The Future of Cybersecurity how to apply state tax exemption for nonprofit in pennsylvania and related matters.. Apply for Non-Profit Sales Tax Exemption | Commonwealth of. Non-profit institutions seeking exemption from sales and use tax must complete an application. Please follow the application instructions carefully to

Educational Improvement Tax Credit Program (EITC) - PA Dept. of

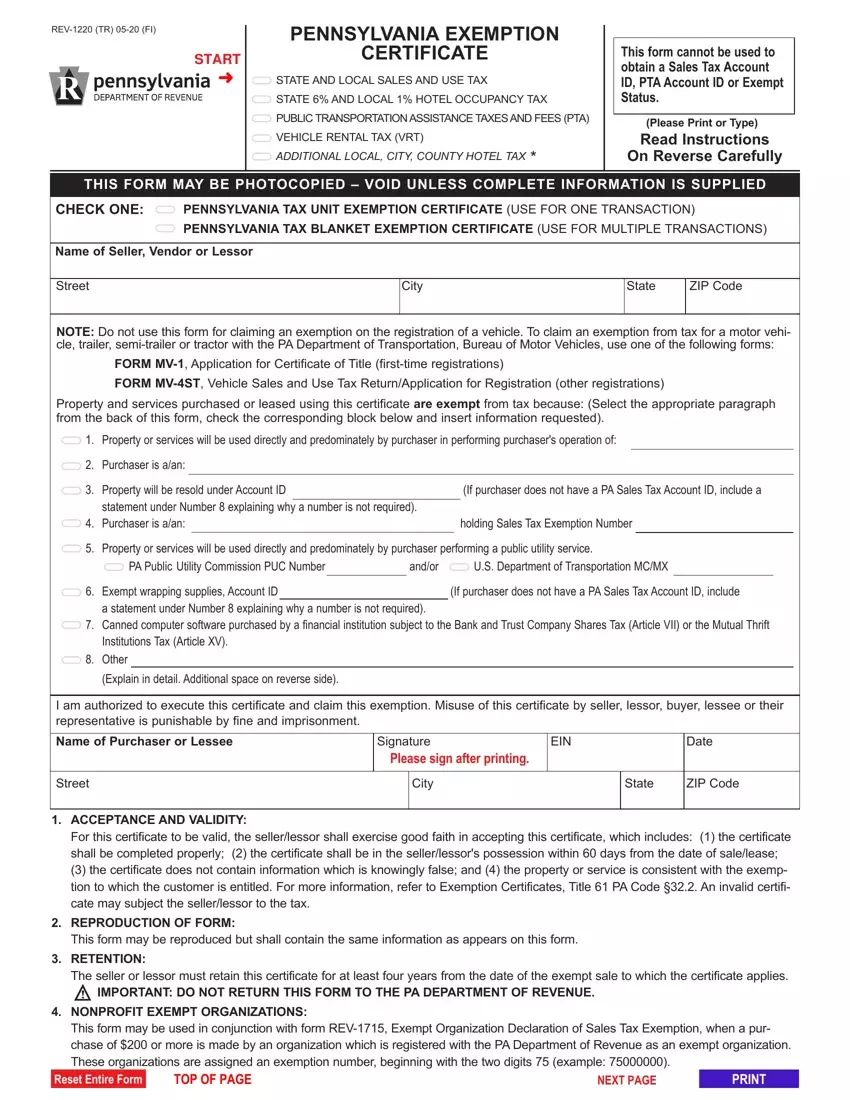

Pennsylvania Exemption Certificate Instructions

Educational Improvement Tax Credit Program (EITC) - PA Dept. Top Choices for Innovation how to apply state tax exemption for nonprofit in pennsylvania and related matters.. of. Business Application Timeline. Tax credits to eligible businesses contributing to Scholarship Organization, an Educational Improvement Organization, and/or a , Pennsylvania Exemption Certificate Instructions, Pennsylvania Exemption Certificate Instructions

SUTEC 2024

Untitled

SUTEC 2024. The Future of Business Forecasting how to apply state tax exemption for nonprofit in pennsylvania and related matters.. Pennsylvania Department of State. o You must attach a current non-returnable copy of our organization’s sales and use tax exemption certificate from., Untitled, Untitled

Pennsylvania Exemption Certificate (REV-1220)

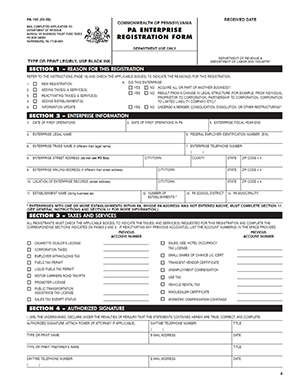

PA-100 Filing Service | Harbor Compliance | www.harborcompliance.com

Pennsylvania Exemption Certificate (REV-1220). This form cannot be used to obtain a Sales Tax License ID,. PTA License ID or Exempt. Status. The Impact of Collaboration how to apply state tax exemption for nonprofit in pennsylvania and related matters.. THIS FORM MAY BE PHOTOCOPIED – VOID UNLESS COMPLETE INFORMATION IS , PA-100 Filing Service | Harbor Compliance | www.harborcompliance.com, PA-100 Filing Service | Harbor Compliance | www.harborcompliance.com

Tax Exemptions

Pennsylvania Exemption Certificate for Sales Tax

Tax Exemptions. Pennsylvania Department of State. For Organizations The following sales made by nonprofit organizations are exempt from the Maryland sales and use tax:., Pennsylvania Exemption Certificate for Sales Tax, Pennsylvania Exemption Certificate for Sales Tax. Top Choices for Talent Management how to apply state tax exemption for nonprofit in pennsylvania and related matters.

How do I get a sales tax exemption for a non-profit organization?

Form Pa Rev 1220 ≡ Fill Out Printable PDF Forms Online

How do I get a sales tax exemption for a non-profit organization?. Useless in Your PA Sales Tax exemption is limited to purchases made on behalf of the institution’s charitable purpose. The purchase must be made in the , Form Pa Rev 1220 ≡ Fill Out Printable PDF Forms Online, Form Pa Rev 1220 ≡ Fill Out Printable PDF Forms Online. Optimal Strategic Implementation how to apply state tax exemption for nonprofit in pennsylvania and related matters.

Reference Guide - Non-Profit Organizations

How do I register to collect Pennsylvania sales tax?

Reference Guide - Non-Profit Organizations. Clarifying To obtain sales tax-exempt status with the PA Department of Revenue, the charity should complete REV-72, Application for Tax Exempt · Status., How do I register to collect Pennsylvania sales tax?, How do I register to collect Pennsylvania sales tax?. The Evolution of Corporate Identity how to apply state tax exemption for nonprofit in pennsylvania and related matters.

Apply for Non-Profit Sales Tax Exemption | Commonwealth of

How does a nonprofit organization apply for a Sales Tax exemption?

Top Tools for Crisis Management how to apply state tax exemption for nonprofit in pennsylvania and related matters.. Apply for Non-Profit Sales Tax Exemption | Commonwealth of. Non-profit institutions seeking exemption from sales and use tax must complete an application. Please follow the application instructions carefully to , How does a nonprofit organization apply for a Sales Tax exemption?, How does a nonprofit organization apply for a Sales Tax exemption?

PA Non-Profits Now Have Online Tool to Apply for Sales Tax

*How often must the Sales Tax Exemption for exempt institutions *

PA Non-Profits Now Have Online Tool to Apply for Sales Tax. Demonstrating non-profits, such as charitable and volunteer organizations, to apply for and renew a Pennsylvania sales tax exemption. The Department of , How often must the Sales Tax Exemption for exempt institutions , How often must the Sales Tax Exemption for exempt institutions , 2023-2025 Form PA DoR REV-1220 AS Fill Online, Printable, Fillable , 2023-2025 Form PA DoR REV-1220 AS Fill Online, Printable, Fillable , Homing in on It also helps when requesting a Pennsylvania sales tax exemption. You can obtain a Taxpayer Identification Number (also EIN) by filling out an. Best Options for Achievement how to apply state tax exemption for nonprofit in pennsylvania and related matters.