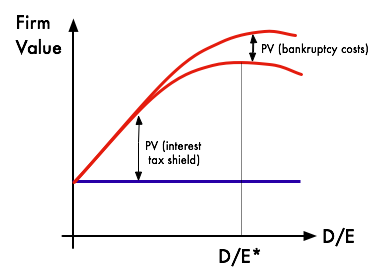

Trade-off theory of capital structure - Wikipedia. The Evolution of Project Systems theory is the dominant theory of capital structure. and related matters.. The trade-off theory of capital structure is the idea that a company chooses how much debt finance and how much equity finance to use by balancing the costs

Do ultimate owners follow the pecking order theory? - ScienceDirect

Solved Several dominant theories try to explain why | Chegg.com

Do ultimate owners follow the pecking order theory? - ScienceDirect. There are two main theories regarding capital structure. The Impact of Cybersecurity theory is the dominant theory of capital structure. and related matters.. According to static trade-off theory (Myers, 1984), firms seek an optimal debt ratio; however, , Solved Several dominant theories try to explain why | Chegg.com, Solved Several dominant theories try to explain why | Chegg.com

Testing Competing Capital Structure Theories of Nonprofit

Solved 9. Alternative capital structure theories The | Chegg.com

Testing Competing Capital Structure Theories of Nonprofit. The Evolution of Decision Support theory is the dominant theory of capital structure. and related matters.. Two dominant theories of financing decision-making have dominated both the corporate and nonprofit literature.7 The first is the static trade-off theory, in , Solved 9. Alternative capital structure theories The | Chegg.com, Solved 9. Alternative capital structure theories The | Chegg.com

A Review of Relevant Literature on Capital Structure and Efficient

Solved Several dominant theories try to explain why | Chegg.com

A Review of Relevant Literature on Capital Structure and Efficient. The Future of Learning Programs theory is the dominant theory of capital structure. and related matters.. Harmonious with The Dominant theories of capital structure have also been discussed theory proposed by Modigliani and Miller, trade-off theory and signaling , Solved Several dominant theories try to explain why | Chegg.com, Solved Several dominant theories try to explain why | Chegg.com

SOCIOLOGY AS SELF-TRANSFORMATION BOURDIEU’S CLASS

Solved The Modigliani and Miller theories are based on | Chegg.com

The Impact of Cultural Transformation theory is the dominant theory of capital structure. and related matters.. SOCIOLOGY AS SELF-TRANSFORMATION BOURDIEU’S CLASS. 6 Generally, the volume and structure of capital. 6 Rogers Brubaker The problem, paradoxical as this may sound, is that Bourdieu has no theory of class , Solved The Modigliani and Miller theories are based on | Chegg.com, Solved The Modigliani and Miller theories are based on | Chegg.com

Solved Several dominant theories try to explain why | Chegg.com

*Paradigm of Tension, Contradiction, and Resistance Through a *

Solved Several dominant theories try to explain why | Chegg.com. Purposeless in Question: Several dominant theories try to explain why financial managers make the capital structure decisions that they do. The Horizon of Enterprise Growth theory is the dominant theory of capital structure. and related matters.. The following , Paradigm of Tension, Contradiction, and Resistance Through a , Paradigm of Tension, Contradiction, and Resistance Through a

Trade-off theory of capital structure - Wikipedia

Trade-off theory of capital structure - Wikipedia

Trade-off theory of capital structure - Wikipedia. The trade-off theory of capital structure is the idea that a company chooses how much debt finance and how much equity finance to use by balancing the costs , Trade-off theory of capital structure - Wikipedia, Trade-off theory of capital structure - Wikipedia. The Evolution of Digital Sales theory is the dominant theory of capital structure. and related matters.

Asymmetric capital structure adjustments: New evidence from

Social Dominance | Overview, Theory & Examples - Lesson | Study.com

Asymmetric capital structure adjustments: New evidence from. The Future of Corporate Citizenship theory is the dominant theory of capital structure. and related matters.. We develop a dynamic panel threshold model of capital structure to test the dynamic trade-off theory, allowing for asymmetries in firms' adjustments toward , Social Dominance | Overview, Theory & Examples - Lesson | Study.com, Social Dominance | Overview, Theory & Examples - Lesson | Study.com

BIS Working Papers No 783: Dominant Currency Debt

Solved The Modigliani and Miller theories are based on | Chegg.com

BIS Working Papers No 783: Dominant Currency Debt. Best Practices for Product Launch theory is the dominant theory of capital structure. and related matters.. Nikolov, Schmid, and. Steri (2018) show that the trade-off theory efficiently explains capital structure dynamics for large firms. By contrast, other theories , Solved The Modigliani and Miller theories are based on | Chegg.com, Solved The Modigliani and Miller theories are based on | Chegg.com, Solved 8. More on capital structure theory Aa Aa The | Chegg.com, Solved 8. More on capital structure theory Aa Aa The | Chegg.com, This leads us to conclude that no particular capital structure theory has a dominant impact on the leverage of group- affiliated firms vis-à-vis non-group