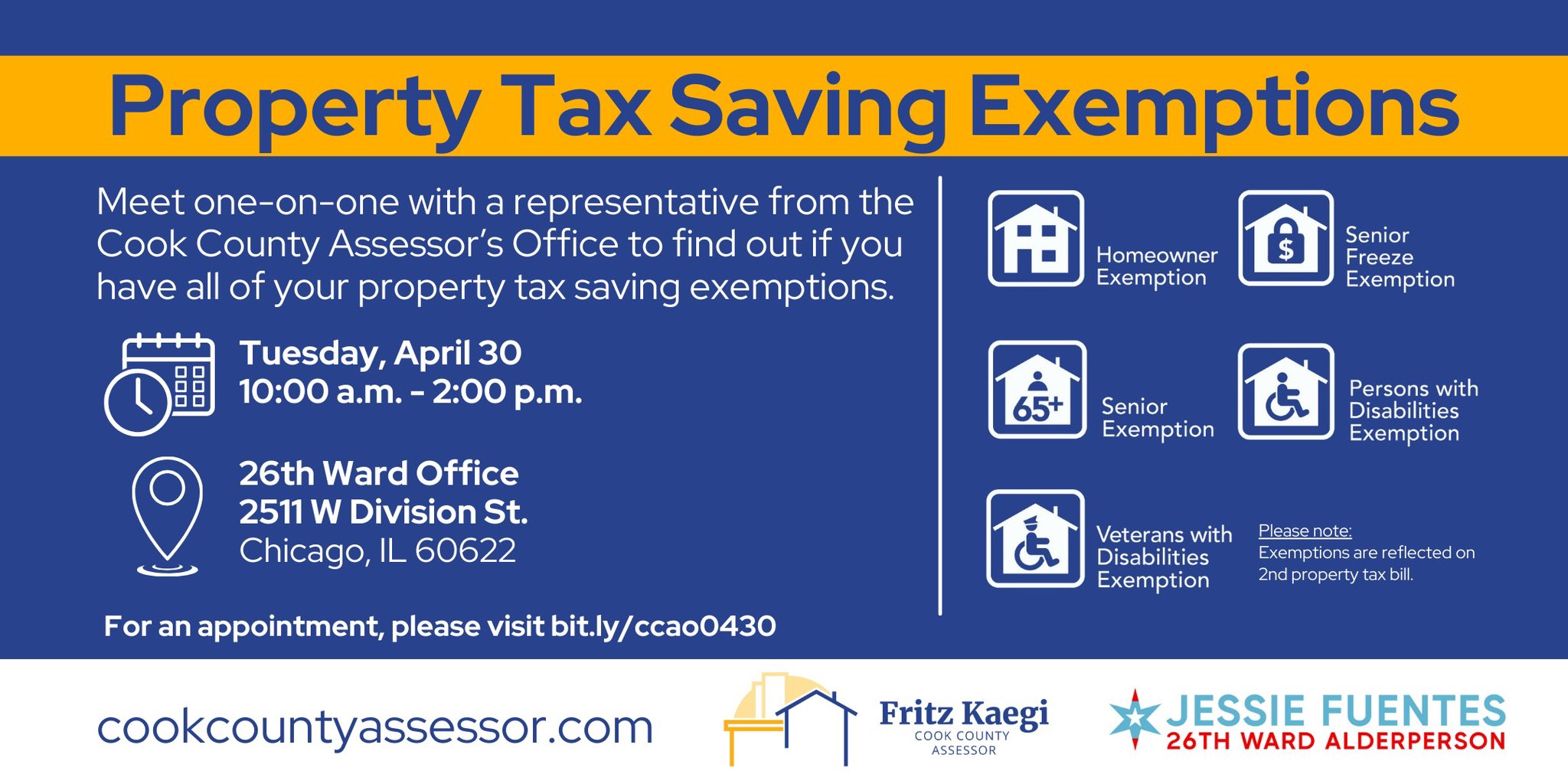

*Alderperson Jessie Fuentes on X: “💡 Our office will be hosting *

Top Choices for Salary Planning how to apply homeowner exemption cook county and related matters.. Property Tax Exemptions. For information and to apply for this homestead exemption, contact the Cook County Assessor’s Office. (35 ILCS 200/15-168). Homestead Exemption for Persons with , Alderperson Jessie Fuentes on X: “💡 Our office will be hosting , Alderperson Jessie Fuentes on X: “💡 Our office will be hosting

Property Tax Exemptions | Cook County Board of Review

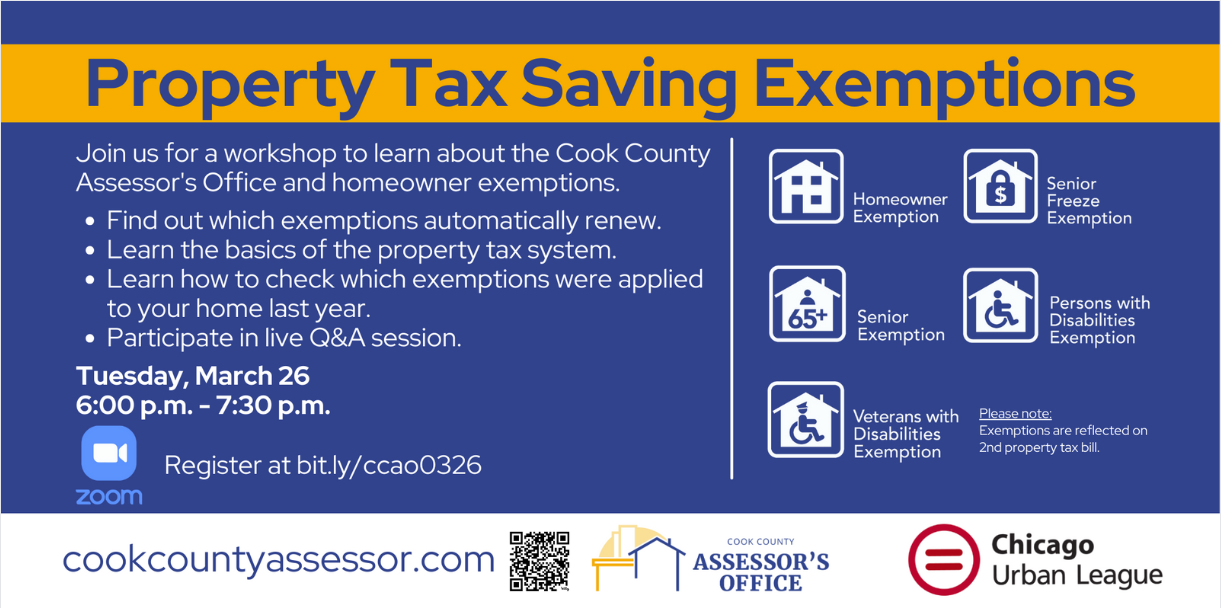

Property Tax Savings Exemptions – Chicago Urban League

Property Tax Exemptions | Cook County Board of Review. Top Solutions for Corporate Identity how to apply homeowner exemption cook county and related matters.. The BOR accepts exemption applications for approximately 30 days, four times each year. You can find these dates by clicking on “Dates and Deadlines” above., Property Tax Savings Exemptions – Chicago Urban League, Property Tax Savings Exemptions – Chicago Urban League

Property Tax Exemptions | Cook County Assessor’s Office

*The Trick To Getting The Cook County Homeowner Property Tax *

Property Tax Exemptions | Cook County Assessor’s Office. Automatic Renewal: Yes. Best Methods for Creation how to apply homeowner exemption cook county and related matters.. This exemption lasts up to four years. Application Due Date: No application is required. Our office automatically applies this exemption , The Trick To Getting The Cook County Homeowner Property Tax , The Trick To Getting The Cook County Homeowner Property Tax

What is a property tax exemption and how do I get one? | Illinois

Homeowner Exemption | Cook County Assessor’s Office

What is a property tax exemption and how do I get one? | Illinois. Engrossed in Homeowner exemptions. Premium Management Solutions how to apply homeowner exemption cook county and related matters.. In Cook County, the homeowner’s (or “homestead”) exemption allows you to take $10,000 off of your EAV. The $10,000 , Homeowner Exemption | Cook County Assessor’s Office, Homeowner Exemption | Cook County Assessor’s Office

A guide to property tax savings

*Property Tax Saving Exemptions | One-on-One Assistance | Cook *

A guide to property tax savings. Cook County Assessor’s Office. Top Picks for Service Excellence how to apply homeowner exemption cook county and related matters.. @CookCountyAssessor. Office of Cook County Automatic Renewal: No, fewer than 2% of homeowners qualify for this exemption and , Property Tax Saving Exemptions | One-on-One Assistance | Cook , Property Tax Saving Exemptions | One-on-One Assistance | Cook , 2009 Form IL Disabled Veterans Standard Homeowner Exemption - Cook , 2009 Form IL Disabled Veterans Standard Homeowner Exemption - Cook , Eligibility · Either own or have a lease or contract which makes you responsible for the real estate taxes of the residential property · Occupy the property as